It's been a while since I've run the statistical exercise because, frankly, the question of correlation between the S&P 500 and the DJIA has been answered to my satisfaction. Here's a post from 2013:

"Why the Dow — Quirks and All — Is Beating the S&P 500"

This is a post I'd have written if I had the time. As I said in last month's "What if the Dow Were Market Cap Weighted?":

One of my pet peeves is pseudo-sophisticates who dismiss the Dow Jones Industrial Average out of hand, usually using the word anachronism somewhere in the dismissal.

The DJIA correlates with the S&P 500 92 to 98% of the time which is very close, the index was valuable enough that the CME structured their 2010 joint venture with a distribution to DJ of $607.5 million and finally the top dog on the DJ side, John Prestbo, won the Sharpe Indexing Lifetime Achievement Award (who knew?)

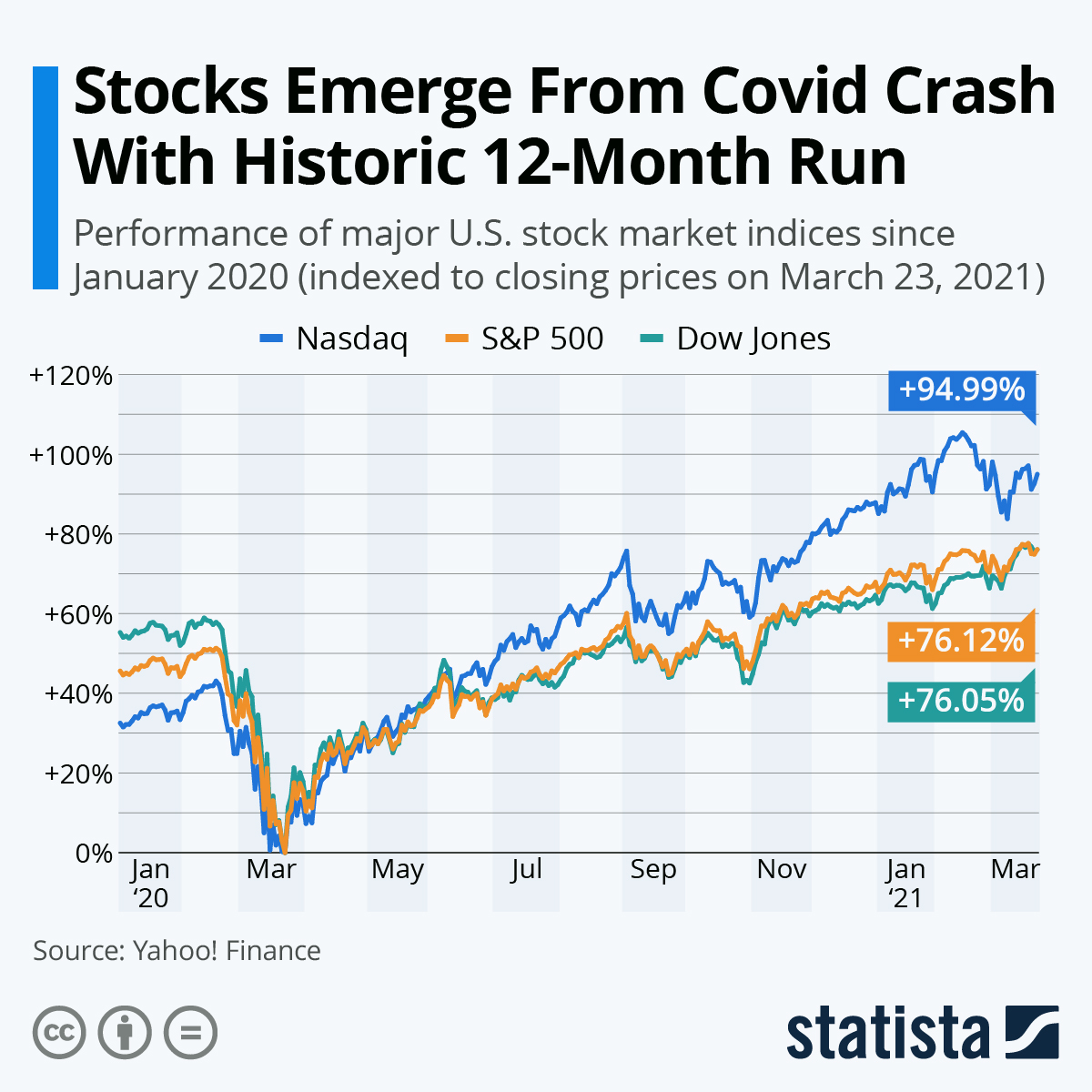

However, over the last 18 months it is not tracking so well...When I hear someone sneering at the venerable old index I know they haven't studied the correlations between it and the S&P 500 and I am reminded of the line attributed to Churchill's detective-bodyguard:

"I detect a whiff of the parvenu."

And here is a chart from Slope of Hope:

A Year Hence

Please note my market review video has been posted here, and all paying members can view it. If you’d like to try a paying membership, please click here to see the offerings.

Now the materiality of the two indices being within 00.07 percentage points of each other for the time period is just a fluke, probably related to the endpoints chosen, but the fact remains the S&P and the Dow track surprisingly well over most intervals.