Following up on some of the ideas in February 26's Going Green: "The battle over raw materials will decide who rules the world".

From Mining.com, February 26:

New study shows Asian cathode, precursor producers’ control of nickel, cobalt supply go way beyond long-term off-take agreements

While it was not named in the executive order, Beijing this week dismissed efforts by the US in a presidential decree to move supply chains for semiconductors, pharmaceuticals, batteries, critical minerals and strategic materials away from China.

Chinese Foreign Ministry spokesman Zhao Lijian said “artificial efforts to shift these chains and to decouple is not realistic,” urging Washington to “uphold the safety and reliability and stability of global supply chains.”

The Biden administration has acknowledged that making the US more self-sufficient would not be achieved overnight but the scale of the task may be underestimated.

In the battery supply chain for energy storage and electric vehicles, China’s command of the market is startling, and wresting it away is likely a decades-long process.

A new report by Roskill on the global cathode and precursor market out to 2030 lays bare how dependent developed markets, particularly Europe, are on China for mined material, precursors and cathode components.

The cathode market is dominated by NCM (nickel-cobalt-manganese) and NCA (nickel-cobalt-aluminum) chemistries and China controls 80% of the precursor market and the bulk of cathode production, according to the London-HQ research company.

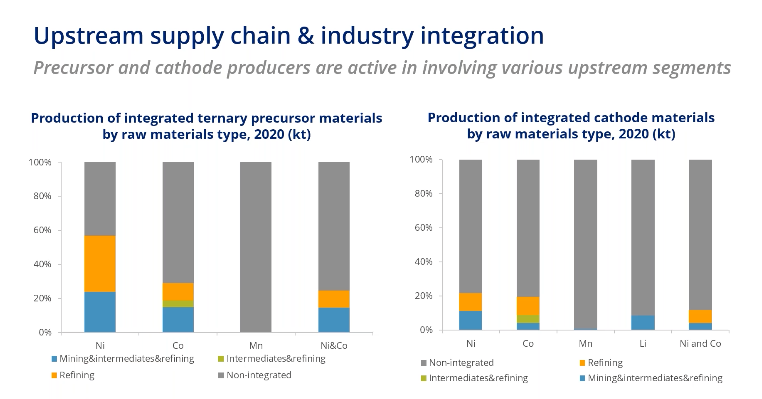

Eileen Wu, consultant based in Roskill’s China office, says apart from signing long-term offtake agreements with producers to secure the supply of cobalt, manganese and nickel the trend of cathode and precursors companies integrating upstream operations has become more and more obvious.

Source: Roskill

More than 50% of nickel in the global precursor supply chain now comes from integrated operations. That figure is 30% for cobalt and more than 20% for Ni-Co – mostly from laterite ore in Indonesia (the subject of a WTO dispute), the Philippines and Papua New Guinea.

Those numbers are lower for cathode producers, but as recycling becomes a more significant source of raw materials for the ternary battery market, further integration should be expected, says Wu.

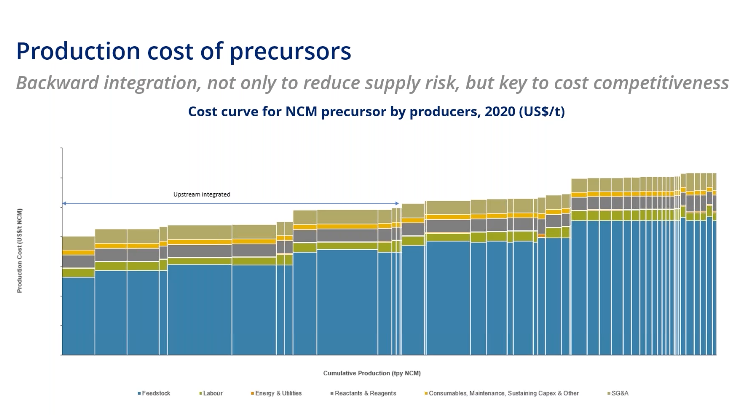

Wu says integrated operations do not only enjoy greater security of mine supply, but are also able to scale up better as the market embarks on rapid growth and, crucially, are able to maintain a lower cost base.

Source: Roskill

Integrated operations occupy the lower half of the cost curve and the gap between the lowest and highest cost producers has now expanded to 30%.

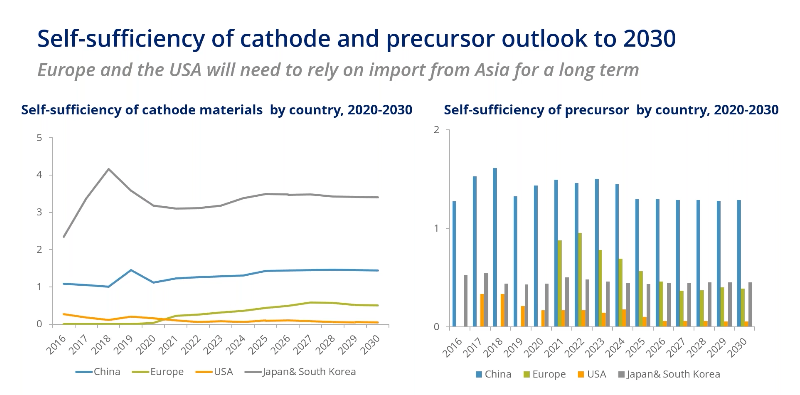

For cathode materials, in terms of self-sufficiency, the US and Europe lag far behind China, Japan (Panasonic, Tesla’s main supplier) and South Korea (LG Energy Solutions, the no. 1 battery supplier to the passenger car market).

Europe will show modest gains towards 2030, but the US position will deteriorate over the next decade. Japan and South Korea’s battery export capability also provides a boost to the countries’ automakers like Nissan and Hyundai, which can supply their factories in Europe and the US from their home bases.

In the precursor market, developed economies are stuck in neutral and reliance on China will remain a feature of the battery supply chain for the long term....

....MUCH MORE

All of which goes some ways toward explaining why there are some 300,000 stories in the link-vault:

February 4, Reuters Explainer: "How the New Caledonia government collapse may affect the nickel market".