He may be too sanguine. Here's his argument at The Overshoot, August 11:

The temporary acceleration in price increases is already fading. But keep an eye on a few consumer services dependent on low-wage workers.

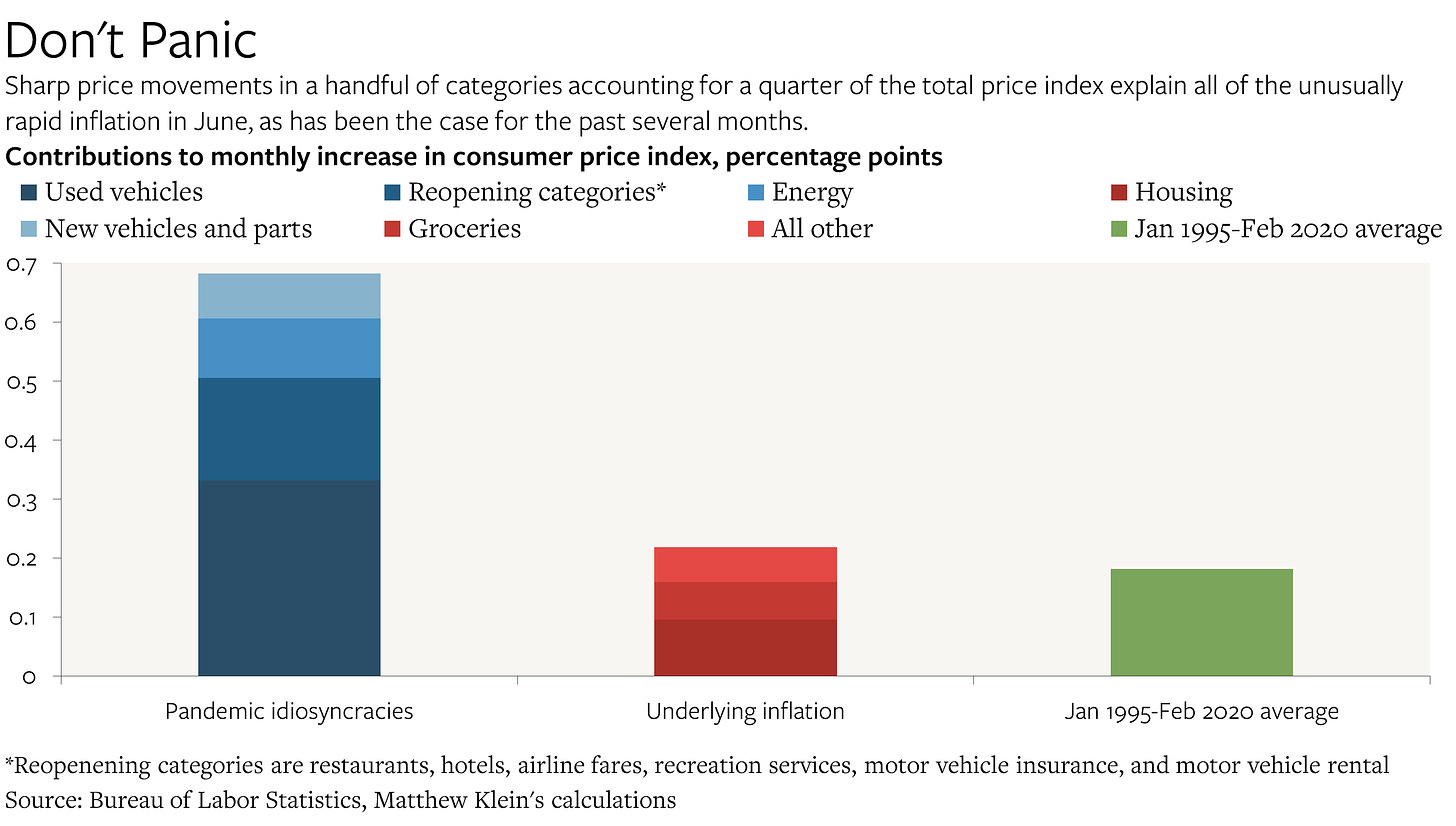

The temporary inflation spike associated with reopening is already beginning to fade as prices that were depressed during the pandemic continue to normalize and as consumer demand for motor vehicles continues to moderate.

The Consumer Price Index in July was 0.47% higher than in June on a seasonally-adjusted basis. That’s the slowest monthly CPI inflation rate since February 2021 (0.35%) and significantly slower than in June (0.90%). Inflation is currently running just 1.1 standard deviations faster than the January 1995-February 2020 average, compared to 2.7 standard deviations faster in June.....

*****

Monthly inflation in July was still faster than the longer-term pre-pandemic average of 0.18%, but, as has been the case since the spring, much of this excess can be explained by temporary factors associated with economic reopening. Those factors have already begun to fade. Here’s the chart I made last month....

And here’s the updated version, with the same scale on the y-axis for perspective....

....MUCH MORE

Mr. Klein does a real service diving into the numbers, the press release for the August 11 CPI report goes on for 37 pages in sometimes excrutiating detail. Here's a tiny snip from page 9:

Bakery products1.........................................

Bread1, 2.................................................

White bread1, 3......................................

Bread other than white1, 3

Fresh biscuits, rolls, muffins2.........................

Cakes, cupcakes, and cookies1......................

Cookies1, 3...........................................

Fresh cakes and cupcakes1, 3.....................

Other bakery products................................

Fresh sweetrolls, coffeecakes, doughnuts1, 3.

Crackers, bread, and cracker products3.........

Frozen and refrigerated bakery products, pies,

tarts, turnovers1, 3.

Where I think he might be seeing the glass as half-full is in housing, both rents and owner-equivalent rents which are not really reflecting the price increases seen in the market. These will be flowing through for months to come with a couple big impulses when the eviction moratoriums are either declared unconstitutional or the $46 billion in rental assistance currently sitting idle frees-up the leasing of units currently frozen by tenants not paying rent and not moving.

And compared to the categories I picked at random above - a craving for fresh sweetrolls having nothing to do with the choice - the housing category is a very heavy weighting in the CPI, 32%+.

On the other hand Mr. Klein's thinking on the price increases that are possible in fast food and services because of labor cost increases, is something I've not seen hammered home quite this clearly anywhere else.

Previously: