Fundamental changes in U.S. crude oil production, crude transportation patterns, refinery sourcing of oil, import volumes and other factors have undermined the ability of the Strategic Petroleum Reserve to mitigate the domestic impact of a world energy crisis. Worse yet, the Department of Energy’s planned fix for the SPR will take at least several years—assuming it’s allowed to proceed according to plan. Today we consider current shortfalls in the SPR’s crude-delivery network, the potential effect on U.S. refineries in the event of an emergency, and the DOE’s plan to fix things.

Few of us give much thought to the jack in the truck, the flashlight in the drawer, or the blue tarp in the garage until a tire goes flat, the lights go out, or a tree falls on the roof. Similarly, it’s easy to forget about the federal government’s Strategic Petroleum Reserve (SPR), which was set up more than 40 years ago after the 1973-74 oil embargo but whose emergency use has been only occasional (thankfully). As we said in our Save It For a Rainy Day series a couple of years back, the SPR, which currently stores about 695 million barrels (MMbbl) of sweet and sour crude at four underground salt dome storage facilities along the Gulf Coast, has been tapped for emergency drawdowns only three times since it was created. The first time was during the Persian Gulf War in 1991, when—at President H.W. Bush’s order—the Department of Energy (DOE) implemented a plan to sell 33.75 MMbbl to help stabilize world oil markets. In the end, only about half of that amount—17.3 MMbbl—needed to be sold to achieve the desired effect. Next, in the aftermath of Hurricane Katrina (and its damage to oil production facilities, terminal pipelines and refineries) in 2005, up to 30 MMbbl was authorized for sale. Again, much less was actually bought—about 11 MMbbl. Finally, in 2011, about 30 MMBbl of SPR crude was authorized for sale—and sold to 15 companies—because of supply disruptions in Libya and other countries. Technically, there was a fourth use of the SPR. In 2013, the SPR conducted an emergency exchange with Marathon Oil after Hurricane Isaac disrupted Gulf Coast oil production, refining and distribution systems. By contract, Marathon repaid the 1 MMbbl in three months.

The initial purposes of the SPR were to help reduce the impact of severe energy supply interruptions (like the 1973-74 embargo) on U.S. refineries, and to meet the U.S.’s obligations under the International Energy Agency’s (IEA) International Energy Program (IEP), which requires IEA members that are net oil importers to maintain crude oil inventories equal to at least 90 days of domestic demand. These purposes remain, but the SPR also came to be used to minimize the price shocks that come with major supply interruptions, whether they be the result of far-away wars or major hurricanes in the Gulf of Mexico. The SPR consists of 60 underground salt caverns (with capacities totaling 714 MMbbl) at four sites: Bryan Mound in Freeport, TX (capacity, 247 MMbbl); Big Hill in Winnie, TX (170 MMbbl); West Hackberry in Hackberry, LA (220 MMbbl); and Bayou Choctaw in Plaquemines, LA. Each of the four is currently between 96% and 99% full.

Fortunately, there’s been no instance so far in which the SPR has needed to go into what you might call “full-bore” operation. The SPR system is designed for an initial maximum drawdown (or oil-withdrawal) rate of 4.415 million barrels a day (MMb/d) —that rate could be sustained for 90 days (by which time ~400 MMbbl would have been withdrawn), after which the maximum rate would gradually drop. It would take a total of more than 150 days to drain the system’s 695 MMbbl if the spigots were left wide open. Figure 1 shows the maximum pace of withdrawals and how much crude (and which types—sweet or sour) would come from each SPR facility.......MUCH MORE

Oil & Gas 360 reported on Jan. 26th:

DOE Announces Sales from Strategic Petroleum Reserve

First sales of largest SPR drawdown in history

The DOE awarded contracts for the sale of 6.4 million barrels of crude from the Strategic Petroleum Reserve (SPR) yesterday, with additional future sales planned. Contracts were awarded to Shell Trading Company and Phillips 66 Company with deliveries scheduled for March and April.

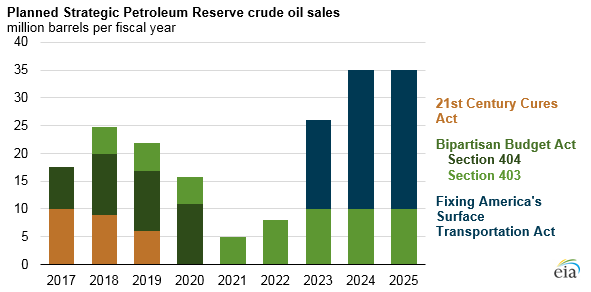

Multiple acts of congress in the past two years have called for sales from the SPR. Two separate sections (403 and 404) of the 2015 Bipartisan Budget Act have mandated yearly sales from the SPR through 2025. Sales made between 2017 and 2020 will generate up to $2 billion in revenue to fund the planned SPR Modernization Program, which will improve the SPR infrastructure to ensure long-term integrity. Additionally, sections of the 21st Century Cures Act and the Fixing America’s Surface Transportation Act have called for SPR sales with proceeds going to the general fund of the Treasury...MORE