Higher and Higher – A Better Forecast of Drilling Rig Productivity

Last month the Energy Information Administration (EIA) debuted a new monthly report detailing oil and gas drilling productivity in six of the largest US production basins. Rather than just being an “after the fact” report telling us what happened in the past, the new report provides a forecast of oil and gas production for the current and next month out in each of the six basins. The initial report indicates that oil production will increase by roughly 60 Mb/d in these basins during November with gas production increasing by 0.4 Bcf/d. The report also highlights continued improvement in rig productivity. Today we begin a series interpreting the new drilling rig productivity data.

We have previously described rapidly increasing US natural gas production from shale (see Golden Years) as well as oil production from shale and other tight resources (see Charge of the Light Brigade). Recent U.S. crude and gas growth has centered largely in a few key regions and has been driven by advances in the application of horizontal drilling and hydraulic fracturing technologies (see Tales of the Tight Sands Laterals). The growth in production has been accompanied by improvements in drilling productivity - described in our six part series on drilling economics (see The Truth is Out There). In fact drilling productivity is driving domestic production to such an extent that the EIA has developed a new approach to measuring it.

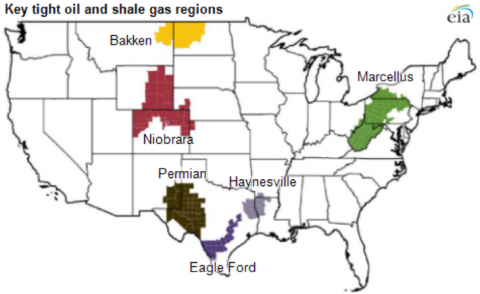

The EIA Drilling Productivity Report (DPR) provides region-specific insights into rig efficiency, new well productivity, decline rates at previously existing wells, and overall production trends. The report covers six regions (see map below). In 2011-12, these six regions accounted for 90 percent of domestic oil production growth and virtually all domestic natural gas production growth.

Source: EIA (Click to Enlarge)

The DPR estimates the current rate of growth or decline in production in each of these basins based on a number of indicators. These include the active rig count, drilling efficiency as well as the productivity of new wells, and production and depletion trends for previously producing wells. The data is intended to be more informative than traditional indicators such as simple oil and gas rig counts. The report also estimates rig productivity - a new measure that EIA has developed to better reflect continuing improvements in drilling rig efficiency. The rig productivity measure starts with an estimate of crude and natural gas output from new wells in a region during their first month in production. The rig productivity (calculated separately for oil and for gas) is the new well output divided by the number of drilling rigs in the region....MORE