I say escapee because Bridgewater Associates always seemed a bit whack and I don't think they would have kept me around for very long. However, it is hard to fault Mr. Dalio's career trajectory: Marry a Vanderbilt/Whitney heiress, trade commodities for a couple wirehouses, set up your own operation, become the largest hedge fund in the world, pontificate from on top of your $21 billion personal pile.

Not knowing Mr. Klein, he might have fit right in but for some reason I think maybe not.

Anyhoo, here's his thinking on inflation via his The Overshoot substack:

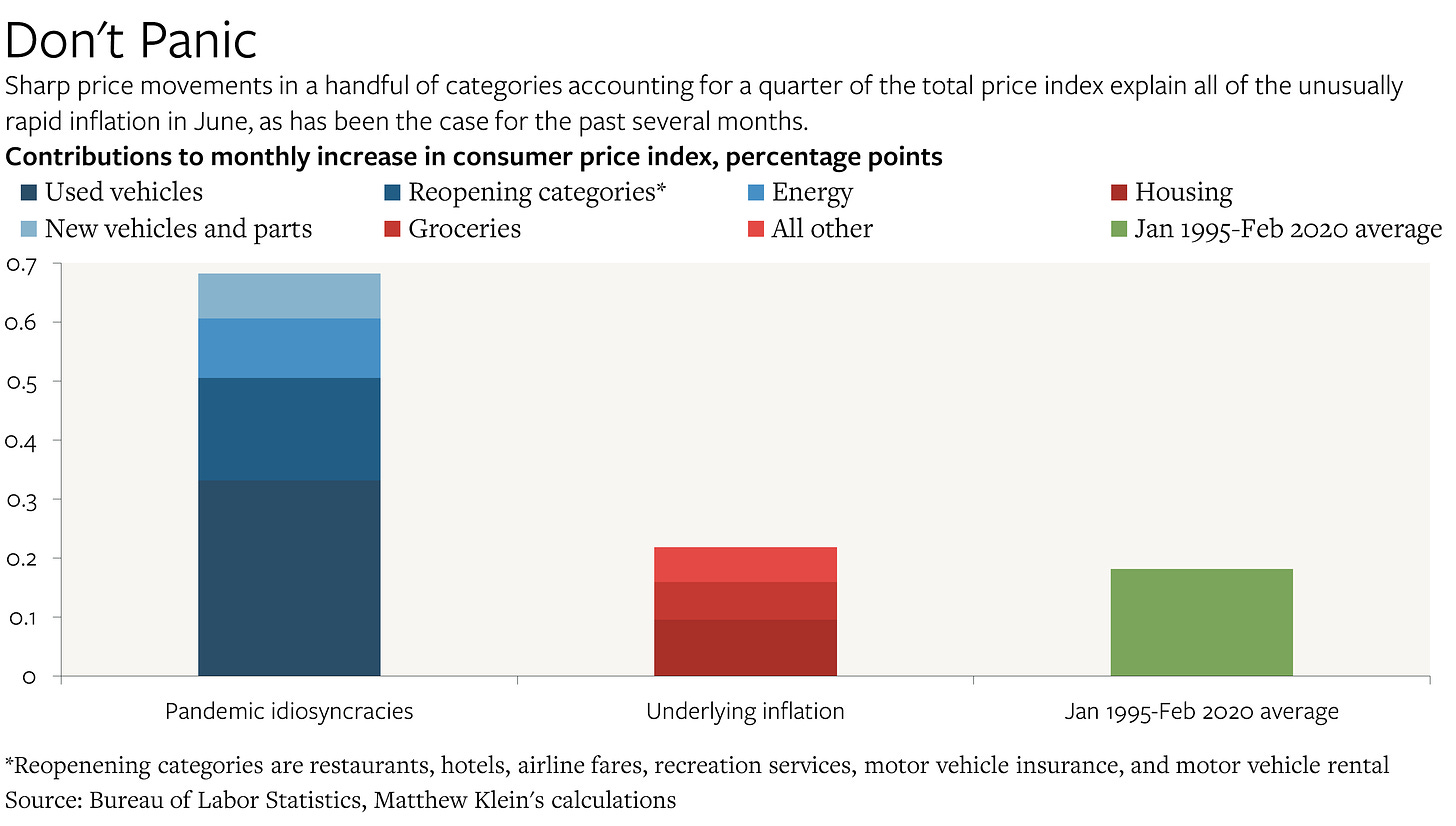

U.S. CPI inflationThe story is still (mostly) about reopening and motor vehicle supply issues

The Consumer Price Index was up 0.9% in June compared to May on a seasonally-adjusted basis, and up 5.4% compared to June 2020.

Here’s the breakdown of what happened on a month-over-month basis:

Outside of a few categories that are either experiencing significant idiosyncratic supply constraints or healthy price normalization due to reopening, prices rose about as much as could reasonably be expected....

....MUCH MORE

He goes on to make a couple important points, one being the differences between CPI and Personal Consumption Expenditures and the second being the change from disinflationary to inflationary impact of of rents and owner equivalent rents, and it is in this area that I think the next round of 'flation that bites and holds on will be seen.

Now if only we can get the packaged food guys to reverse their accelerating shrinkflation trend.

Ha!(sometimes I amuse myself)