Just in case though, could we maybe put the Chairman on mute for the next couple of years?

NDX down 172.47 (-1.36%) 10-year treasury yield 1.5380% +0.0680%

From ZeroHedge:

Stocks & Bonds Are Plunging As Powell Fails To Deliver

No hints at a 'Twist', refuses to speculate on repo issues, no pushback against recent bond vol, and no mention of SLR exemption.

This was the closest he came to saying anything of note:

“We monitor a broad range of financial conditions and we think that we are a long way from our goals,” he said.

“I would be concerned by disorderly conditions in markets or persistent tightening in financial conditions that threatens the achievement of our goals.”

Which is just more of the same generic platitudes, and that is not what the market wanted to hear...

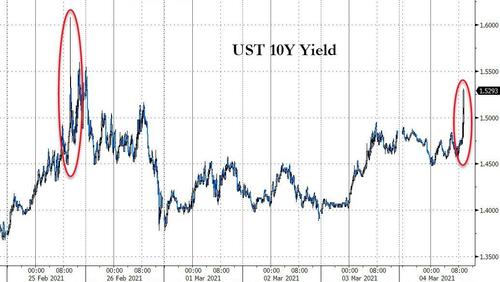

Treasury yields are spiking with 10Y well above 1.50%...

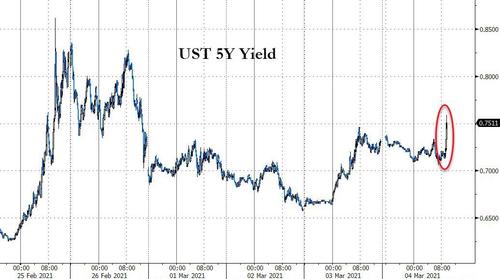

And 5Y is back above the critical 75bps level...

Real yields are surging, and weighing on gold...

....MORE

Hmmm...they seem to be on the other side of the trade.

Same fact set, two different conclusions. It's like the old joke about the two shoe sellers sent to Kenya in the early years of the last century:

1) "Terrible market, nobody wears shoes here".

2) "Wonderful market, nobody wears shoes here".

Previously:

Today

Capital Markets: "OPEC+ and Powell are Awaited"

...Mr. Chandler goes on to say he doesn't expect a change in rhetoric from Fed head Powell later today but I am nervous.

And I don't get nervous.

A Possibly Dangerous Spot For Shorting Long Duration Paper

Including tech equities.

And the Fed doesn't even have to do anything. The market is so skittish that just a hint from Powell could spark a melt-up....