In the second part of a beyondbrics series on India and gold, we look at the surge in gold loans – a market that highlights the country’s obession with the metal, and serves to reinforce demand.

See part one: India’s jewellers in a desperate spot. Coming on Friday: India and gold in charts.

As gold demand has grown in India, so has the gold loan industry. It’s a bit of a self reinforcing loop. Imports add to the supply for loan collateral, while the availability of these loans creates more demand for buying the precious metal.

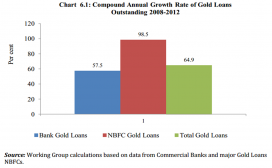

And the rapid expansion of this gold-backed finance through non-banking financial companies (NBFCs) is worrying India’s policy makers.

India is said to have more than 10 per cent of all the gold stock above the surface of the earth, and much of that is with households who buy gold as either a store or show of wealth.

Gold loans involve lending against that stock. In return for a loan borrowers deposit some metal, which is kept safe and returned at maturity – unless the borrower defaults, of course, in which case the metal is auctioned off.

This isn’t a new concept in India, where small operations have been around for centuries in rural areas.

“It’s very easy to get loans against gold,” says Nupur Pavan Bang of the Indian School of Business. “Even in small villages you have these pawn brokers who lend you money against gold.”

The formal gold loan industry, however, has expanded hugely in recent years. It is now worth around Rs1,500bn ($24.4bn), according to I Unnikrishnan, deputy chief executive of Manappuram Finance, one of the country’s major gold loan companies. He says about two-thirds of that is controlled by banks and the rest is with NBFCs like Manappuram – and that’s leaving out the unorganised sector which is said to be several times larger than the organised.Highly recommended are India: Part of the fabric at the FT and two at Alphaville:

At Manappuram the average loan is around Rs30,000 ($490) with interest of 21 per cent and a repayment rate of 96 per cent....MORE

Hurrah for India’s FX swap strategy, or not?

The informal Rajan

Here's part three of the beyondbrics series:

India and gold (3): the story in charts