From FT Alphaville:

It wasn’t too long ago many economy-watchers were worried the Federal Reserve was underestimating the risk of slowing inflation. Whether or not such concerns were reasonable at the time, it’s safe to say traders now think the danger has passed.

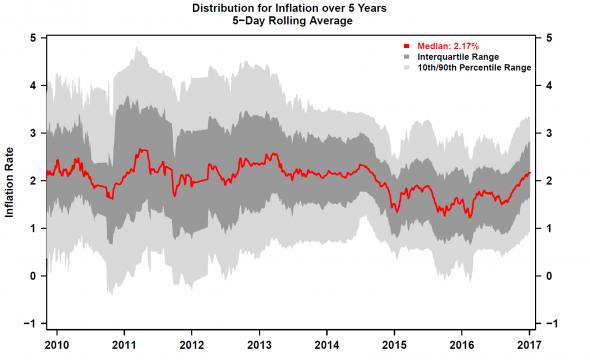

Just look at this chart from Michael Gaston of the Federal Reserve Bank of Minneapolis, which shows the market-implied forecast of consumer price inflation over the next five years according to the relative prices of options:

From the middle of 2014 to February 2016, the midpoint of the market-implied forecast dropped from a little more than 2 per cent — roughly in line with the Fed’s target — to as little as 1.2 per cent.

Inflation expectations have since reverted to normal. About half the recovery occurred immediately after the Chinese government opened the credit spigot in the spring, with the rest taking place since the end of September.

Even more encouraging is why the average implied probability rose as much as it did.

“Trumpflation” may yet materialise, but options prices imply traders are as convinced as they’ve ever been (70 per cent chance) the Fed will keep inflation within a range of 1 to 3 per cent, on average, over the next five years:...

... This sanguine outlook is due entirely to the collapse in the implied odds of ultra-slow inflation from just over 40 per cent last February to 11 per cent now. Traders aren’t worried prices will rise too quickly over the next five years....MORE