Agricultural commodities will be under more pressure from a strong dollar, weak China, and volatile weather patterns.

Investors in agricultural commodities will continue to feel the pain of weak prices this year.Ample global supplies, a strong U.S. dollar, and weakness in the currencies of other commodity producing and exporting countries are the main factors that will keep prices of corn, wheat, and soybeans under pressure.The U.S. dollar has gained 24% over the past 18 months, according to The Wall Street Journal Dollar Index, which compares the U.S. currency against a basket of 16 commonly traded others. This appreciation has been a major head wind to grain and soybean prices because they are traded in dollars and become more expensive for foreign buyers when the dollar rises against their home currencies. Demand usually weakens and sends the commodity’s price lower.The dollar’s strength can also cause top producers like Brazil and Argentina to increase output for exports, as they receive more local currency for every unit of the dollar-denominated commodity. This, in turn, increases global supplies and weighs on prices.Brazil and Argentina have witnessed their currencies—the real and peso—fall by 34% and 30%, respectively. The peso fell against the dollar after Argentina’s government late last year lifted capital controls; it also cut the export tax on soybeans, boosting the country’s export competitiveness.

On the other hand, the Financial Times of January 5 warns:“The general strength of the dollar has played a key role in crop prices over the past 12 months, undermining the competitiveness of U.S. exports,” says Hamish Smith, commodities economist at research firm Capital Economics.The U.S. is the world’s largest exporter of corn and wheat, and its third-largest soybean exporter. But weaker demand from China, the global commodities consumer juggernaut, is further pressuring a U.S. agricultural market already weighed down by three straight years of bumper harvests.Prices of corn, wheat, and soybeans have risen 1.4%, 5.5%, and 3.5%, respectively, so far in 2016.The March delivery contract for wheat on the Chicago Board of Trade ended on Friday at $4.73 a bushel. The March futures contract for corn ended on Friday at $3.63 a bushel, and the March contract for soybeans ended at $8.79 a bushel....MORE

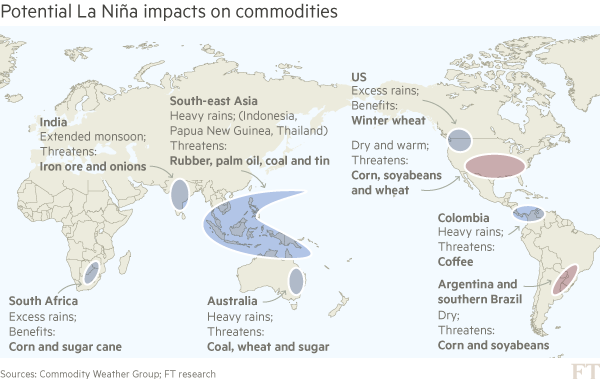

After El Niño, commodity markets brace for La Niña

The strongest El Niño in almost two decades that caused droughts in Asia and was linked to storms in the UK could be followed by the opposite weather phenomenon.

Australia’s Bureau of Meteorology said the chances of a La Niña event in the second half of 2016 were equal to those of conditions returning to neutral.Farmers, miners and commodities traders will be keeping a close watch on sea temperature patterns linked to La Niña, which tends to bring rainfall to Southeast Asia and Australia and dryness to the US Midwest.

Significant La Niñas tend to be linked to increased levels of volatility on agricultural markets, according to CME Group.

The US drought in 2012 that devastated grain and oilseed crops struck during a La Niña year. According to the US National Oceanic and Atmospheric Administration, 2012 was the third-warmest La Niña year on record.

The 2010-11 La Niña wrought havoc on the mining industry in Australia, with thermal and coking coal mines in Queensland hit by flooding from cyclones and heavy rain.

In Colombia, coffee farmers suffered from relentless wet weather that led to the spread of a tree fungus....MORE

Here's the current ensemble of model predictions for ENSO (El Niño/Southern Oscillation) Sea Surface Temperatures:

A full blown La Niña is declared when the conditions persist for a rolling three-month period which actually covers five months on the calendar.

We have a couple hundred posts on ENSO, El Niño and La Nina, use the search blog box if interested.