From the CME:

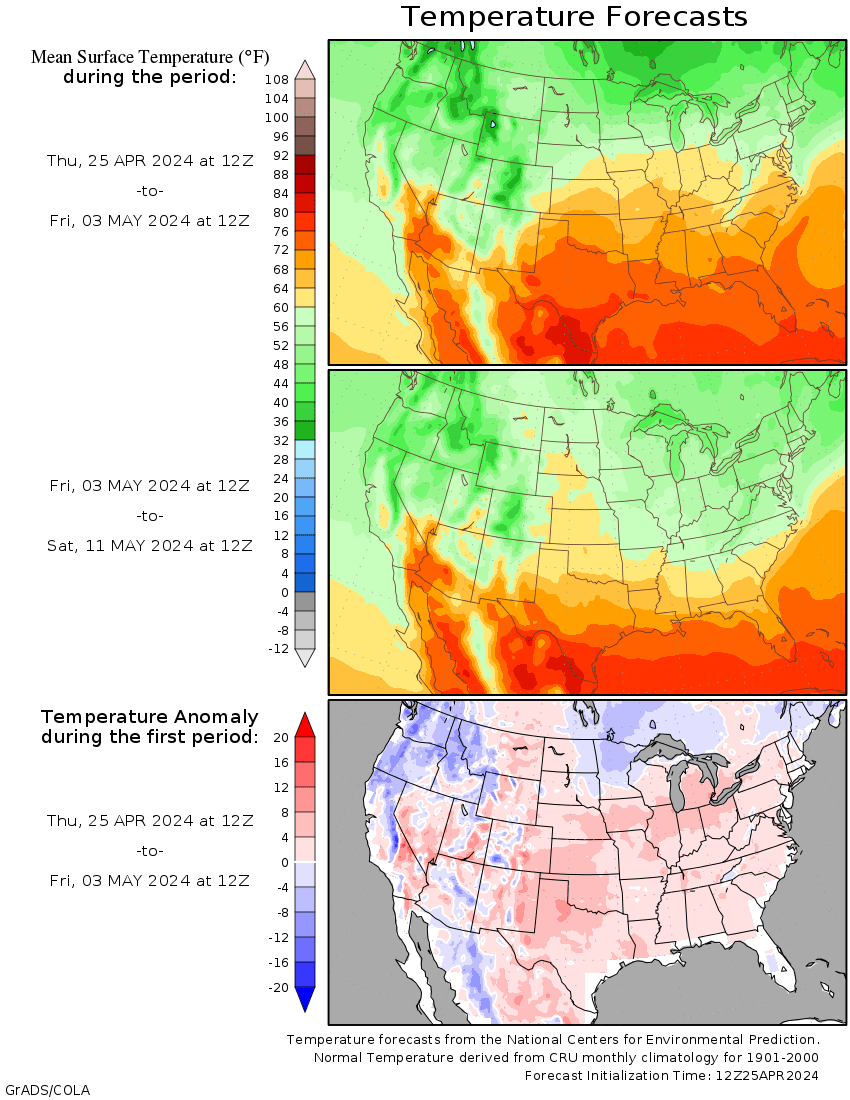

Nat Gas prices are getting another upside push after a bullish weekly EIA inventory report. The first net withdrawal of the year came in greater than the expectations as well as the historical data for the same week. The current Nat Gas price rally is modest with the spot December contract up by 1.6 percent or $0.061/mmbtu as of this writing. The contract has put some distance from the new technical support area of $3.64/mmbtu.Here is the Temp and Temp anomaly forecast from WXMaps:

The early reaction to the bullish inventory report is not as strong as the 45 BCF net withdrawal would suggest. Part of the modest reaction is due to the mild weather that hit the US over the last week which should result in an underperformance in next week's Nat Gas inventory report. However, beyond that the inventory reports will be reflective of a return to colder than normal temperatures through the first week of December.

The latest NOAA six to ten day and eight to fourteen day forecasts remain supportive for above normal heating related Nat Gas demand. The shorter term six to ten day forecasts is projecting very cold temperatures… winter like… through the end of November. This period should experience a high level of Nat Gas related heating demand and thus a larger than normal withdrawal from inventory. The longer eight to fourteen day forecasts is projecting a bit of moderation for the first week of December by still showing the eastern two-thirds of the country expecting below normal temperatures which should also result in a modestly strong net withdrawal for inventory.

Today's EIA report was bullish versus the market consensus and compared to the so called normal five year average and last year. The report showed a net withdrawal that was above the market consensus (45 versus 33), and greater than last year and the five year average net withdrawal for the same period. The 45 BCF withdrawal (above normal for this time of the year) was about 12 BCF above the market consensus calling for a withdrawal of around 33 BCF. The draw of 45 BCF was above my model forecast (15 BCF withdrawal) this week. The year over year inventory situation remains in a deficit position versus last year and is still in a small surplus position versus the so called normal five year average. The current inventory surplus came in at 16 BCF versus the normal five year average or about a positive 0.4 percent....MUCH MORE