- Global head of credit strategy at Credit Suisse

- Global Head of Fixed Income Research for Bank of America

- Global Head of Fixed Income Research at Cantor Fitzgerald

In addition to apparently not being able to hold onto a job I think one of his requirements for moving on was a "Global Head" title. (JK, young Master. G.)

From Asia Times, January 12:

Worst US inflation since '82 is huge underestimate

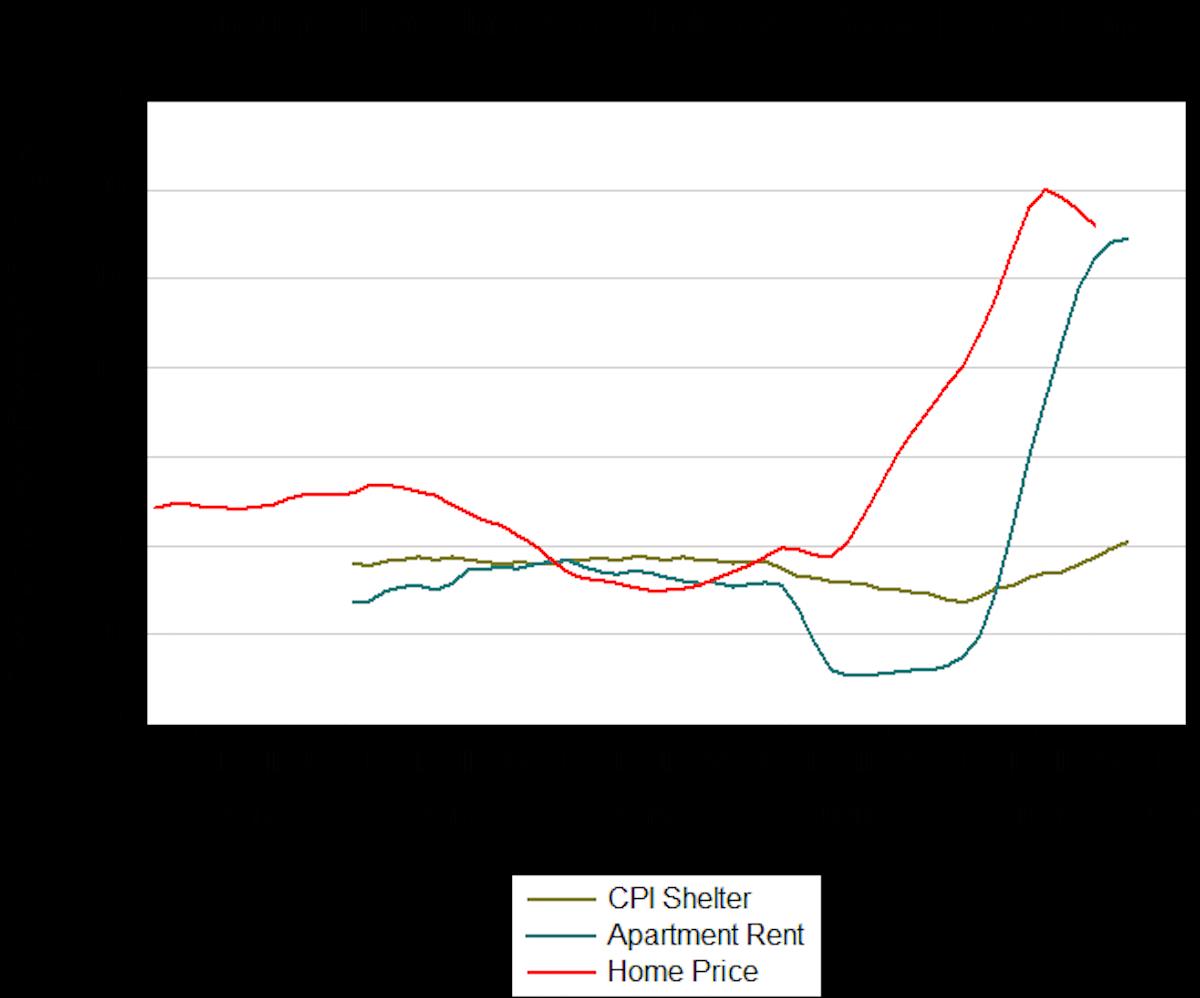

Shelter accounts for about a third of American household expenditure, and the cost of buying or renting shelter is up nearly 20% over the past year. Yet the Consumer Price Index for shelter reported Jan. 12 by the US Bureau of Labor Statistics showed an increase of just 4.2 over the past year. Private surveys conducted by the big rental sites, Zillow and Apartmentlist.com, show increases of 13% to 18% during 2021, and the Case-Shiller Index of US home prices jumped 18% in the year through October.

Who are you going to believe, to paraphrase Groucho Marx – the US government or your own eyes?

Part of the discrepancy involves a simple time lag. The US government looks at the present cost of housing while the private rental surveys register the cost of a new rental. It takes a while for leases to expire and new, higher-cost leases to take effect. Changes in the Apartmentlist.com rent index predict changes in the CPI shelter index with lags up to eight months. That explains at least part of the divergence of the CPI rent inflation number from the private rental surveys.

This time, the CPI rent inflation rate of 4.2% undershot the private rental data. As old leases expire and new leases are written, the CPI index for shelter should rise by 14 percentage points. Shelter makes up 32.3% of the Consumer Price Index, so 14 percentage points in the cost of shelter would add another 4.5 percentage points to the headline inflation number.

That's an additional 4.5 percentage points on top of the 7% annual rate of CPI inflation. In other words, accurate accounting for real-world shelter costs would put consumer inflation in the US around 10% a year. And double-digit inflation would cause a market meltdown....

....MORE

Previous visits with Mr. Goldman on this topic:

October 2021

"Inflation depresses – later will clobber – stocks"

September 2021

Prices: "Rent blowout mysteriously missing from US report"

August 2021

"Home rents set to turbocharge US inflation"

Its almost as though he's trying to tell us something.