For a while last November and December I was trying out the tagline "Climateer, he's a man who goes where the action is".

It didn't catch on.

...Besides as they say around here, "Climateer, he's a man who goes where the action is".The point is, deleveraging notwithstanding, there are still huge pools of money sloshing across the globe in search of returns. That's why I posted "Surprising Corn Numbers" when the USDA put out the acreage numbers in late June. Corn was at $3.48/bushel. Today it's at $3.81.

(okay, I'm the only one who says it, and I've noticed a huge drop off in party invitations since the self-referential Tourette's [without the coprolalia] kicked in)...

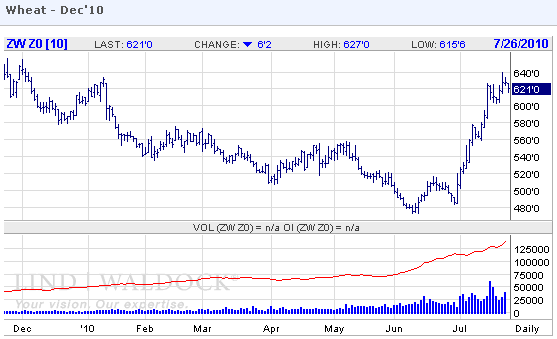

Here's wheat, from Bloomberg:

Wheat rose for the first time in three sessions on speculation that the prolonged drought in Russia will slash output further, boosting demand for grain from the U.S., the world’s largest exporter.Here's Inside Futures with some discussion of the headline question:

The harvest of crops including wheat, barley, rye and corn may drop below 80 million metric tons, compared with the current estimate of 85 million, Deputy Economy Minister Andrei Klepach said today. Russian grain traders may halt new export agreements because the government may limit shipments, the Moscow-based researcher SovEcon said last week.

“People are concerned that Russia may ban exports,” said Brian Grete, the senior market analyst for Professional Farmers of America Newsletter in Cedar Falls, Iowa. Demand may increase for crops from the U.S., Grete said.

Wheat futures for September delivery rose 5.5 cents, or 0.9 percent, to $5.95 a bushel on the Chicago Board of Trade, after falling 1.2 percent the previous two sessions. The price has risen 39 percent since June 9 as drought damaged crops in parts of Europe and Russia, while too much rain in Canada reduced the area farmers planted this year.

Smaller Harvest

Russia’s grain harvest may fall below 70 million tons as yields drop amid the worst drought in at least a decade, SovEcon said today. The U.S. Department of Agriculture forecast Russian production of wheat and feed grains at 79.8 million tons earlier this month, down from 93.5 million last year...MORE

Has Wheat Peaked?

Wheat has had a phenomenal run over the past month. Since June 30, CBOT December wheat futures have rallied more than 30 percent, moving from $ 4.85 to $6.40 a bushel. A prolonged drought in Eastern Europe could create a bit more upside, but I think most of the bad news is already priced in, and traders should watch for a correction at any time.

The main factor driving the rally in wheat has been an unusually hot summer and drought spreading through Russia, part of the Ukraine and Kazakhstan. Wild fires are burning in several areas, and the heat wave is expected to continue. In Moscow, the temperature soared to 99.3 Fahrenheit on July 26, the hottest in 130-years of record keeping.

About a third of the Russian grain harvest has been affected so far. This year’s harvest is expected to be less than 80 million metric tons, according to Russia’s Deputy Economy Minister. Some analysts said it could fall below 70 million tons. It looks like Russia will lose about 20 percent of its crop this year. At one point, the Russian government said it would start selling grain from its strategic reserves into its domestic market.

Other factors supporting gains in wheat include recent weakness in the U.S. dollar, and short covering activity. The most recent Commitments of Traders data from the Commodity Futures Trading Commission showed trend followers (managed funds) trimmed their short positions by 14,000 contracts. Three weeks ago, they were short 77,000 contracts. So that indicates to me much of the recent gain wasn’t due to new buying interest, but short covering of prior positions. Taking that out of the equation, volume hasn’t been robust.

The question is whether this rally can continue. Some analysts are predicting $7 wheat, and the market does look strong technically. However, I think it’s getting overbought and the market has already priced in adverse weather. If it spreads or intensifies, we might see a renewed bounce.

However, I think this market went up too far, too fast. It’s important to keep in mind that the U.S. crop is in much better shape. The USDA’s June 30 acreage and grain stocks report showed the largest carryover that we’ve seen in 20 years. The July report reflected a yield forecast for U.S. winter wheat of 46.9 bushels per acre, up 2.7 bushels from last year. It would tie the third-largest yield on record. Other spring wheat was up 4 percent from last year, and also on track for the third-largest yield on record.

The late winter and spring wheat harvests are coming in with good yields, and we also have slow exports, which will create a strain on storage. Farmers should have incentive to start to sell at these levels.

This market had a big run, supply is good and exports are slow. Bottom line, I feel that the December contract could fall back to $5.50 - $5, which is more in line with where I think is an appropriate price point. I am advising clients to consider buying inexpensive puts in anticipation of a corrective move, which could come at any time. If you are bullish wheat, you could consider buying on a pullback, but if you want to get in the market, I recommend conservative strategies.