"Accordingly, there is a competitive disadvantage in operating honest and profit-oriented businesses..."

The passage was clipped, formatted, and promptly misfiled.

Which ends up being fortuitous because it's the introduction to today's link, also from FTAV:

What happens when fintech valuations come back down to Earth?

In this guest post Victor Basta, managing director of boutique investment bank Magister Advisors and a specialist in the technology sector, argues that we'll see fintech valuations fall steeply across the board this year. That's likely to spell pain for the crop of start-ups that are set to go public in the coming months.

No tech subsector has reached stratospheric valuations as consistently as financial technology, or fintech. The heady combination of huge markets, a radical platform shift to mobile, and newly vulnerable incumbent dinosaurs (be they banks, wealth managers, or insurers) has attracted over $30bn of annual investment. After a decade of evolution, 2018 looks set to be the first year we’ll see a herd of fintech firms go public. At least ten have filed or talked about an impending listing this year, including TransferWise, Credit Karma, Adyen and Funding Circle.

But there’s a danger this flurry of IPO activity could be a mixed blessing for the wider fintech industry. In a market buzzing with hyperbole and over-generous funding-round valuations, the reality of IPOs could present a real danger not just to company shareholders but across the wider industry.

Nowhere is this more apparent than at Funding Circle. Bankers and investors are talking up Funding Circle’s valuation at £2bn, despite the company having last raised money at below £1bn. £2bn for a business generating only something around £100m of revenue annually, even if it's growing at its current rate of around 50 per cent, is an awfully big sticker price for any industry. That amounts to over 16x revenue - for perspective, Google and PayPal are both valued at only 7x revenue.

The curse of comparability

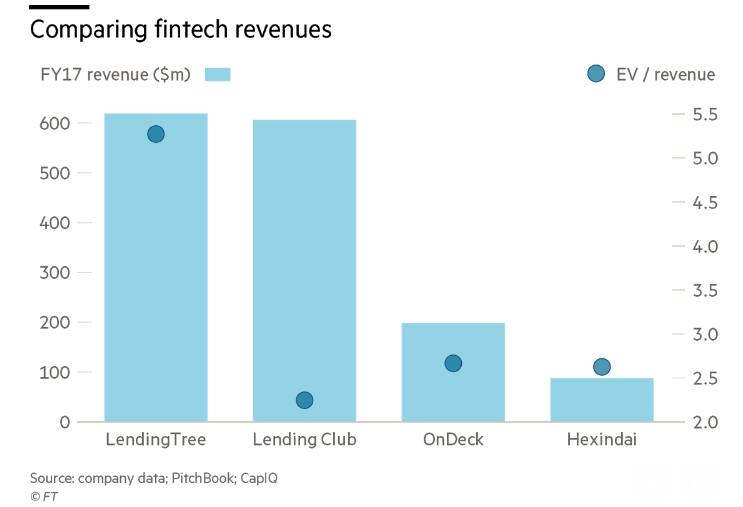

Relative to other similar publicly listed companies, Funding Circle’s trumpeted valuation looks heady to say the least. There are several US companies including Lending Club ($1.4bn market value) and OnDeck ($400m market value) directly comparable to Funding Circle’s business model which are valued at far less.

This “curse of comparability” is bound to threaten Funding Circle’s IPO valuation and share price performance. Even with fast growth and a high-end price tag, Funding Circle would be doing very well to get far above £600m, a fraction of the valuation chatter so far.

Square’s painful IPO experience offers a worst-case precedent for what could go wrong. The company raised money at a $6bn valuation, and went public a year later at $3-4bln, leading to widespread criticism and media derision. The problem was that public investors valued the company purely as a fast-growing alternative to existing public payment service providers, rather than the game-changing disruptive technology its early-stage investors had hoped it to be....MUCH MORE