That is, you should if you have financial assets.

If not, you're doomed to a life of poverty at whatever level the powers-that-be think they can get away with.

It's the flip side of the quote attributed to the Sun King's Finance Minister, Jean-Baptiste Colbert:

“that the act of taxation consists in so plucking the goose [i.e., the people] as to

procure the largest quantity of feathers with the least possible amount of hissing”

What follows is a repost from May 2020 i.e. the market miracle of Spring 2020, originally titled "With JP Morgan Up 7.10%, Bank of America Up 7.15% and Citigroup Up 9.23% On the Day, Let's Talk Cantillon Effect (JPM; BAC; C)"

I know a lot of this stuff is junior high school material for many of our readers but talking about currency in the post immediately below

got me thinking about money more broadly and I might have a shot at a

sustainable business model for a pitchfork manufacturing business if

gentle reader indulges me.

There are arguments whether Cantillon's observations only apply to a gold standard or also to fiat but we will leave that for another day.

First up, Matt Stoller at his BIG Newsletter last month

There are arguments whether Cantillon's observations only apply to a gold standard or also to fiat but we will leave that for another day.

First up, Matt Stoller at his BIG Newsletter last month

April 9

The Cantillon Effect: Why Wall Street Gets a Bailout and You Don't

And from some Austrians (real Austrians: Jasomirgottstrasse 3/12, 1010 Vienna):

Austrian Economics Center

The Cantillon Effect and Populism

There are currently no pure-play pitchfork manufacturers and it has been a long-cherished dream (since 2008!) to fill the void and/or live up to my junior high school personal file description: the instigator was....

The Cantillon Effect: Why Wall Street Gets a Bailout and You Don't

Hi,

Welcome to BIG, a newsletter about the politics of monopoly. If you’d like to sign up, you can do so here. Or just read on…

Today I’m going to try and explain why the Fed and Congress, while attempting to throw money at everyone, disproportionately tends to aid certain narrow financial actors.

The Cantillon Effect

Three weeks ago, the government passed a giant multi-trillion dollar bailout. Supposedly, it was money for a host of stakeholders, including hospitals, states, Wall Street banks, big business, the unemployed, and small businesses. Today the Federal Reserve built on top of Congress’s framework, announcing yet another multi-trillion dollar set of facilities, on top of what it already put out, to help cities, states, small businesses, main street businesses, and so on and so forth.

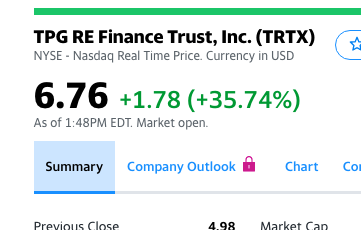

So what has happened so far? This is today’s change in stock price of a real estate venture run by one of largest private equity funds in the world.

A thirty five percent jump in a day is… a lot. The reason the stock skyrocketed is because investors believe the new measures from the Federal Reserve will bailout the debt of this private equity fund. There’s a ‘monetary bazooka’ aimed at the economy. And yet there’s a puzzle. If there’s money for the entire economy, why is that normal people and small businesses can’t access unemployment insurance and lending programs? To put it another way, why is the money meant for everyone only showing up in the stock market?

The reason is because money has to travel through institutions, and right now, the institutions for the powerful function well, and those for the rest of us are rickety and broken. So money gets to the rich first. Eventually, some money will get to the rest of us, but in the interim period before that money fully circulates, the wealthy can use their access to money to buy up physical or financial assets.

An 18th century French banker and philosopher named Richard Cantillon noticed an early version of this phenomenon in a book he wrote called ‘An Essay on Economic Theory.’ His basic theory was that who benefits when the state prints a bunch of money is based on the institutional setup of that state. In the 18th century, this meant that the closer you were to the king and the wealthy, the more you benefitted, and the further away you were, the more you were harmed. Money, in other words, is not neutral. This general observation, that money printing has distributional consequences that operate through the price system, is known as the “Cantillon Effect.”

In Cantillon’s day, the basis of money was gold, so he wrote about what happened when a nation-state discovered a gold mine in its territory. Increasing the amount of gold in the realm would not just increase price levels, he observed, but would change who had wealth and he didn’t. As he put it, “doubling the quantity of money in a state, the prices of products and merchandise are not always doubled. The river, which runs and winds about in its bed, will not flow with double the speed when the amount of water is doubled.”

Cantillon went on to discuss how money would flow, basically noting that rich people near the mine would spend it on 18th century luxuries like servants and meat pies, prompting a general rise in prices. Eventually the money would get out to the populace, but until it did, working people would have to pay higher prices without access to the new money that mine owners had. So there would be inflation, with uneven distribution of purchasing power.

There’s also a China angle. Cantillon noted that a kingdom discovering gold would in the long-run erode its own manufacturing base, that the non-neutrality of money also had geopolitical consequences.....MUCH MORE

Here’s how he put it:...

And from some Austrians (real Austrians: Jasomirgottstrasse 3/12, 1010 Vienna):

Austrian Economics Center

The Cantillon Effect and Populism

Monetary policy and everything concerning it has to be one of the most interesting topics out there. With monetary economics, there are quite a few interesting concepts which come with it. One is the so-called Cantillon effect.....MUCH MORE

Richard Cantillon was an economist in the 18th century who mainly wrote about money and how it circles around the economy.

The so-called Cantillon effect describes the uneven expansion of the amount of money. If a central bank pumps more money into the economy, the resulting increase in prices does not happen evenly. The Austrian economist Friedrich August von Hayek compared this monetary expansion with honey. If you pour honey into a cup, it won’t spread out evenly. It will clump in the middle of the cup first before spreading out.....

*****.... This theory doesn’t imply that money creation is always biased towards the powerful, only that how money travels matter. There is no inherent money neutrality, such neutrality must be constructed by institutional arrangements. Much of the New Deal in the 1930s and 1940s was designed to build alternative channels for lending so that small business, industry and individuals could have access to money as quickly as big banks.....

There are currently no pure-play pitchfork manufacturers and it has been a long-cherished dream (since 2008!) to fill the void and/or live up to my junior high school personal file description: the instigator was....