Does Wednesday, September 9, 2009 ring a bell? 6:07 AM PDT?

Well, if you force me, I'll repost after the jump. First though, the headliner, lifted in toto from ZeroHedge:

Mon, 06/08/2020 - 17:14

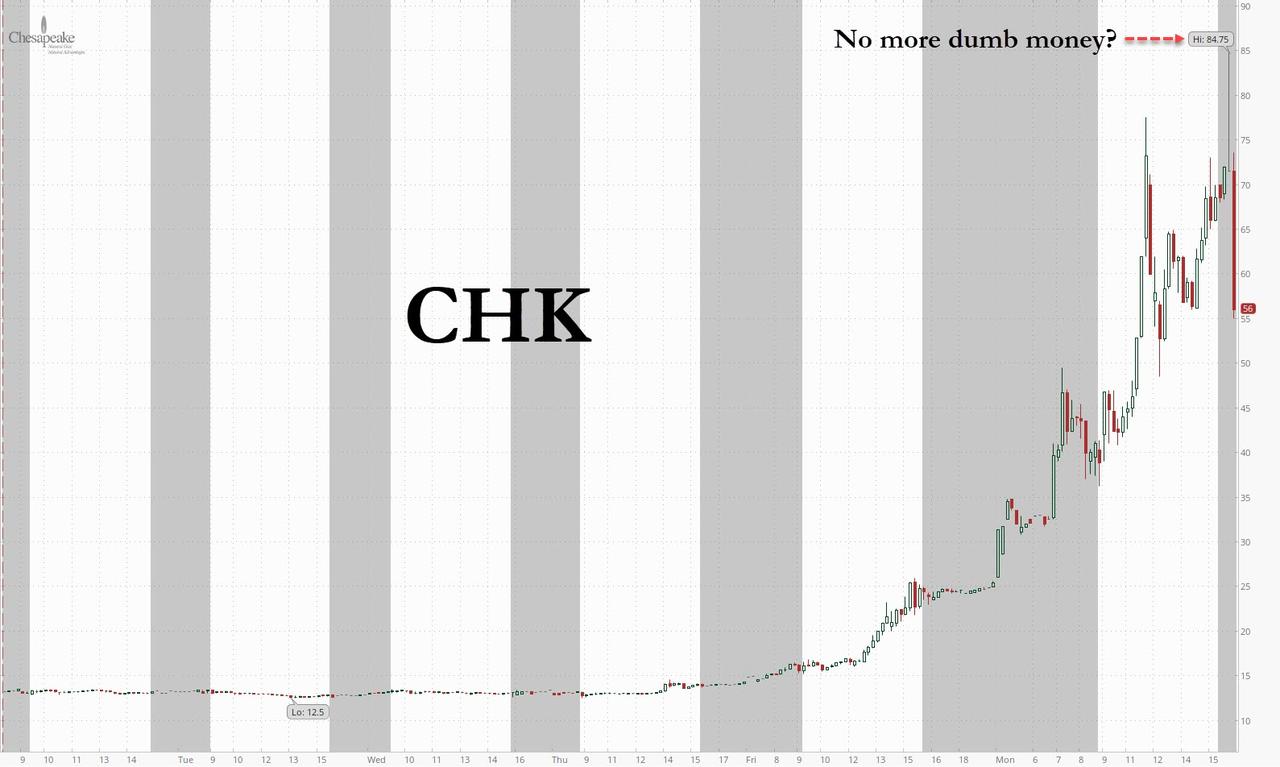

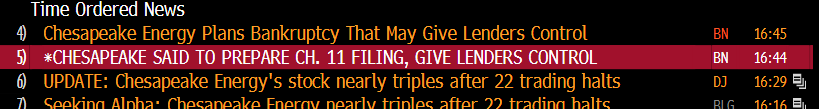

How insane is this "market"? So insane that shale pioneer Chesapeake, which for weeks has been rumored to be on the verge of bankruptcy, exploded by over 300% from Friday's closing print of $25 to $84.75 after the close.

Well, thedaytradergambler who bought at $84.75 after hours in hopes of finding an even greater idiot to sell to - such as Jerome Powell perhaps - will be disappointed because as Bloomberg reported shortly after the close, Chesapeake is preparing a bankruptcy filing that could hand control of the oil and gas company to its senior lenders, as in no value to existing equity, which as of the close on Thursday had a market cap of $684 million, an increase of over 425% in the past two days!

The timing of these Bloomberg headlines is without doubt the best testament to the absolute idiocy that the moron in charge of the Marriner Eccles buildings has unleashed.

According to the Bloomberg report, the shale driller which was once the largest American gas producer before things turned south, including the March 2016 suicide of founder Aubrey McClendon, owes about $9 billion in debt and is debating whether to skip interest payments due on June 15 and invoke a grace period while it talks with creditors. The company has also begun soliciting lenders to provide debtor-in-possession financing to fund its operations during bankruptcy, according to one of the people.$69.92 up $45.12 (+181.94%) at close: 4:00PM EDT

The Oklahoma City-based producer is negotiating a restructuring support agreement that could see holders of its so-called FILO term loan take a majority of the equity in bankruptcy, the people said, who asked not to be identified discussing confidential matters. The support agreement remains fluid and the terms could change, the people said.The company has retained Kirkland & Ellis and Rothschild as bankruptcy advisors while the FILO lenders are organized with Davis Polk & Wardwell and Perella Weinberg Partners.

Rumors of Chesapeake's inevitable demise were already swirling well before the coronavirus pandemic crushed commodity prices and crude demand plummeting. At its height more than a decade ago, the producer was a $37.5 billion juggernaut commanded by McClendon, an outspoken advocate for the gas industry. But Chesapeake’s success at extracting the fuel from deeply buried rock - funded by billions in cheap junk debt - contributed to a massive gas glut, and the eventual collapse of the company.

