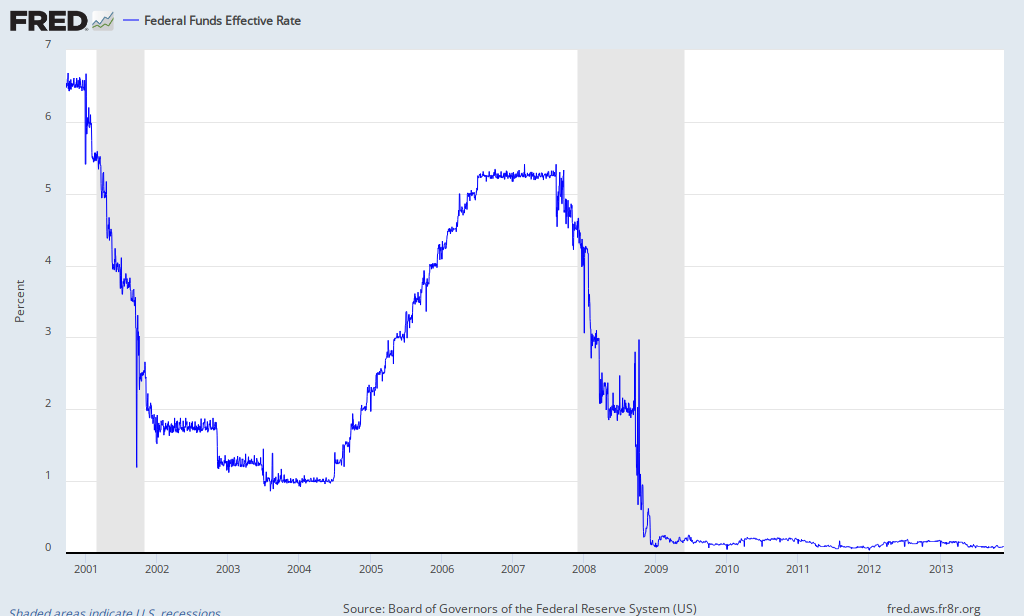

After the bursting of the dotcom bubble and the terrorist attacks of 2001 Greenspan did the right thing and brought rates, in this chart Fed Funds, down fast. The problem was he kept them down too long as this FRED Chart shows:

So, the question coming into the last month of 2013 is "with the effective Fed Funds rate at 0.09% what the hell are we going to do when the next recession hits?"

Just as Bernanke, the expert on the Great Depression, was brought in to clean up Greenspan's mess, Yellen is being brought in to clean up Bernanke's.

Reasoning from that point means she won't be as loosey-goosey as Ben, at least at first, which is going to surprise some folks who don't understand she has to get some room to maneuver.

Let's just hope the economy is strong enough to handle the upticks.

From Tim Duy's Fed Watch:

The minutes of the October FOMC meeting leave little doubt that the Fed increasingly desires to end the asset purchase program, enough so to contemplate tapering regardless of seeing satisfactory improvement in labor markets. It is that desire - or perhaps desperation - that puts an element of random chance into the policymaking process and keeps the expectation of near-term tapering alive despite efforts of policymakers to reassure market participants that it is all data dependent. Trouble with that story is simple - it is not only data dependent. The Fed has already admitted as much.

Policy planning and communication strategy were the hot topic of this FOMC meeting, and the discussion of the specifics of the asset purchase program began with:

During this general discussion of policy strategy and tactics, participants reviewed issues specific to the Committee's asset purchase program. They generally expected that the data would prove consistent with the Committee's outlook for ongoing improvement in labor market conditions and would thus warrant trimming the pace of purchases in coming months.The mythical taper - just a few months away. And it will always be just a few months away given the broad weakness in the labor chart. Recall the Yellen Charts:

Unless they narrow their focus to only the unemployment rate, the argument to taper is challenged to say the least. It is even more challenged considering inflation indicators. Knowing that the data continuously refuses to cooperate, the Fed explores plan B:

However, participants also considered scenarios under which it might, at some stage, be appropriate to begin to wind down the program before an unambiguous further improvement in the outlook was apparent.To be sure, some doves shrieked...MUCH MORE