From the Bureau of Labor Statistics, March 12:

PRODUCER PRICE INDEXES - FEBRUARY 2021

The Producer Price Index for final demand increased 0.5 percent in February, seasonally

adjusted, the U.S. Bureau of Labor Statistics reported today. This rise followed advances of 1.3

percent in January and 0.3 percent in December. (See table A.) On an unadjusted basis, the final

demand index moved up 2.8 percent for the 12 months ended in February, the largest increase

since rising 3.1 percent for the 12 months ended October 2018.

Most of the February advance in prices for final demand can be traced to a 1.4-percent rise in the

index for final demand goods. Prices for final demand services increased 0.1 percent.

Prices for final demand less foods, energy, and trade services moved up 0.2 percent in February,

the tenth consecutive advance. For the 12 months ended in February, the index for final demand

less foods, energy, and trade services rose 2.2 percent, the largest increase since a 2.4-percent

advance for the 12 months ended May 2019.

Final Demand

Final demand goods: The index for final demand goods rose 1.4 percent in February, the same as in

January. Over two-thirds of the broad-based February increase can be traced to prices for final

demand energy, which climbed 6.0 percent. The indexes for final demand goods less foods and

energy and for final demand foods advanced 0.3 percent and 1.3 percent, respectively.

Product detail: Forty percent of the February increase in the index for final demand goods is

attributable to gasoline prices, which jumped 13.1 percent. The indexes for diesel fuel, beef and veal,

basic organic chemicals, residential electric power, and chicken eggs also moved higher. Conversely,

prices for fresh and dry vegetables fell 16.7 percent. The indexes for iron and steel scrap and for

distilled and bottled liquor (except brandy) also declined. (See table 4.)...

....MUCH MORE Going forward those energy price increases are going to bleed into everything that uses oil and gasoline as we come off the April 2020 bottom (negative number) to today's $65.71 futures price.

Where this gets especially interesting is in the CPI food price indices. This is because the energy inputs into agriculture are the sun and the oil (plus fertilizer) where you are basically turning one type of calorie (or Joule) into another.

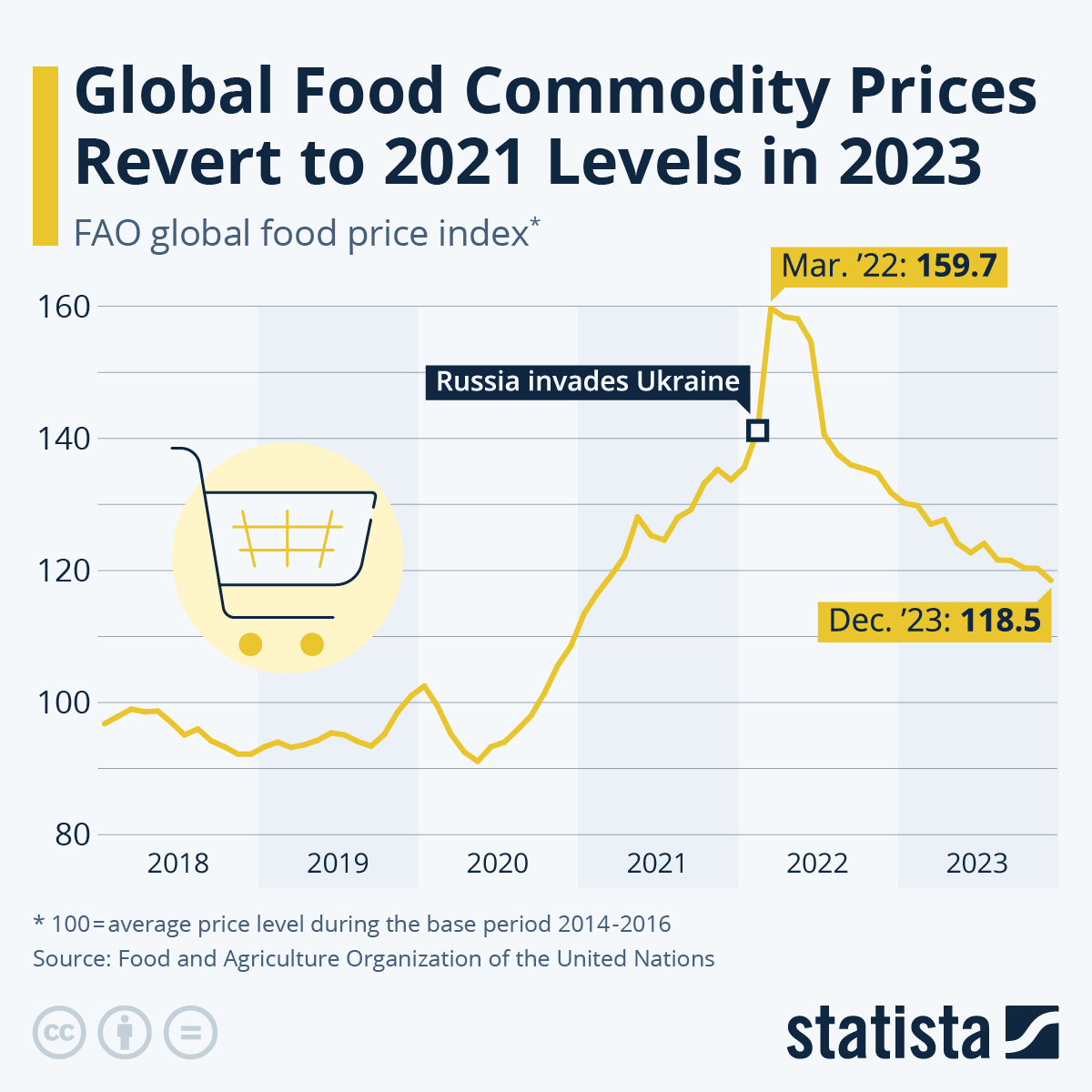

And this will be on top of world food prices that are already up 22% since their 2019 lows:

Statista has a nice write-up dated March 5 from whence the graph was extracted.