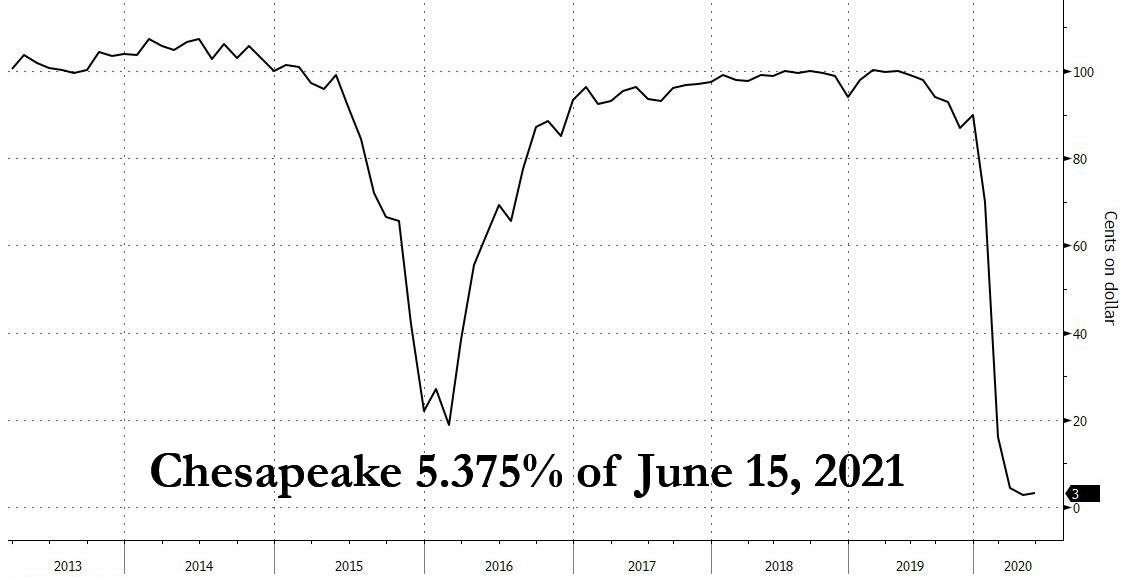

Finally, for those are about to say that there may be some value to the equity, just a take look at the June 2021 bonds which are about to default and are trading at 3 cents on the dollar and just keep your mouth shut.

Down $3.34 (-4.78%) to $$66.58 after hours: 5:56PM EDT

And Northwest?

I re-referenced it in passing, oddly enough in a CHK post, 10 years and 2 months later:

November 2019

Chesapeake Energy Downgraded At Tudor Pickering, Price Target Lowered to $0.00 (CHK)

Chesapeake is deer nuts.

(under a buck).....

*****

.....Sometimes markets confuse me.If interested, here's the whole post:

Back in 2009 I posted a few lines on adventures in short selling:

...Prior to and just after filing for bankruptcy, Northwest Airlines seemed to offer a short opportunity. A friend had me double-check his balance sheet analysis and I ended up selling myself on the idea. The common shareholders would be wiped out and the stock was trading around $1.25. We got the short on. The stock tripled or quadrupled. I started quoting Keynes (attributed) as we threw money at the monster:

The market can stay irrational longer than you can stay solvent....

....Sometimes markets confuse me.

Back in 2009 I posted a few lines on adventures in short selling:

Credit Suisse Analysts on AIG: ‘Little to No Value for Common Equity’

...Prior to and just after filing for bankruptcy, Northwest Airlines seemed to offer a short opportunity. A friend had me double-check his balance sheet analysis and I ended up selling myself on the idea. The common shareholders would be wiped out and the stock was trading around $1.25. We got the short on. The stock tripled or quadrupled. I started quoting Keynes (attributed) as we threw money at the monster:The airline was actually concerned enough about people buying the stock that they warned against the practice. Here's another NWA post, this time from 2015:

The market can stay irrational longer than you can stay solvent.It worked out, the stock went to zero and I kept quoting Keynes:

“It is the one sphere of life and activity where victory, security and success is always to the minority and never to the majority. When you find any one agreeing with you, change your mind...."There a a few lessons to take away from this adventure:

1) If your timing is wrong you had better be right in your analysis.

2) It is really, really good to have a friendly banker.

3) Keynes talked a lot.

I'm always amazed when the stock of companies that have entered bankruptcy protection continue to trade as if the common shareholders had claims that were anything more than dreams.Cancelled.

Yet it happens over and over again. And can be immensely profitable if you can locate stock to short....

...Here's one of those bankruptcy stories

Northwest's reorganization jolts investors

Updated 5/31/2007 6:14 AM

Anthony Hicks thought he was getting a bargain when he saw Northwest Airlines stock trading for $1.70 per share.

Tempted by that low price, the 39-year-old Detroiter bought 2,000 shares earlier this year, knowing that the airline was restructuring in bankruptcy. It was in bankruptcy that Northwest's stock had skyrocketed from 60 cents to $7.50 in January, on speculation that the company would merge with another airline.Hicks saw that surge and hoped to catch it on a second wave.There was no second wave. What Hicks didn't know was that those Northwest shares would be worthless the day the company emerged from bankruptcy.That day is today. After 20 months of shedding billions of dollars in debt and costs, Northwest is set to leave bankruptcy protection.The airline had warned since it filed for bankruptcy in September 2005 that its stock could be cancelled....The company was warning for twenty months that the stock would be canceled!....