-Tom Wolfe

Chase Isn't the Only Bank in Trouble

I've been away for weeks now on a non-financial assignment (we have something unusual coming out in Rolling Stone in a few weeks) so I've fallen behind on some crazy developments on Wall Street. There are multiple scandals blowing up right now, including a whole set of ominous legal cases that could result in punishments so extreme that they might significantly alter the long-term future of the financial services sector.Fighting moral nihilism with political nihilism.

As one friend of mine put it, "Whatever those morons put aside for settlements, they'd better double it."

Firstly, there's a huge mess involving possible manipulation of the world currency markets. This scandal is already drawing comparisons to the last biggest-financial-scandal-in-history (the Financial Times wondered about a "repeat Libor scandal"), the manipulation of interest rates via the gaming of the London Interbank Offered Rate, or Libor. The foreign exchange or FX market is the largest financial market in the world, with a daily trading volume of nearly $5 trillion.

Regulators on multiple continents are investigating the possibility that at least four (and probably many more) banks may have been involved in widespread, Libor-style manipulation of currencies for years on end. One of the allegations is that traders have been gambling heavily before and after the release of the WM/Reuters rates, which like Libor are benchmark rates calculated privately by a small subset of financial companies that are perfectly positioned to take advantage of their own foreknowledge of pricing information.

A month ago, Bloomberg reported that it had observed a pattern of spikes in trading in certain pairs of currencies at the same time, at 4 p.m. London time on the last trading day of the month, when WM/Reuters rates are released. From the article:

In the space of 20 minutes on the last Friday in June, the value of the U.S. dollar jumped 0.57 percent against its Canadian counterpart, the biggest move in a month. Within an hour, two-thirds of that gain had melted away.The same pattern – a sudden surge minutes before 4 p.m. in London on the last trading day of the month, followed by a quick reversal – occurred 31 percent of the time across 14 currency pairs over two years, according to data compiled by Bloomberg. For the most frequently traded pairs, such as euro-dollar, it happened about half the time, the data show.The Forex story broke at a time when the industry was already coping with price-fixing messes involving oil (the European commission is investigating manipulation of yet another Libor-like price-setting process here) and manipulation cases involving benchmark rates for precious metals and interest rate swaps. As Quartz put it after the FX story broke:

The recurring spikes take place at the same time financial benchmarks known as the WM/Reuters (TRI) rates are set based on those trades…

For those keeping score: That means the world's key price benchmarks for interest rates, energy and currencies may now all be compromised.Perhaps most importantly, however, there's a major drama brewing over legal case in London tied to the Libor scandal.

Guardian Care Homes, a British "residential home care operator," is suing the British bank Barclays for over $100 million for allegedly selling the company interest rate swaps based on Libor, which numerous companies have now admitted to manipulating, in a series of high-profile settlements. The theory of the case is that if Libor was not a real number, and was being manipulated for years as numerous companies have admitted, then the Libor-based swaps banks sold to companies like Guardian Care are inherently unenforceable.

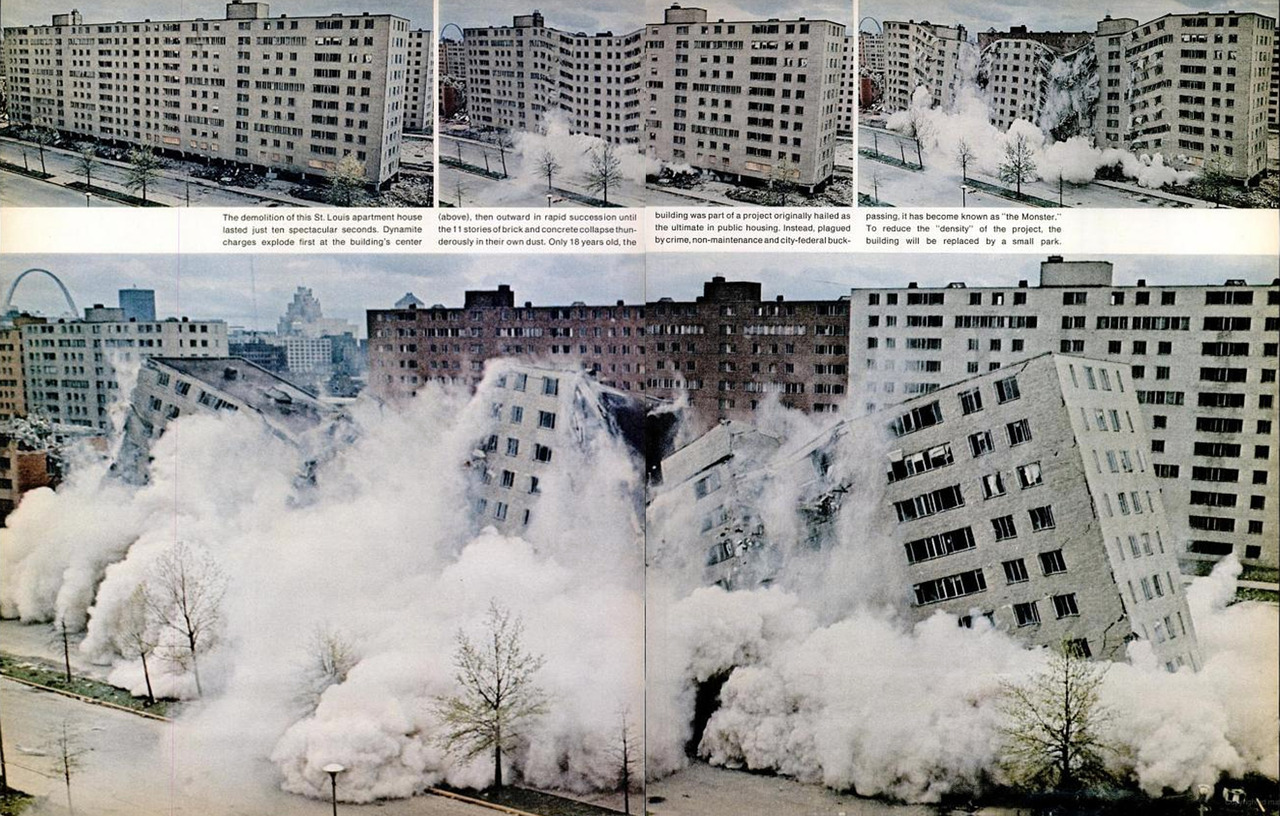

Blow it up.