"... Monitoring Compliance With The OPEC/NOPEC Deal To Cut Production"

From RBN Energy:

The agreement by OPEC and several non-OPEC members to cut crude oil

production by a total of 1.8 million barrels a day (MMb/d), which caused

a rise in crude prices, kicked in on January 1. Now, more than three

weeks in, many in the market remain skeptical that the deal will hold,

and are on the lookout for the slightest hint that parties to the

agreement may be—for lack of a kinder word—cheating. In today’s blog,

“Won’t Get Fooled Again—Monitoring Compliance With The OPEC/NOPEC Deal

To Cut Production,” we recap the agreement’s terms, examine how

participating producers might try to skirt the rules, and discuss ways

to check that everyone is acting on the up and up.

Much of the 17% run-up in crude oil prices since September 2016 is

attributed to the hope (then the fact) that OPEC, Russia and a few other

crude producers that are not part of OPEC would agree to significantly

reduce their oil output in the hope of tightening the international

supply/demand balance and boost crude prices. As we said in Is This The Real Life? Is This Just Fantasy?,

OPEC’s 13 member countries on November 30 (2016) agreed to reduce their

output (from October 2016 levels) by 1.2 MMb/d starting on January 1

(2017). Ten days later, on December 10, 11 non-OPEC (NOPEC) countries

(including Russia and Mexico) joined in, saying they would collectively

cut their production by another 558 thousand barrels a day (Mb/d), also

effective on New Year’s Day. The OPEC/NOPEC commitments will run for at

least six months, and may be renewed for additional half-year periods

after that—all with the hope of maintaining oil prices at levels that

work to all producers’ advantage.

Now, all eyes are on these OPEC/NOPEC producers to see if they do, in

fact, reduce their production as promised, and to check for any

rule-bending by deal participants who may be tempted to make a few extra

bucks (or, more accurately, a few riyals or rubles or pesos) by

producing some extra crude they can sell at early 2017’s propped-up

prices. Judging from previous experience with such accords, the

temptation of higher prices is difficult to resist for countries that

are dependent on oil exports for much of their income.

Unlike previous production-cut agreements though, the flow of oil is

now under a constant magnifying glass. More pipelines flows are being

monitored and reported (albeit most of them not on a real-time basis),

and cargo tracking companies such as ClipperData every day tally up all

OPEC and participating NOPEC producers’ exports moving by ship. Also,

the Joint Ministerial Monitoring Committee (JMMC) formed by five OPEC

and NOPEC countries agreed this past Saturday (January 21) on a

framework for tracking production by all 24 of the countries that

committed to cuts. Under that plan, OPEC’s secretariat will issue a

report with production data from each country on the 17th of each month going forward.

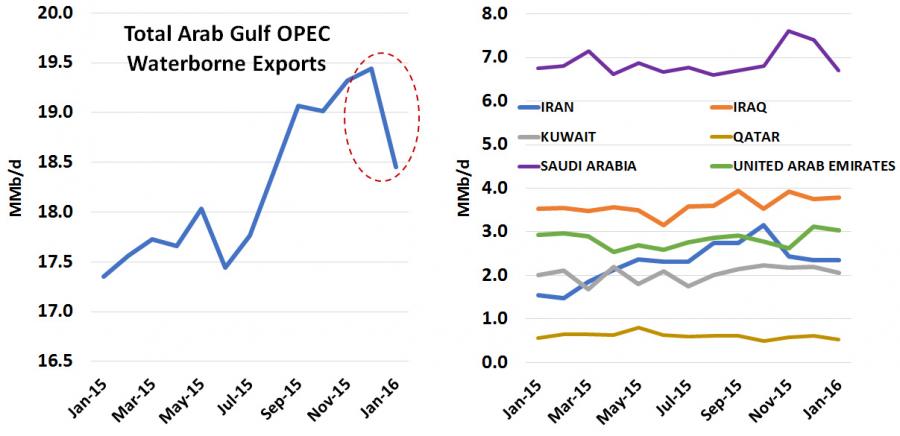

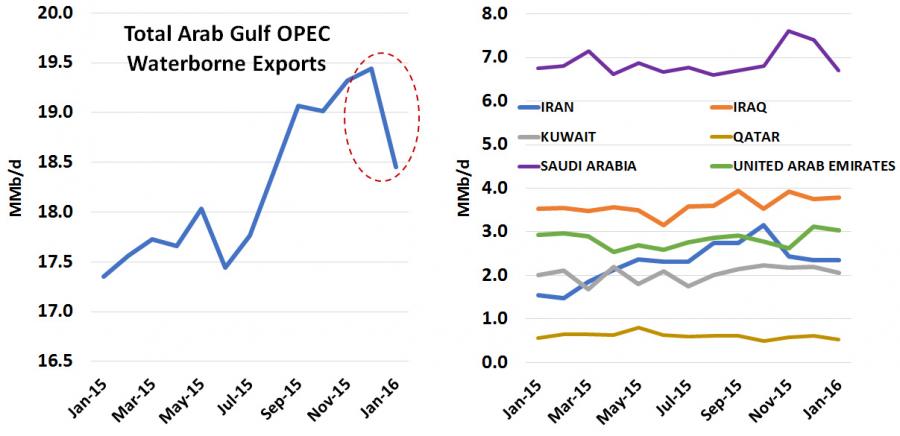

Hiding non-compliance will be considerably more difficult this go-round

than in the past, but it doesn’t mean that no one will try. Over the

first three weeks of January, the agreement seems to be holding. There

is no way for outsiders to precisely monitor how much oil is being

produced daily in each country, of course, but we do know (from

ClipperData’s tracking) that shipments from six leading OPEC producers

in the Middle East (Saudi Arabia, Iraq, United Arab Emirates, Iran,

Kuwait and Qatar) have dropped sharply––from ~19.4 MMb/d in December

2016 to ~18.5 MMb/d so far in January 2017 (blue line/red-dashed oval in

graph to left of Figure 1). Exports from Saudi Arabia (the largest OPEC

producer by far) were down more than 9% month-over-month, from ~7.4

MMb/d to ~6.7 MMb/d (purple line in graph to right), accounting for the

most of the Middle East’s cuts....MUCH MORE