"The Dow hasn't seen a month-long range this narrow since at least 1957"

From CNBC:

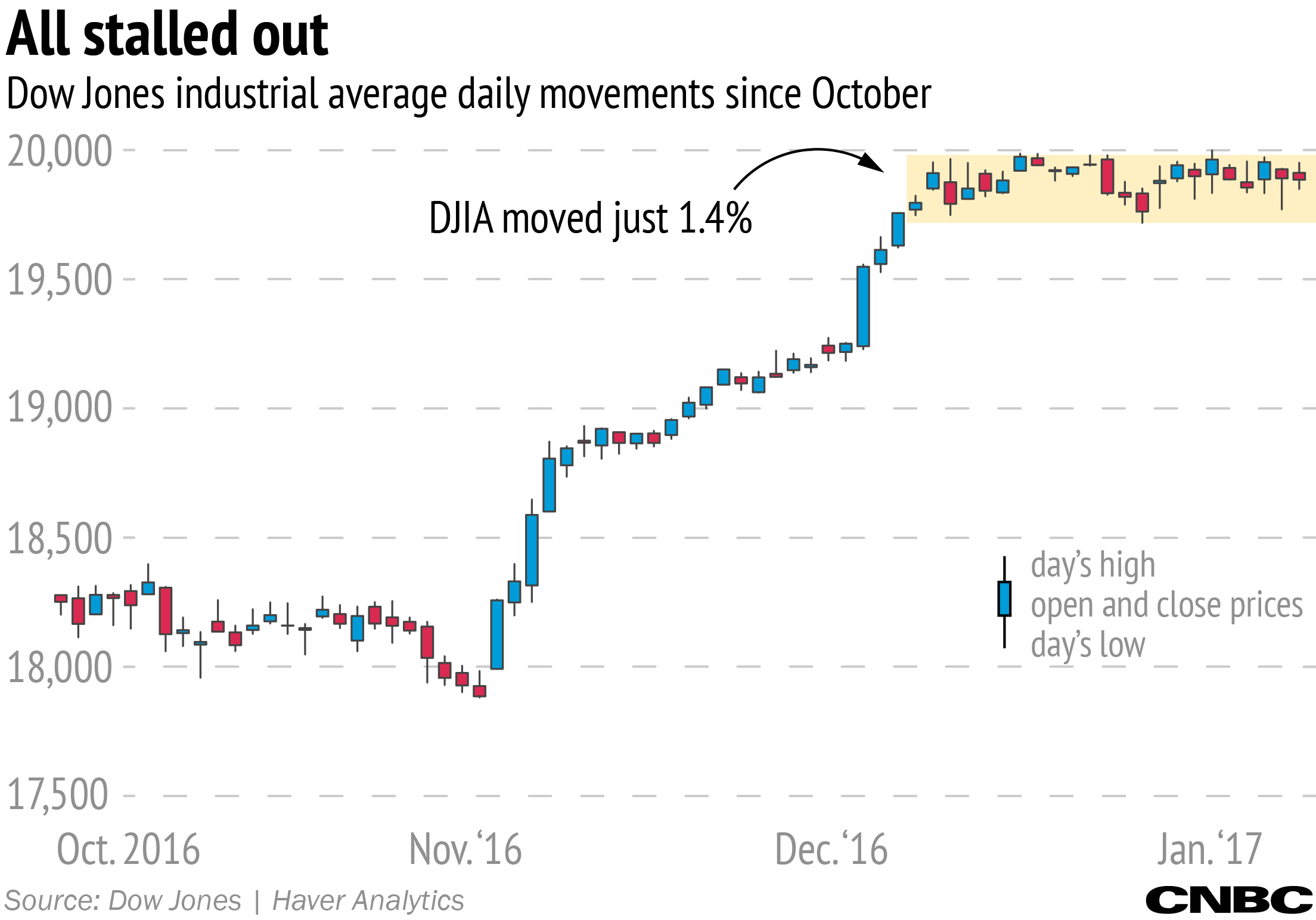

If it seems like the stock market's crawl to

nowhere over the past month has been particularly strange, that's

because it has been. It turns out the gap between the Dow's high and low

prices over the past month is a tiny 1.4 percent — the narrowest gap in

data going back to 1957.

It was just over a month ago, on Dec. 13, when we saw the Dow Jones industrial average

cross 19,900 for the first time. Since then, we've seen an intraday

high of 19999.63 and a low of 19719.67. The gap between those two levels

is only 1.4 percent. The Dow's entire past month has stayed within that

extremely tight range.

To put this in perspective: We usually see a 6 to 7 percent average

range in a typical month. In fact, the typical trading day in the past

60 years has seen a 1.5 percent move just on that day alone....MORE