Nothing actionable here, just Albert venting.

Via ZeroHedge:

Much has been said in recent days about the death of the Phillips Curve, which was officially cast into the funeral pyre last week when the Fed unveiled its new approach to monetary policy, which puts more emphasis on shortfalls in employment and less weight on the fear that low unemployment could spark higher inflation.

The WSJ also piled on, with the newspaper's economic commentator Greg Ip writing that "the revamp of its monetary policy framework, the Federal Reserve has subtly but clearly shifted its priorities away from inflation to employment.... Central banks have long operated on the assumption that there is a trade-off between employment and inflation. As the unemployment rate drops below some “natural” level, inflation starts to rise, a relationship dubbed the Phillips curve. That means unemployment could be both too high or too low. The Fed in its old operating principles thus sought to minimize “deviations” of unemployment from this natural level. In practice, this meant the Fed had to both estimate the natural rate and raise interest rates if actual unemployment threatened to fall below it. The new framework replaces "deviations” with “shortfalls,” implying unemployment can be too high but never too low.”

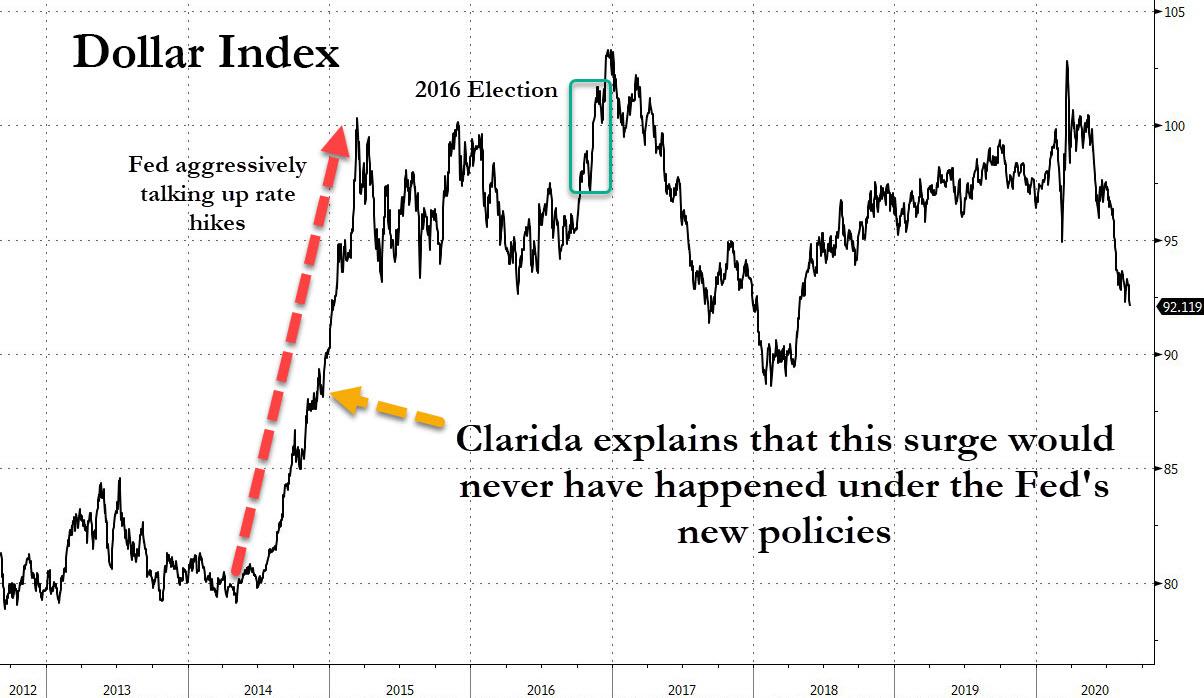

And just to make sure that the relationship between unemployment and inflation is never again shown in an official Fed slideshow, last week Fed vice chair Richard Clarida delivered a remarkable speech in which he admitted that the Fed's new Average Inflation Targeting framework, was "a robust evolution in the Federal Reserve's policy framework and, to me reflects the reality that econometric models of maximum employment, while essential inputs to monetary policy, can be and have been wrong."

