A quick note up front: trading off the information embedded in the Commodity Trading Advisors reports or the gamma gurus is only a guide to what is going on, it is not the ultimate reality. There are events that overcome option dealer positioning or commercials vs. specs and this is especially true in situations like the dollar or the 10-year where the crowd, ourselves included, have been on the right side of the trades.

By the bye, although we did not catch the exact recent bottom on the 10-year yield, 0.5040% on August 6th, (we really started beating the drum that rates were going higher at 0.56%) the 10-year's yield—proxied by the CBOE's TNX—has backed up to 0.9200 -0.0280 (-2.95%):

We saw .9660% on Wednesday afternoon.

From ZeroHedge

One question that has emerged recently on trading desks is what will happen first: Bitcoin hits $20,000 or the 10Y rises above 1.0%. The answer may depend on what bond-trading CTAs do.

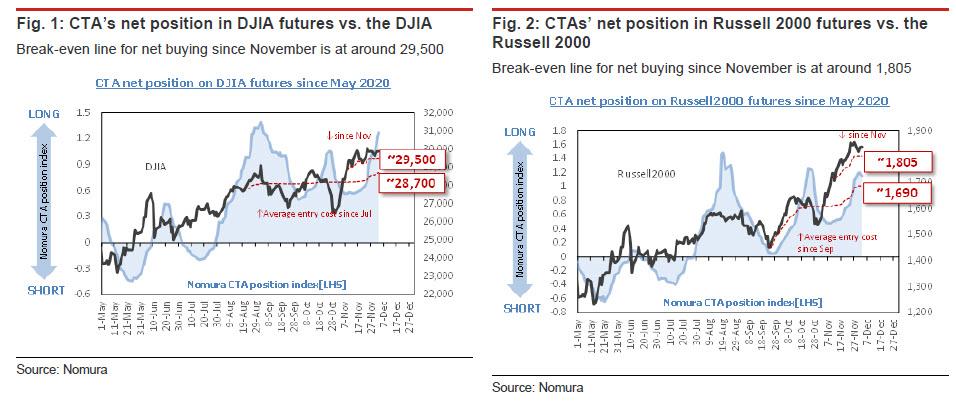

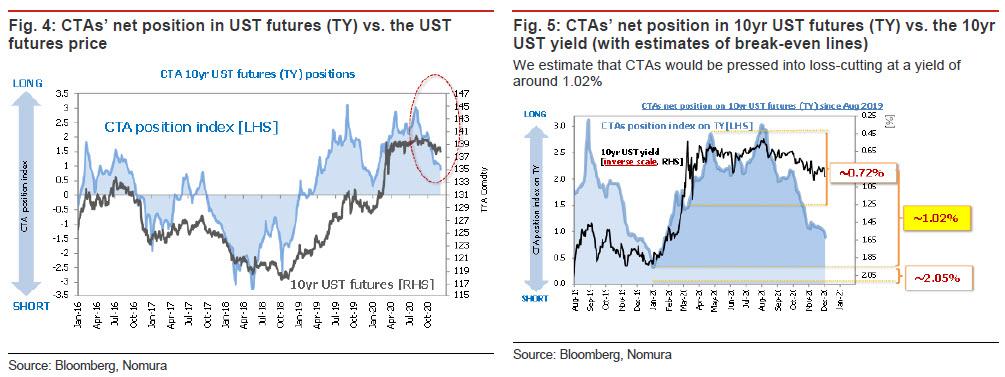

As Nomura quant Masanari Takada writes when commenting on yesterday's spike in 10Y yield which rose as high as 0.96%, "CTAs have resumed preemptive exits from long positions in UST futures." Noting that at the same time as momentum-chasing CTAs have been gradually adding to their exposure in DJIA and Russell 2000 futures ...

... CTAs are being drawn back into exiting long positions in 10yr UST futures (TY). As 10yr yields bounced back up to around 0.95% this week, "CTAs, who had been waiting on the sidelines, have again been pressed into action" with the Nomura quant estimating that CTAs have already liquidated about 65% of the long TY positions they held at the peak in August, and with a key trigger line at around 1.02% on the near horizon, CTAs are looking increasingly likely to have to exit the entirety of their aggregate net long TY position.

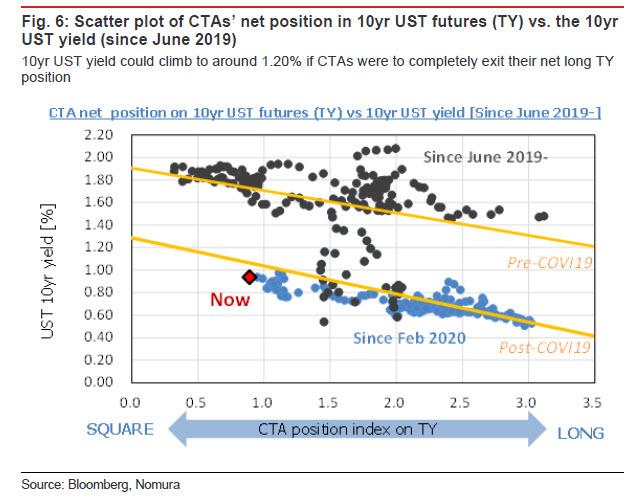

Should 10yr yields break above 1.02%, CTAs would be pushed "en masse" into loss-cutting mode, and the resulting systematic sell-off would put additional upward pressure on yields. According to Takada, based on past correlations "the 10yr UST yield could jump up to around 1.20% if CTAs were to sell their way down to a flat position."

While any systematic selloff would likely lead to buying by other investor types, Takada cautions that UST bulls would probably would probably encounter a pair of headwinds, the first of which is that risk-parity funds have little room in which to go any further with their buying of bonds driven by the decline in DM government bond market volatility. The reason for this is that the portfolio weight that risk-parity funds have assigned to low-risk bonds has already hit a ceiling (as a reminder 60/40 portfolios have been pivoting away from bonds for the "40" component of the basket amid fears upside is now largely capped). Also, demand for 1-m options on UST futures is tilted solidly to the put side, which is an indication that traders picturing a decline in prices for 10yr UST futures (TY) and a rise in volatility are in the majority....

....MUCH MORE