The prop trading that got away

The Bank of England’s proprietary trading review came out this week, but it has largely gone under the radar. That’s a shame because among its findings is this (our emphasis):

There is evidence that other activities falling within the statutory definition of proprietary trading are substantial for some firms, but these activities arise in the context of the wider business needs of the firms concerned. Many firms, especially larger firms, continue to serve their clients through market making and related activities. Firms’ liquid asset buffers (LABs) hold material amounts of financial instruments, although these are largely cash, central bank reserves, or low risk government bonds, and interest rate risk in the LAB is often largely hedged. Furthermore, firms hedge the risks arising from serving clients in both trading and banking books through own-account positions in financial instruments and commodities.The Bank’s conclusion is that this sort of activity is AOK because new capital and liquidity requirements for banks, as well as tougher internal controls, have diminished most associated systemic risks.

But to those in the know, especially with respect to how traders themselves view market-making risk, that feels like a regulatory a cop out sitting in plain sight.

In the exact same report the BoE also finds that there is evidence of substantial activities falling “within the statutory definition of proprietary trading” precisely under the market-making name. It goes on to disclose that it remains hard to separate market making from proprietary trading, since both activities involve holding positions for the bank’s own trading account, with the only real distinction being intent.

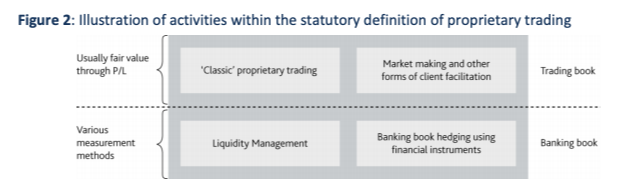

In case you’re confused about what falls under that statutory definition of proprietary trading, here’s a convenient diagram from the Bank:

Worryingly, the BoE says firms’ hedging activities and liquidity investments (the fuel that powers the market-making desk) are substantial and have not declined even as market risk has. But, again, the BoE is not worried because hedging is supposed to reduce risk -- and there’s some evidence from both regulatory and firms’ own risk measures that they do, they say........MUCH MORE