The stock is currently changing hands at $86.36 down $0.92 (-1.06%).

We haven't posted much on the solar stocks over the last few years, primarily because their fortunes are so dependent on policy moves (and tsunamis of cash) from Washington.

Additionally the truth of the matter is that the biggest beneficiary of the solar component of the "Build Back Better" bill, if it had passed in 2021 was going to be the Chinese because of their dominance in silicon-based solar, from the silicon ingots to the cells to the panels.

First Solar is different in that their main technology is not silicon based.

We covered the rather remarkable history of the stock from the $20 IPO to the $317 top tick to the subsequent closing low $11.77. Use the 'search blog' box if interested, keyword: FSLR.

The point of all this is to be prepared should the BBB be revived in 2022.

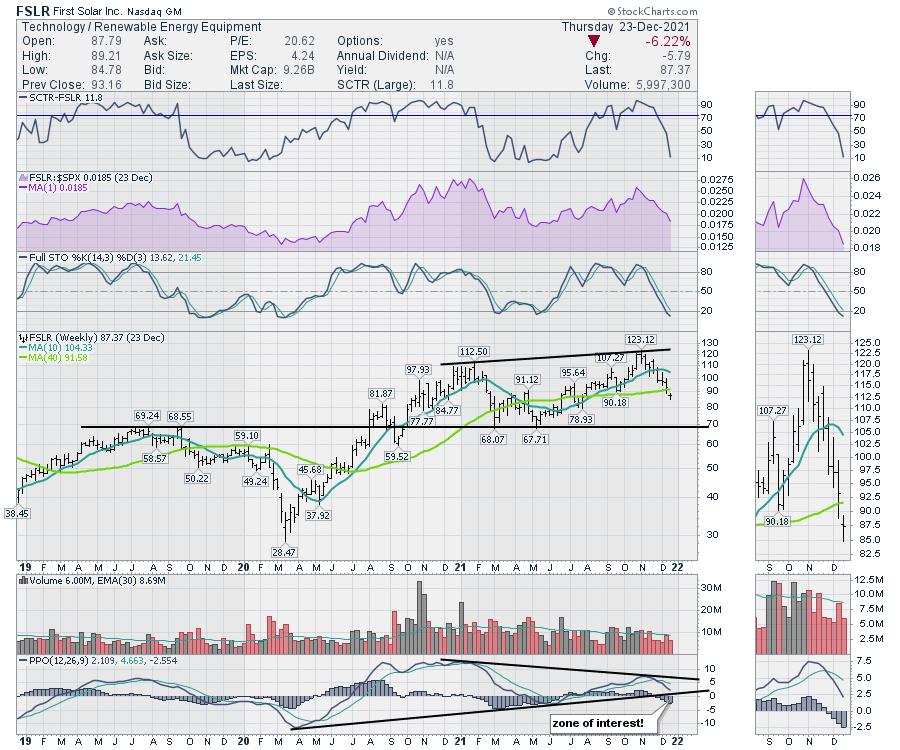

The stock started sliding in early November 2021:

and a resumption of the down move to just below $80 (note June gap and subsequent bounce off that level in July) would set up some upside action should BBB whispers begin again.

Here's a December 24 story from ChartWatchers with more:

Does the Sun Shine in December?

While charting is always an interesting look back, it looks like the solar charts have had a bit of shade, with two real peaks and valley's in 2021. As the world energy crisis adds continent after continent to its grasp, I would expect these charts to gather some power for another rally in 2022. As I roll through the list of companies, the charts still look weak, but shopping is part of the process, watching for the change in investor sentiment.

I noticed First Solar (FSLR)'s offices in Phoenix a few weeks ago. Let's start there. First Solar had a massive run in 2020, topping out in early 2021. After a big pullback, it soared to a new high in late October, made a higher high the next week and then dropped 30% in under 2 months. You'd think the sun stopped shining in December! There is a low at $80 that might provide support, but the big horizontal area is $70. For the PPO momentum indicator, the trend line and the zero level are both in play here. The full stochastic is already under 20%, so we have numerous reasons to keep watching this name for an upside ride.

Sun Run (RUN) is a big one. The problem with the chart below is the developing downward channel since the beginning of the year....

....MUCH MORE

And always, always remember, these are rentier businesses dependent on their political paymasters. Or, as re-iterated last month:

"Solar Shares Tumble After California Proposes Incentive Cuts"

Our Hero

"The honest politician is one who

when he is bought, will stay bought."