As John Templeton showed when he was buying Japanese companies at as little as 2x earnings, if you can get the big trends right, the rest of this stuff seems easier.

From Slope of Hope March 17:

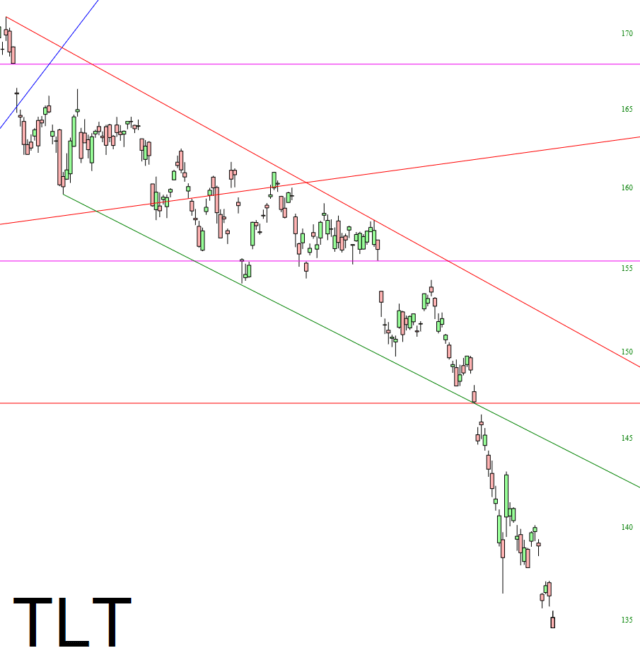

Seven Months of Slide

There was a time when the most boring, reliable financial investment around was TLT. I mean, come on, it’s a bond fund. You put your money in and collect your modest interest payment and life goes on. But not anymore. Just look at this – – seven months, and 22% of the value gone. Losing 22% is expected for the likes of Tesla. But – – government bonds?

Templeton rode those Japanese stocks for forty years.

With the long end getting whacked again today we are probably getting set up for a rip-your-face-off counter-trend spike up to cream the shorts but stepping back the picture sure seems to paint a downtrend.

And speaking of seven months ago:

....As noted in the introduction to July 30's "Tech stocks set to lead market higher Friday after the big four post blowout earnings, QQQ gains 1%":

The thing to keep an eye on are rates, not equities.

Sometime in August we expect Treasury issuance to exceed Fed buying causing a backup in rates.

Current ten year: 0.5410% -0.0380% .

Since the Fed can buy any amount they want, up to and including all issuance (and even all outstanding!), the mismatch will by definition have to be a deliberate decision, although it won't be communicated as such.

Right now equities are a distraction that will trade higher for a few weeks....

"Treasury Announces Record $112BN Quarterly Debt Sale, Unveils Tsunami Of New Bond Issuance"

"A $1 Trillion Glut of Bonds Is Dwarfing Central-Bank Demand"

By the bye, although we did not catch the exact recent bottom on the 10-year yield, 0.5040% on August 6th, (we really started beating the drum that rates were going higher at 0.56%) the 10-year's yield—proxied by the CBOE's TNX—has backed up to 0.891%:

I know it is unseemly to take a victory lap while the move is ongoing but his morning our proxy for the ten year yield, the CBOE's TNX, traded at 1.7540% and it's either take the lap or try to emulate Dogbert with his happy little tail wag.

And nobody wants to see that.