Nor are these the Marks conjectured to have been printed to facilitate Germany's exit from the euro.

Rather these are the D-mark equivalents represented by the current price of the euro.

From the Financial Times' Long Short blog:

Everyone from the US Treasury to the European Commission to our very own Martin Wolf is upset about Germany’s export-driven growth model – as I said on Saturday, it’s acting as a parasite on the rest of the world.

The blame can be laid on Germany’s savers – they just refuse to go on the sort of debt-fuelled spending binges Brits and Americans love so much – as well as on the German government for not encouraging them to spend more, or stepping in to spend in their stead.

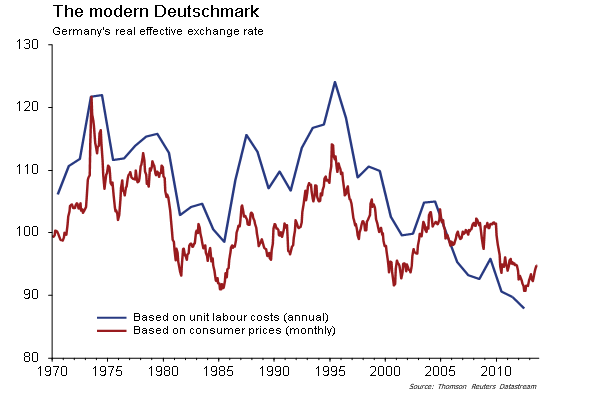

But the blame should also be put on the euro. If Germany still had the Deutschmark, the country’s current account surplus would have led to some natural rebalancing, with the currency strengthening to make BMWs and other German exports more expensive, and so less competitive. The euro has risen a bit, but not nearly enough.

This chart shows exactly how competitive Germany has become, thanks to the Hartz reforms of the labour market of 2003-2005, and self-imposed austerity.

If Germany still had the Deutschmark, it would be the weakest since just before the Plaza accord in 1985...MORECompare with a note we just happened to have lying around. From 2007:

...The euro’s record against the dollar today needs to be viewed in two contexts — one, during the euro’s existence itself — and second, because the euro trading at $1.4571 translates to $1.3423 in Deutschmarks, which beats the all-time peak of 1.345 in the now-defunct currency, reached March 8, 1995, according to RT-ICAP....See also:

"If Europe Went Back to Its Old Currencies…"