This may be the first time in years when the Fed has admitted that canonical models it had followed for decades were wrong, leading to catastrophic results (such as the ill-fated rate hikes of 2015-2018, which as we noted last week may have cost Hillary Clinton the 2016 election).

And yet, maybe there is more here than meets the eye: just over a year ago we asked the most obvious question - perhaps it was not the Phillips curve that was dead but "the way the government measures inflation is (purposefully) wrong."

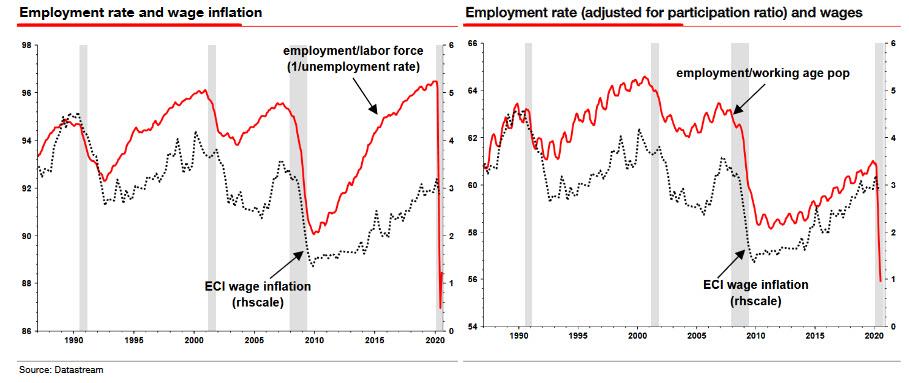

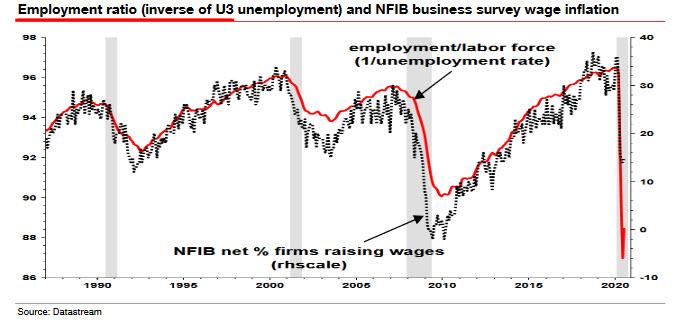

We were not the only ones to question the Fed's desire to quickly shove the Phillips Curve into the dustbin of history (while ignoring the real elephant in the room - flawed inflation measurements and a CPI and PCE print that have been gamed for political purposes since the 1980s): in a note today, SocGen's cuddly permabear Albert Edwards writes that "it is totally wrong to believe that the Phillips Curve is dead, dormant or even flattened" instead noting that "there was simply more slack in the labor market than the Fed’s estimates of NAIRU at 5% supposed" something we also said for much of the past decade when we pointed out the 100 million or so people out of the labor force after every single jobs report.

Indeed, as Edwards continues, if one simply measures unemployment correctly "and the relationship still fits perfectly (right-hand chart below)."

"So", the increasingly angry SocGen strategist fumes, "for the Fed to consign NAIRU to the dustbin of economic history just because of its own failure to consider that discouraged workers were holding down wages seems a total nonsense. But even using the simple U3 unemployment rate and looking at the rate at which companies were increasing wages, I simply cannot see any breakdown in the normal Phillips Curve relationship (see chart below)."

Here, Albert takes a slight detour into the implications of the Fed's new policy review, which as Clarida and more recently Brainard said would have meant the Fed would not have launched the 2015-2018 tightening cycle at all, and writes that the "howls of protests about Fed tightening in the last cycle were really about the direction not the absolute level of interest rates. The Fed was tightening policy but from an extremely accommodative stance. It was taking its foot off the accelerator but not tapping the brakes. Monetary policy was not as loose as previously but was certainly not tight. This is a key and important difference. A tight monetary policy would have slowed growth relative to trend growth. A return to neutral would not."........MORE

*Born too late for the Summer of Love, yet still counter-counter-culture: