It's called a ledger.

As part of their 2016 Christmas special the BoE's Bank Underground blog presented the wholesale bank, Overend Gurney:

Unto us a lender of last resort is born: Overend Gurney goes bust in 1866which of course reminded me of something, in this case the fact we had looked at the collapse a few months before the BoE post:

That failure of Overend Gurney was rather a big deal, it was in all the papers.

From our August post "Overend, Gurney & Co.: An Inspiration to Karl Marx and Bear Stearns":

One of the most dramatic events in the financial history of Victorian England was the collapse of Overend, Gurney and Co. Its failure had a more severe impact on the London financial market than the collapse of Bear Stearns had on U.S. markets over 140 years later. During the financial crisis of 1866, over 200 firms went bankrupt, including a number of banks. The failure of Overend, Gurney and Co. also led to one of the first trials for financial fraud in history when all six directors were brought before the courts of London to answer for their alleged crimes....Enough reminiscing, here's Bank Underground, December 11, 2017:

Looking inside the ledgers: the Bank of England as a Lender of Last Resort

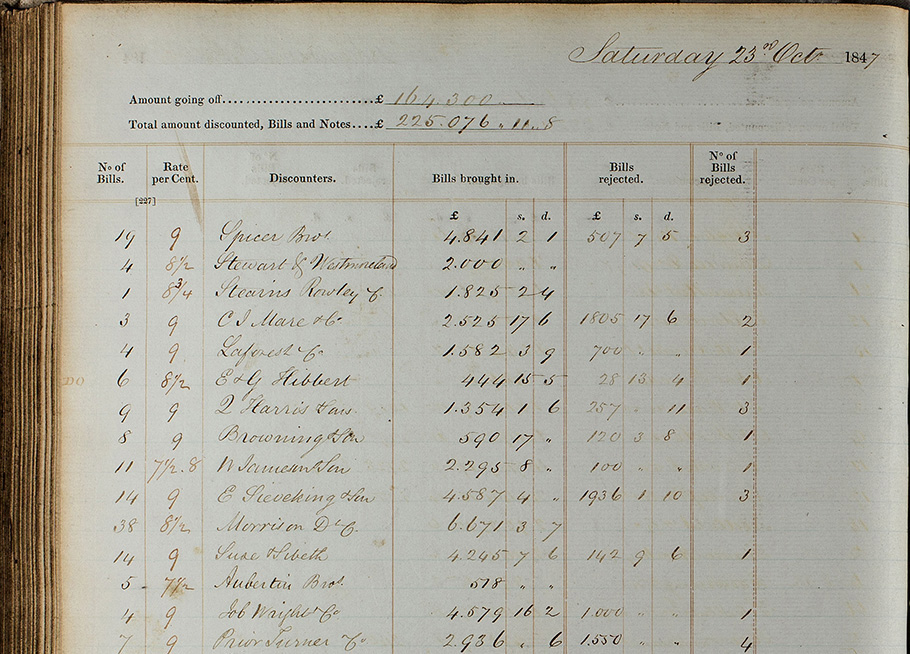

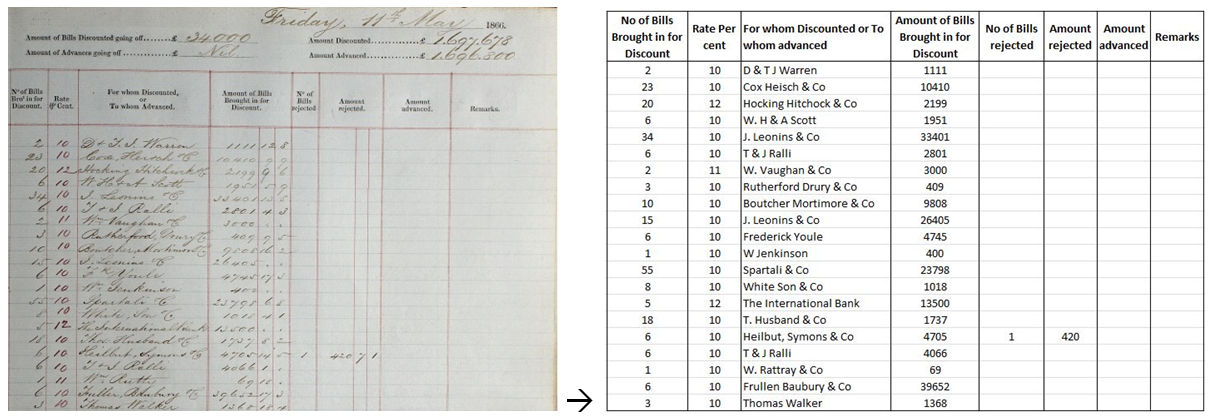

Imagine if you could peek inside the Bank’s historical ledgers and see the array of interest rates the Bank has charged for emergency loans in the past. If you could get the inside scoop on how many of these loans were never repaid, and how that impacted the Bank’s bottom line? Now you can. We have transcribed the Bank’s daily transactional ledgers and put them into an Excel workbook for you to explore. These ledgers contain a wealth of information on everyone who asked the Bank for a loan during the 1847, 1857 and 1866 crises.Figure 1 Turning ledgers (left) into data (right)

