Even for Facebook it's an open question whether all the hubbub isn't just Macbeth's comment on life itself, writ small: "full of sound and fury, Signifying nothing."

For Amazon the question is even trickier, what with Bezos fanboys on one side who have no problem at all with anything he does and those on the other who think:

Although we've used a half-dozen pictures of Mr. Bezos over the years, this, from last July is my new fav and I have to resist using it in every post on Amazon:

"Now I am become Death, the destroyer of worlds."*

Today's look at the behemoth is from FT Alphaville:

Amazon is not a bubble

Donald Trump has declared war on Amazon. Infuriated by its perceived abuse of the US postal service the flaxen-haired, SEC-settling President of the United States has launched a string of attacks on Bezos' Seattle-based empire over the past fortnight.

He's not the only one feeling aggrieved though.

Over the past year several high-profile fund managers, from Greenlight Capital's David Einhorn to Nordea Bank's Robert Naess to Morgan Creek's Mark Yusko, have decried the anti-gravity performance of the ecommerce giant's share price:

All three investors have referred to the stock in passing as a 'bubble' -- but are they right?

Optically, there is little doubt Amazon is richly priced. Today it trades at four times last years sales and 170 times next-years projected earnings. If you were to liquidate Amazon tomorrow, the book value would only cover 4 per cent of the $680 billion market capitalisation.

Fast-forward five years, and analyst's crystal balls are radiating with even more mind-boggling numbers. By 2023, Amazon is expected to generate $535bn in revenue, or 12 percent of 2017's total US retail sales, according to Bloomberg. If profit margins rise to eight per cent, at a twenty-five time earnings multiple Amazon will comfortably be a trillion-dollar company in the near future. Optimistic, no?

Perhaps not. Let's dive under the hood to see if Amazon's corporate engine really has all pistons firing.

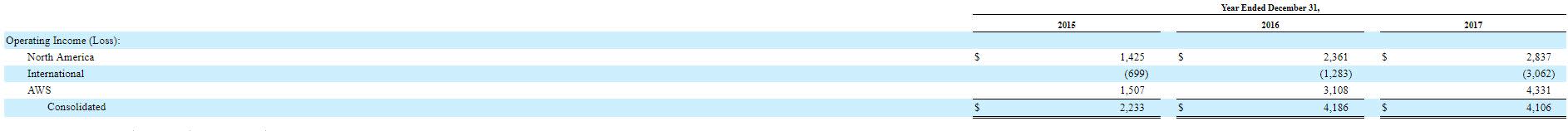

First we'll start with Amazon's retail services, which includes the traditional e-commerce business; Fulfilled By Amazon (FBA); Amazon Prime and pioneering home-surveillance device, the Amazon Echo. Last year, these segments accounted for 90 per cent of Amazon's revenues, and had negative profitability. Ouch.

Well, that is only an issue if you assume Amazon wants to be profitable. NYU's Scott Galloway mused last year that if Amazon makes a profit, Bezos calls his senior management to his office and tells them “you f**ked up”, such is its famed obsession with recycling revenues back into investments meant to spur both domestic and international growth.

This tactic has proven extremely effective so far.

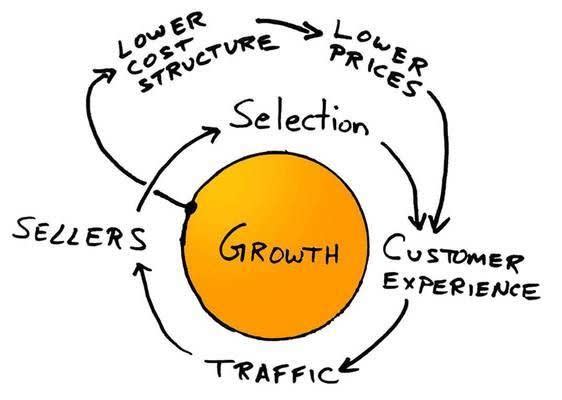

By re-investing in distribution infrastructure, the increasing economies of scale allow Amazon to drive down prices and lower shipping costs, thus improving Prime retention rates, increasing the third party-seller base and driving more web-traffic through the online site in a virtuous growth cycle.

This is no real secret, in fact Bezos allegedly outlined this 'flywheel' strategy on a restaurant napkin at some point in the 2000s:

The increasing importance of third-party sellers is testament to this strategy....MUCH MORE

Over the past three years, FBA has grown from 21 percent of retail services to 30 per cent. No longer needing to purchase its inventory from suppliers, Amazon is now renting out its platform (more on this later)...