The first part of the headline would more accurately describe Goldman Sachs in 2008. First they profited from their credit default swaps on transactions GS did with AIG when the big insurer became insolvent. Then they profited again when the U.S. Treasury bought 79.9% of AIG and made good on all of AIG's outstanding contracts. AIG, the perfect counterparty: they're so nice you get paid twice.

From CB Insights, March 2:

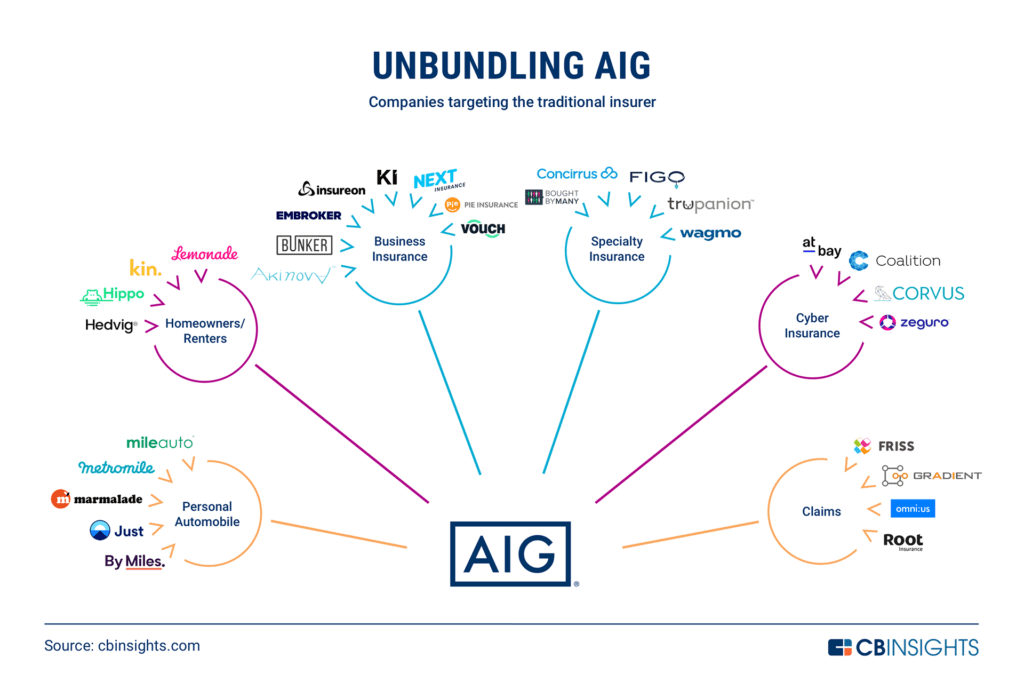

From automobile to pet insurance, here’s how insurtech companies are unbundling AIG’s property & casualty products and services.

American International Group (AIG) is a global giant in the property & casualty (P&C) industry, with personal and commercial insurance revenues of $34B in 2020. Like other traditional insurers, its revenue streams and service offerings are being challenged by newcomers.

New entrants are increasingly chipping away at the traditional insurer’s market with digital-first products that offer convenience and personalization. On top of this, Covid-19 has dramatically shifted consumer and business behaviors and needs, creating fresh opportunities for technology upstarts.

Below, we take a look at how tech companies are unbundling AIG’s business — for individual consumers buying personal insurance policies, for businesses purchasing business coverages, and for claims servicing.

Category breakdown

PERSONAL AUTOMOBILE

Personal automobile insurance is the largest P&C product line, representing 36% of total industry revenue in the US. Traditionally, policies are sold for a one-year period; the cost remains the same regardless of usage.

However, pandemic-induced stay-at-home orders, widespread remote work, and flight from city centers have resulted in a surge in interest in pay-per-mile automobile insurance, which varies in cost depending on how much the policyholder drives.

The top 10 US insurance carriers all offer some variation of behavior-based auto insurance, but only Allstate’s Milewise and Nationwide’s SmartMiles offer pay-per-mile plans — an area where tech companies are innovating.

- Metromile, a pioneer in the pay-per-mile model, primarily targets low-mileage drivers and charges a combined low base rate and variable per-mile cost. Metromile‘s impending SPAC merger will create new opportunities for expansion.

- Several other companies have emerged to provide mile-based insurance, including By Miles, Just Auto, Mile Auto, and Marmalade.

HOMEOWNERS/RENTERS

The Covid-19 pandemic is causing people to spend more time in their homes, leading a generation to rethink what a home can and should do. Funding levels for smart home technologies neared all-time highs in 2020.

Most homeowners and renters insurance policies make only a passing note of this trend, for instance by providing discounts for home security systems. However, a number of insurtechs recognize the risk-avoiding value of the smart home trend....

....MUCH MORE