From The Capital Spectator:

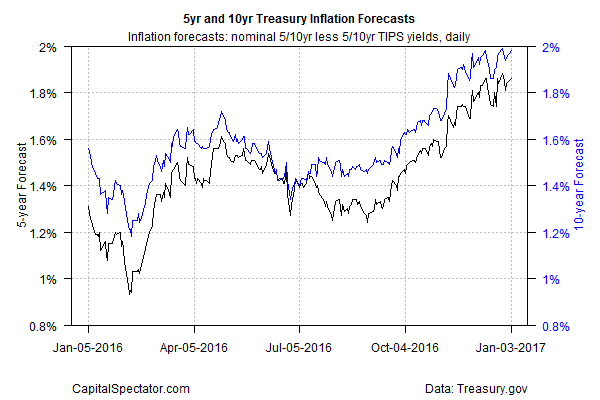

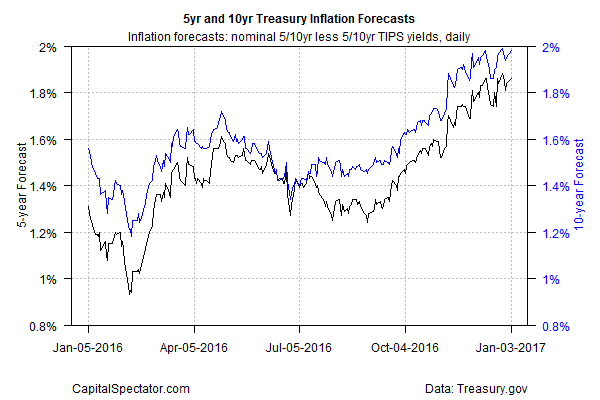

Inflation expectations have been ticking higher lately, according to

several sources, signaling that headline measures of year-over-year

price indexes could reach the Federal Reserve’s 2% inflation target in

2017 for the first time in several years.

Market-based estimates of future inflation have been trending up in

recent months, based on the yield spread between nominal and

inflation-indexed Treasuries. The the yield spread on 10-year

Treasuries, for instance, touched 1.98% on the first trading day of the

year, based on daily data via Treasury.gov—close to the highest level in

well over two years.

The Cleveland Fed’s inflation nowcast

is even higher. The January 2017 estimate for the year-over-year change

in the headline consumer price index is 2.28%, up from the 2.07% in

December. The core CPI nowcast is a bit softer, but the current nowcast

tops 2.0% as well. The key takeaway: this model’s anticipating that the

1.7% annual pace in headline CPI through November (the current report)

will soon exceed the Fed’s 2.0% target....MORE

We last visited Cleveland on Dec. 21: "

Cleveland Fed: Hope for U.S. Productivity Growth"