Robert Sarnoff , the CEO of RCA before it was absorbed by GE, once said, “Finance is the passing of money from hand to hand until it disappears.”

That process is very clearly defined in The Age of Greed by Jeffrey Madrick. It recounts, in concise terms, how a few dozen individuals—some in the private sector, some in government--brought us to our current economic pass, in which finance seems to have been completely detached from life. Names from the past come back, and their crimes are explained. Ivan Boesky, Michael Milken, and Dennis Levine look guiltier in the retelling than they did in the newspapers at the time. And in this telling, the philosopher king of the new finance was Walter Wriston, CEO of Citicorp.

I wrote for Wriston and other senior managers of Citibank from 1980 through his retirement in 1984, and for his successors through 1991. My colleagues and I were charged with helping Wriston make the case that the financial regulatory regime that was put in place during the Depression was obsolete. Let me make it clear: I was a footnote, although I occasionally run into old acquaintances who still shake their fingers at me.

Madrick’s Wriston is by far the book’s most compelling character. As with all the other subjects, there’s a smattering of armchair Freud, although most of the political figures who make appearances here escape their two minutes on the shrink’s couch. Wriston’s psyche was more interesting than the insecurities of Ivan Boesky and Sandy Weill, to name just two; his university-president father Henry Wriston despised the New Deal as it was happening, and imparted that attitude to the son. Henry then remarried too quickly after Walter’s mother died for the son’s taste, and they became estranged.

But there’s more to Wriston than you read in Madrick. He was a restless intellect, impatient with field of diplomacy he had studied for before World War II, and after taking a job in banking, which he once wrote seemed like, “the embodiment of everything dull,” found a vehicle for exerting his imagination, and then for fulfilling his ambitions.

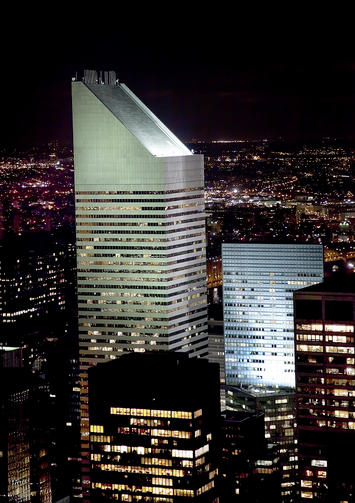

The First National City Bank, later to become Citibank and Citicorp, and then Citibank again, had inspired imperial dreams before. Through a series of mergers it became the biggest bank in the biggest city in the country. When trade followed the flag around the world, Citibank’s precursors were right there with it. During the Roaring Twenties, Charles Mitchell dreamed of a “bank for all”, the forerunner of Wriston’s vision of one-stop banking, although Mitchell’s stewardship ended with a trial (and an acquittal) after the stock market crash and the Pecora hearings in the early ‘30s. While the bank had social register threads running through its history—when Wriston started the president was James Stillman Rockefeller, descended both from the Stillmans and the Rockefellers, married to a Carnegie—the patrician elements always had hungry outsiders around to push the envelop of banking practice. When Rockefeller was chairman, he had a president named George Moore, and Wriston was his protégé. However, Moore was too frisky for Rockefeller, and when a successor was chosen, it was Wriston.

Wriston hung a portrait of Friederich Hayek on the wall of his office. He was a reader. When Adam Smith became the Holy Ghost of the Church of Deregulation, Wriston’s top writer (and later my boss) was the man who actually edited The Wealth of Nations for the Great Books. When I was new there, I asked one of the bigshot corporate bankers which great thinkers he liked to quote in his speeches. He answered, “The only person who can get away with that is Walt Wriston, and I’m not sure he can.” Wriston’s ambition may have been shaped by philosophy, but he achieved it with tactics and strategy that sprang from a contrary nature as much as by the force of his ideas, and Madrick recounts that. He wanted his bank to be valued like a growth stock, and promised analysts 15% a year return on equity—not a recipe for safety and soundness.

Whether it was inventing financial instruments to get around interest rate restrictions, making outsize bets on railroad bonds and New York City bonds, creating the Eurodollar market, blitzing the country with credit cards, or wholesale lending to developing countries to recycle petrodollars, Wriston had a knack for making money when the economy was right and then challenging the government to deregulate in time to accommodate his losses. Personally, I think that before the bank was too big to fail, it was too big to succeed.

Looked at now, there’s something quaint about these investments. At least they had to do with real things, like trains, oil, municipal governance, and the ostensible aspirations of people in emerging markets, although they were mostly oligarchs and autocrats....MORE

Saturday, January 14, 2012

"Citibank, Citizen Wriston, And The Age of Greed" (C)

From New Geography: