"US venture capital activity so far this year in 15 charts"

From PitchBook:

There's been more venture capital invested through the first six

months of 2018 in the US than any six-month period in recent history,

which highlights the new normal in the industry: more capital

concentrated into fewer, larger deals. On the exit end of the spectrum,

there's been improved access to the IPO market, particularly for

enterprise tech companies.

The 2Q 2018 PitchBook-NVCA Venture Monitor,

created in partnership with Silicon Valley Bank, Perkins Coie and

Solium, provides a snapshot of the VC landscape by delving deep into

data on fundraising, exits, valuation trends and more. For a summary,

we've put together a collection of charts from the report, which is

available to download for free.

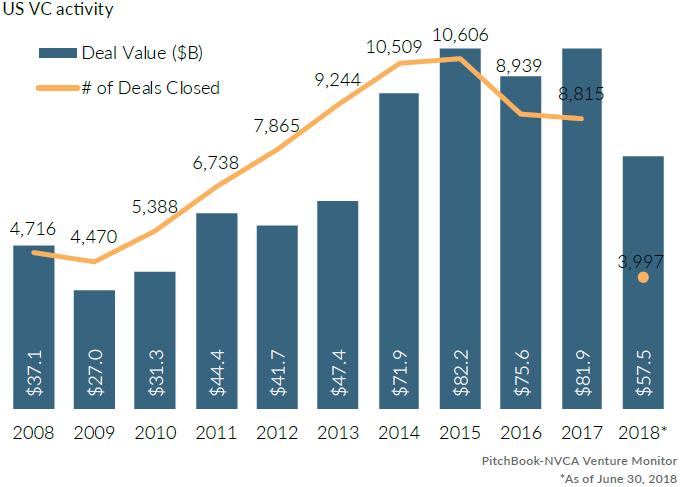

Deal value is on pace to reach decade-high record

Through the end of 2Q 2018, $57.5 billion has been invested in US

VC-backed companies, a number that exceeds the full-year total for six

of the past 10 years. During the first half of the year, 94 financings

have totaled more than $100 million and 42 have been at unicorn

valuations.

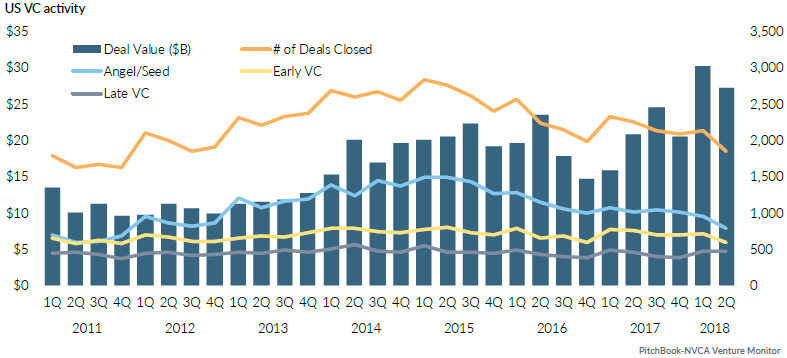

A look at the last two quarters

There was more venture capital invested during 1Q 2018 than any quarter

since at least the beginning of the decade, and it's followed closely by

2Q 2018.

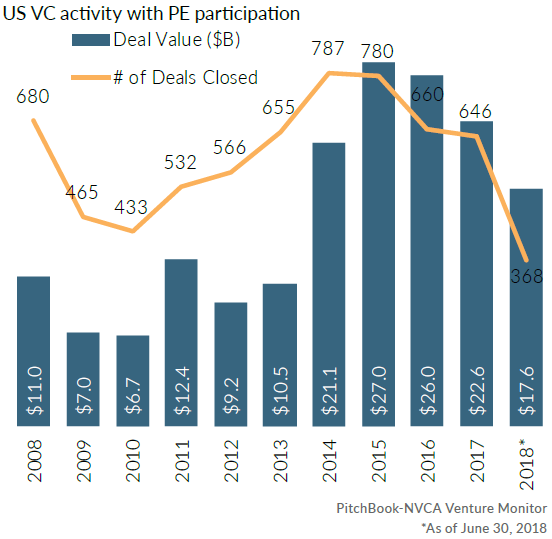

PE investors continue to join large rounds

This year is on pace to be the fifth consecutive year that more than

1,500 deals are completed with participation from nontraditional

investors, including private equity firms. PE firms alone have been

involved in 368 VC deals so far this year.

Exits are slightly quicker than last year

For VC-backed companies, time to exit reached a decade high in 2017.

Time to exit is still relatively high, but it has dropped a bit since

last year....MUCH MORE