The data records who applied; whether their requests were accepted or rejected; the value and volume of assets they exchanged for cash; as well as the price (interest rate) at which they did so. Besides the ledger data, our Excel workbook includes granular data on the Bank’s balance sheet and income statement.

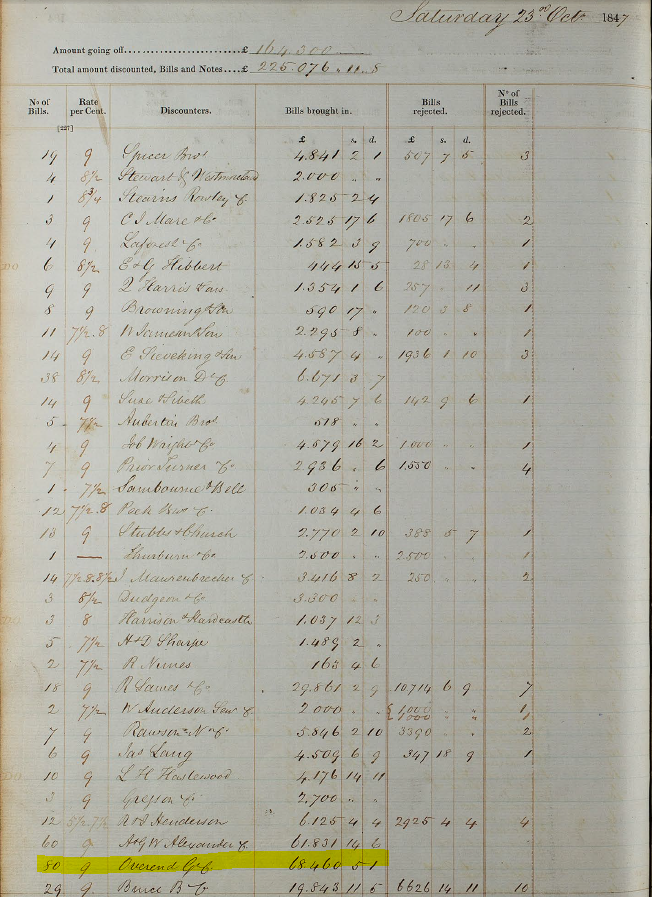

These data lie at the heart of a recently published Staff Working Paper exploring the Bank of England’s role historically as a lender of last resort. The paper analyses the extent to which the Bank adhered to Walter Bagehot’s dictum that a central bank during financial crises should lend cash freely at a penalty rate in exchange for ‘good security’ in the period before Bagehot published his book Lombard Street.Figure 2: Excerpt from the Bank’s ledgers. Transaction with Overend Gurney highlighted.

Lending freely

During the crises of the nineteenth century, the Bank would provide financial markets with liquidity by purchasing ‘packets’ of bills of exchange. These packets were like modern day CDOs in that they bundled together various bills. The Bank’s Discount Office would typically discount the bundle at a single rate of interest, sometimes at two. For example, Figure 2 shows that on 23 October 1847, Overend Gurney brought in a packet of 80 bills with a face value of £68,460 and got a loan at 9 percent discount. They walked away with £62,299, just under £6 million in today’s terms.

...MUCH MORE