From Bloomberg, August 20:

The gateways to global trade face costly conversions to retool in new era of rivalry, automation and green energy

For centuries, control of the world’s biggest shipping centers helped expand empires, spark and settle wars, ease poverty and build middle classes while giving international companies access to cheap workers and cash-flush consumers in distant markets.

Along the way, maritime ports evolved from trading posts and naval bases into economies within economies that supercharged globalization, becoming vital junctions for energy flows, hubs for infrastructure like rail lines and power stations, and clusters for industrial production, warehousing and distribution.

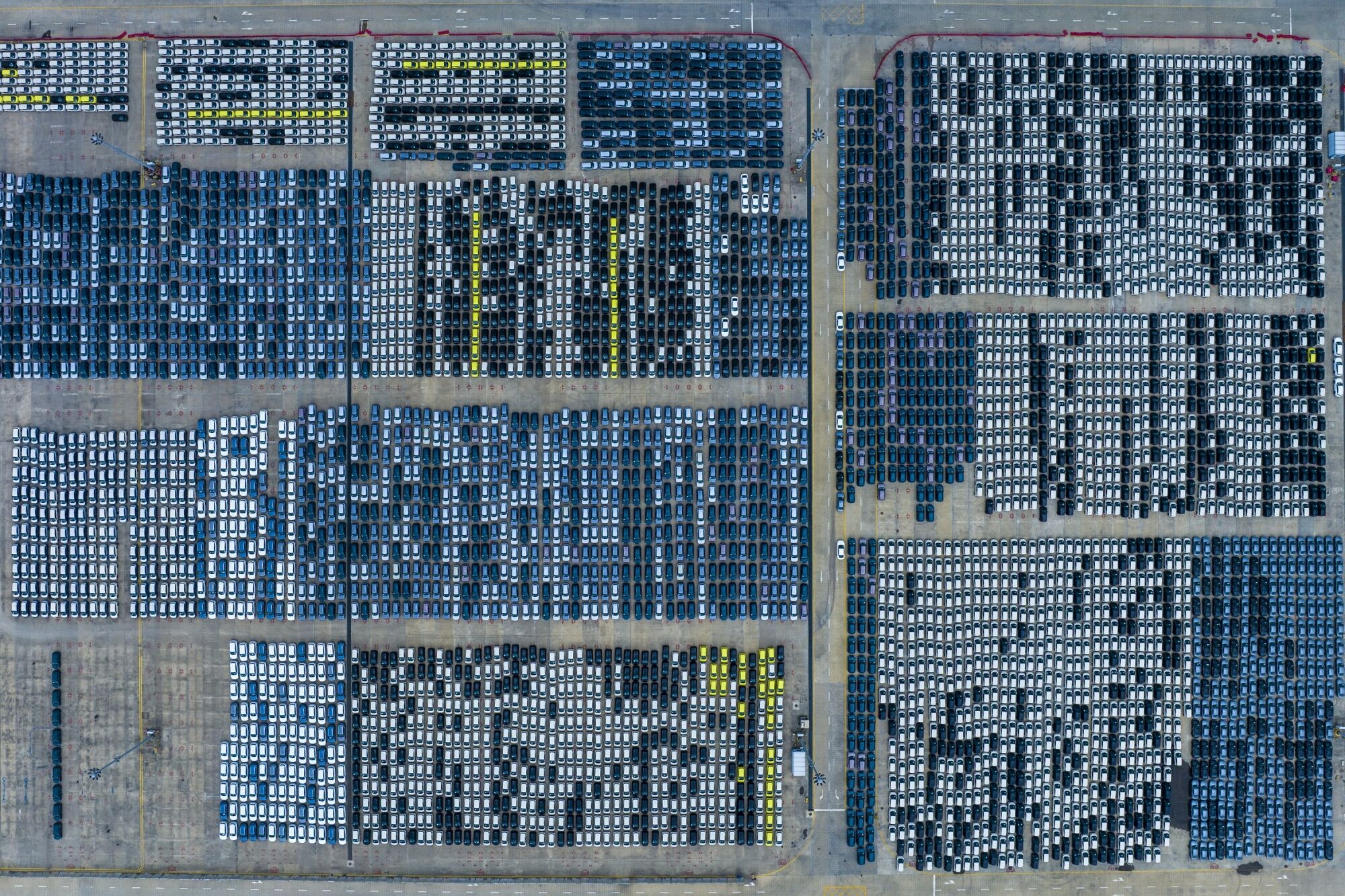

Shenzhen Retools for Auto ExportsNow, both old and new gateways for seaborne commerce— responsible for handling 80% of the world’s $25 trillion in annual merchandise trade—are economic fortresses in the great-power struggles of a multipolar world.

