Although I sometimes poke gentle fun at Mr. Bassman for his proprietary product creation and packaging during his time at Mother Merrill—remember all those cutesy acronyms (OPOSSMS et al) in the '80's and '90's? That was him—although I poke fun at that, his knowledge of debt instruments and markets, particularly mortgage-related structured products (pre-2007), is unrivaled.

From The Convexity Maven at Simplify Asset Management, July 25:

In 1986 Herbert Stein, a University of Chicago economist and onetime Chairman of the President’s Council of Economic Advisors, modestly proposed Stein’s Law: “If something cannot go on forever, it will stop.”

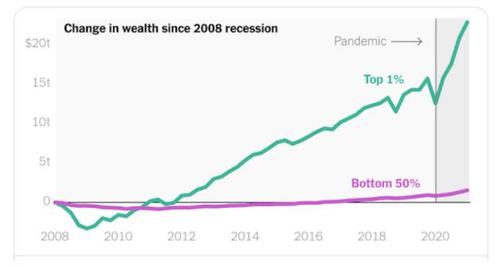

As such, with similar modestly, let me propose a few ways for the Federal Reserve Bank (FED) to “trim the sails” of their monetary support programs before another “Chuck Prince moment” arrives with a deafening silence.As a reminder, we have a massive debt problem in the US, both public and private; and there are only two paths out of such a situation, either default or inflate, where inflation is simply a slow-motion default.Thus, the FED’s program of Quantitative Easing (QE) was well-intentioned, and in fact it did create inflation; such a pity this inflation occurred in asset prices instead of Service (Labor) wages as intended.

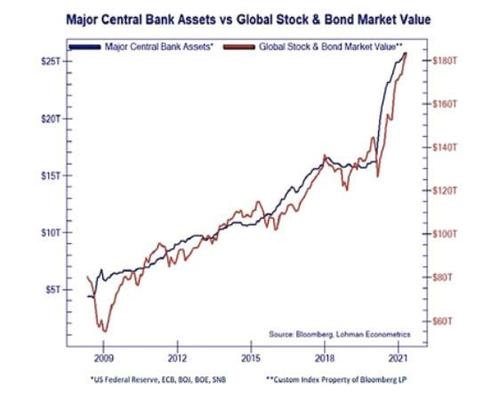

Clever quants will say that a statistically significant mathematical correlation does not exist between money creation and financial asset prices;but who are you going to believe, them or your lying eyes? Below the blue line is the balance sheet assets of the major Western Central Banks, while the red line is the value of their Global financial market.

Perhaps on a week-to-week basis asset prices do not move synchronously with the production of fiat currency, but $20 Trillion of money must reside someplace, and with the magic of financial leverage it is quite clear where.

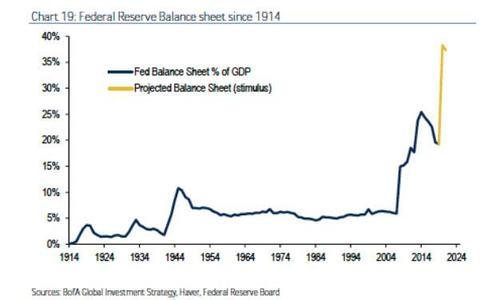

Similarly, while I cannot show a formula that links concentrated wealth creation to significant political unrest, once again I will let your lying eyes consider the green line and the purple line on the prior chart. The yellow line below was a projection for the growth of the FED’s balance sheet relative to US GDP; hat tip to Bank of America as the balance sheet presently tops out at $8.24Tn versus a GDP of $22.79Tn, or 35.2%.

At some point,simple common sense must be a viable consideration. After all, if it were possible for the Sovereign to create the coin of the realm (fiat currency) at a pace faster than the growth of the economy, wouldn’t there be a record of that happening successfully before? Why should there be poor people if it is possible to create wealth and offer it to all citizens? It must stop eventually....

....MUCH MORE

HT the letter was out: ZH