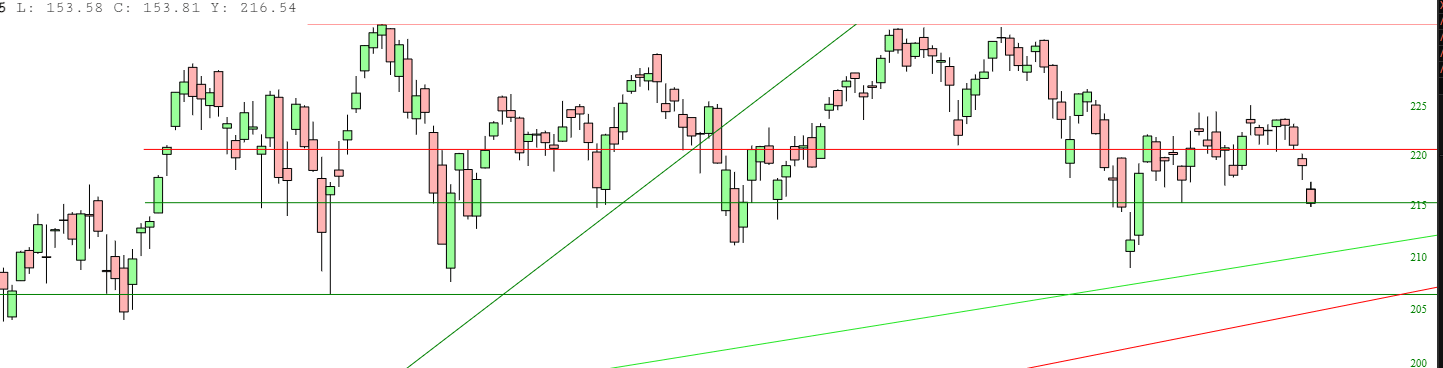

People who spend too much time at the market have this image burned into their retinas but it is worth highlighting, if for nothing else, the opportunity to see how these things resolve.

From Slope of Hope, August 17:

The small caps (as represented by the ETF symbol IWM, below) has been range-bound literally all year long. The reason, of course, is that the Federal Reserve has totally captured and controlled this market, and it knows all too well the kind of holy hell that will break loose if they stop pouring literally trillions of dollars directly into the pockets of their banker friends.

I will say, however, that ever so slowly, the small caps are indeed starting to chip and wither away. The horizontal lines make plain the breakdown required.

....MORE (there appears to be some downside potential)

The pattern, to the amateur eye, may bear a superficial resemblance to the 28 step Three Peaks and a Domed House pattern:

But it is actually closer in structure to the more symmetrical Palais des Beaux-Arts de Lille Set-up:

Chartology: You see what you want to see.

(but keep an eye on those small caps, if/when they break down the opportunity is enormous)