From CB Insights, January 22:

Despite a drop in total funding dollars, investment activity in the

fourth quarter of 2019 points towards pockets of opportunities for

blockchain technology in enterprise applications.

Blockchain companies have lost a step in the private markets.

Total equity funding to the space, which is one measure of investor

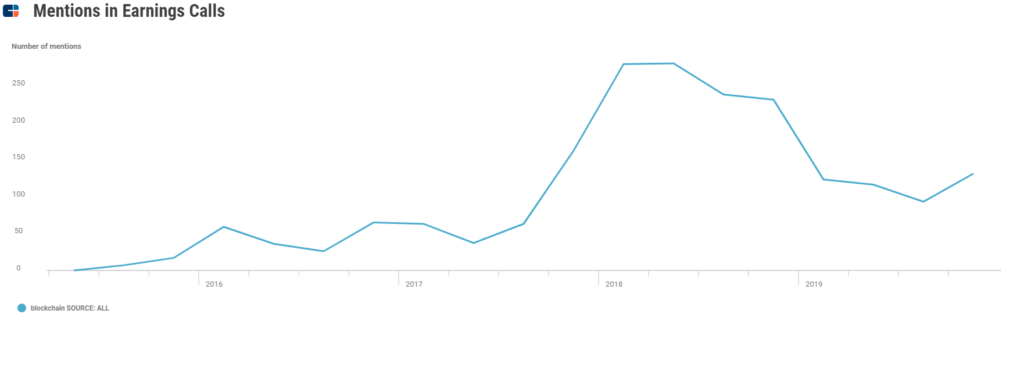

enthusiasm, fell over 30% in 2019. Mentions of the technology in public

company earnings transcripts also dropped off.

One of the reasons for this slip is that many products are still trying to find product market fit.

Entrepreneurs have pitched applications for blockchain technology

ranging from supply chain tracking to financial asset settlement, but

the only one that has found adoption at any significant scale so far is

cryptocurrency creation and trading. Bitcoin still dominates in that

area, representing over 65% of the cryptocurrency market’s total value.

Still, investor activity shows there are pockets of potential in the

blockchain sector worth tracking. Using CB Insights data, we analyze

investment trends across the space from Q4 2019.

Fourth quarter funding down sharply from a year ago

Overall, dollar funding in 2019 was down 28% from 2018’s peak of $4.3B, while deal activity remained relatively flat.

Companies like Bitmain (cryptocurrency mining hardware) and Coinbase

(cryptocurrency exchange) were the top two fundraisers in 2018,

demonstrating investors’ focus on public cryptocurrencies. The companies

raised $400M and $321M, respectively, both contributing to 2018’s

spike.

In Q4’19, companies in the blockchain space raised $785M across 164

deals, representing a 36% decline from Q4’18. Though lower than 2018

numbers by a stretch, the quarter still outperformed Q1 and Q2 in 2019,

with investor interest pointing specifically towards enterprise

applications.

Enterprise payments network Ripple

raised the highest amount of funding in the quarter — a $200M Series C

round from SBI Group, Tetragon Financial Group, and Route 66 Ventures,

which valued the company at $10B. Ripple stated the financing would go

towards additional hiring, adding overseas offices, and improving

balance sheet flexibility.

The company has continued to market its RippleNet payments platform

as a disruptive technology to the cross-border payments market and the

correspondent banking system that banks use to transfer funds.....

....

MUCH MORE