Meantime, they’re having to undergo costly and painstaking conversions to digital technologies, automation and green energy with a price tag estimated at €200 billion ($216 billion) a year in new investment, for a total of €2 trillion over the next decade.

“It’s now much clearer that ports are geopolitical assets and that emphasis hasn’t always been there,” said Peter de Langen, the owner and principal consultant of Ports & Logistics Advisory, based in Malaga, Spain.

A closer inspection of eight of the world’s most dynamic ports helps crystallize the complicated geo-economic strategies at play—the commercial ambitions for manufacturing prowess, the jockeying for influence in volatile regions and the race to mitigate risks stemming from climate change or scarce labor.

On the path to prosperity, Chinese President Xi Jinping once said a nation “must first build ports.”China’s status as the factory-to-the-world wouldn’t be possible without its parallel role as a maritime juggernaut. Of the world’s 10 biggest container ports, seven are in China and none are in Europe or the Americas, according to the latest ranking from Lloyd's List.

Lately, China’s rapid ascent to become the world’s biggest car exporter has unsettled rivals that worry about a new wave of job losses at the hands of an advanced manufacturing megapower. The port of Shenzhen will only add to their anxiety.

Shenzhen Yantian Port began car exports from a new terminal called Xiaomo in January 2023, with 20,000 cars shipped in the first year. This past January, the BYD Explorer 1—the first cargo ship made by a Chinese shipbuilder specifically for exporting Chinese cars—called into port to pick up vehicles bound for Europe.

The ship was built for China’s biggest electric vehicle maker BYD Co., which dominates the domestic market and is boosting exports and overseas investments. In February, Shenzhen announced a plan to expand its automaking capacity, including supporting the construction of the second phase of an industrial park that BYD calls home, tailoring production for overseas markets, and establishing second-hand car export businesses.

The second voyage of the BYD ship was to South America, docking in Brazil in late May. The third left Xiaomo port in early July, heading for Europe again and taking total exports so far this year from this one port to more than 30,000 vehicles.

But that’s just a start. BYD has another seven car-carrying ships on order and in July announced a 6.5 billion yuan ($900 million) investment into phase 3 of the industrial park.

As for the port, which is owned by the city, it’s just 25 kilometers (15.5 miles) from BYD’s headquarters and one of its main production sites. The new factory will be even closer, meaning it will take just 5 minutes for a new car to get from plant to port.

The aim is for as many as 100,000 cars to be shipped from Xiaomo this year, with that rising to a million vehicles a year by 2030, according to the city’s government.

“The combination of a private firm, an industrial zone, and a state-owned port all coordinating so closely is a textbook example of China Inc. in action,” said Jacob Gunter, lead analyst at the Mercator Institute for China Studies in Berlin who last year wrote on how China’s Belt and Road Initiative is shaping global trade and ports.

India Aims for Slice of the Export Pie–James Mayger in Beijing

A few hours north of India’s financial capital of Mumbai, a fleet of ships is set to start dredging an otherwise pristine coastline. With the blessing of New Delhi, they’ll soon start reclaiming land for what’s to be India’s largest, deepest and most expensive port to date.The port at Vadhvan will be a behemoth, with nine one-kilometer-long container terminals, with special berths for wheeled and liquid cargo and one for the coast guard. Projected for completion toward the end of the decade, the $9 billion port will have capacity to handle some 23 million container units, making it one of the 10 largest ports in the world, according to the project’s backers.

That scale matches the ambition of newly reelected Prime Minister Narendra Modi’s bold—and fledgling—goal to turn India into a manufacturing and exporting powerhouse....

....MUCH MORE