Original post:

A few more reactions to the Summers speech.

So far the person coming closest to where we believe this is going is Izzy@Alphaville with her focus on the Keynesian coal mines (although the money hole is not bitcoin).

I'll quit teasing about our thinking when (if) some people respond to queries.

Because this stuff is so serious if you are playing the real money version of the game, it is best if we get this thesis nailed down. In the interim we'll keep an open mind.

From Arnold Kling at askblog:

Paul Krugman endorses the idea. Pointer from Mark Thoma.And Mr. Cowen's Marginal Revolution:

My own first reaction to Larry Summers’ talk was to write

there are so many problems with Summers’ story that one does not even know where to begin.Tyler Cowen writes,

I don’t mean this in a rude or polemic way, but the arguments we have been reading do not yet make sense.Cowen’s stagnation story is that the pace of innovation has slowed, resulting in declining growth in aggregate supply. In contrast, Summers’ story is one of a permanent shortfall of aggregate demand, due to an excess of desired saving over desired investment, which can only be eliminated at a negative real interest rate.

Here are some criticisms that come to mind.

1. If “the” full-employment real interest rate is negative, then why do we need quantitative easing? Why does not the excess of saving over investment not by itself drive long-term rates to zero?

2. Summers wants to claim that full employment has been achieved in recent years because of asset bubbles. However, in a world of negative real interest rates, there is no such thing as an asset bubble. Real assets have infinite value in such a world.

3. As Tyler points out, it is hard to reconcile positive economic growth with negative real interest rates. We have had positive economic growth, even since 2008....MORE

Are real rates of return negative? Is the “natural” real rate of return negative?

Here is a long and very interesting post by Paul Krugman, also referencing a recent talk by Larry Summers. There is also this older Krugman post, and here is Gavyn Davies, and also Ryan Avent. And Scott Sumner. Do read and listen to these, there is much in there to ponder. I do very much agree with the claim that lower rates of return make recovery more difficult and for the longer haul as well. And I am happy to welcome these thinkers, or in the case of Krugman re-welcome, to stagnationist ideas.At Real World Economics Review we have a polemic and a nifty infographic:

I cannot, however, agree with the central arguments about negative real interest rates, and the necessity for negative natural rates of interest (there are a variety of interlocking claims here, so do read them for yourself. I am not sure any brief summary can quite reproduce the arguments, which are also not fully clear).

As I frame the data, we have had negative real rates on government securities, but positive rates on many other investments in the U.S. The difference reflects a very high real risk premium, which of course we would like to lower, and the differences also reflect some degree of investment segmentation. The positive rates on these other investments are evidenced by recent broad stock market gains, observed rates of productivity growth (low but clearly positive), high internal corporate hurdle rates, and so on. The “average vs. marginal” distinction is an important one, but still I don’t see how it can be used to push us away from seeing relevant real rates of return as positive. Nor do I think monopoly is widespread enough for that assumption to be a game-changer. Even Apple competes with Samsung and others in its major product lines.

Given the multiplicity of real rates in the American economy, I get nervous when I read about the real rate or the natural rate. (Don’t forget Sraffa [1932] and also Arnold Kling discusses the different issue of varying rates across people. Interfluidity questions whether the idea of a natural rate makes sense at all.)

I also get nervous when I do not see serious talk about the embedded risk premium in the observed structure of market rates....MUCH MORE

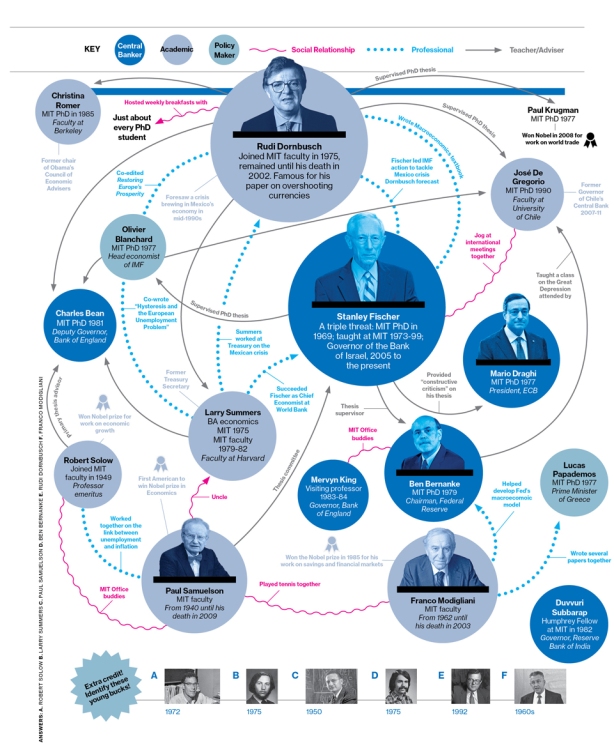

All in the family: Krugman, Summers, Fisher, . . . .

My better half has insisted for years that I not be too hard on Paul Krugman. The enemy of my enemy. Popular Front. And all that. . .

But enough is enough.

I simply can’t let Krugman [ht: br] get away with writing off a large part of contemporary economic discourse (not to mention of the history of economic thought) and with his declaration that Larry Summers has “laid down what amounts to a very radical manifesto” (not to mention the fact that I was forced to waste the better part of a quarter of an hour this morning listening to Summers’s talk in honor of Stanley Fischer at the IMF Economic Forum, during which he announces that he’s finally discovered the possibility that the current level of economic stagnation may persist for some time).

Krugman may want to curse Summers out of professional jealousy. Me, I want to curse the lot of them—not only the MIT family but mainstream economists generally—for their utter cluelessness when it comes to making sense of (and maybe, eventually, actually doing something about) the current crises of capitalism....MORE

Previously:

Economists,Top 0.0001% Agree, Time For a New Bubble

The Essential Larry Summers: How He and Alan Greenspan Laid the Groundwork for the Financial Crisis and Larry Lost $1.8 Billion for Harvard

We Are Raising A Generation of Short(er) Lawrence Summers Wannabes

Hey, These Alphaville Readers Are Pretty Sharp!