From ZeroHedge, September 27:

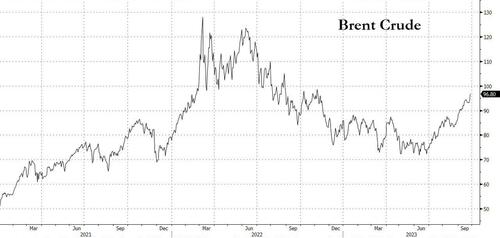

Slowly but surely, the market is waking up to a jarring realization: the price of oil is now higher than where it was a year ago, and also where it was right before the start of the Ukraine war, but in the meantime the Biden administration has drained 240 million barrels of oil in pursuit of short-term popularity gains. Alas, those gains are now all gone, as are the oil price declines, but the SPR is down to half of where it was at its peak.

What happens next is even less pleasant.

As JPM discussed last week when it predicted the return of the oil "supercycle", crude is about to rise much higher as a result of what JPM sees as a staggering 7mmb/d deficit by 2030...

... but also other factors as follows:

- higher for longer rates tempering the flow of capital into new supply,

- higher cost of equity driving elevated Cash Breakevens of >$75/bbl Brent (post buybacks) as companies return structurally more cash to shareholders, in turn, pushing the marginal cost of oil higher,

- Institutional and policy led pressures driving an accelerated transition away from hydrocarbons and peak demand fears. Taken together, their corollary is a self-reinforcing ‘higher-for-longer’ energy macro outlook as the industry struggles to justify large investments beyond 2030.

JPM also upgraded global energy equities to overweight for the following reasons:

- More positive macro outlook (preference is oil over gas owing to the former’s structurally positive characteristics and lower OPEC-mitigated volatility),

- in-the-money corporate cash breakevens (vs the forward strip), implying ~12% ‘24 FCF yields rising to ~15% at $100/bbl,

- Upside risks to EPS (we are ~10% higher than the street in 2024 (on MTM basis) having been ~10% below in January),

- Attractive valuations relative to the market underpinned by cash return yields >30%,

- In the event that global inventories continue to fall and a rising oil price environment, OPEC is likely to add in the next 12 months. Historically, this has been supportive for energy equities as it typically indicates improving underlying fundamentals (demand) – we show energy equities tend to outperform and positively decouple to oil on production adds (we note that although oil prices are up 30% since June when Saudi initiated the 1mb/d cut, equities have lagged, only up ~10% i.e. negatively decoupled).

While there was much more in the full note (read here), the bank's thesis could be summarized in a simple price target: $150 oil. But the largest US bank is not the only one expecting oil to soar by more than 50% from its current price.

Continental Resources, the shale driller controlled by billionaire Harold Hamm, agrees that oil is headed as high as $150 a barrel unless the US government does more to encourage exploration,

Crude output in the Permian Basin will one day peak as it already has in rival shale regions such as the Bakken region of North Dakota and the Eagle Ford in Texas, Continental Chief Executive Officer Doug Lawler said during an interview with Bloomberg TV. Without new production, “you’re going to see $120 to $150” oil, he said.

“That’s going to send a shock through the system,” he said. Without policies encouraging new drilling, “you’re going to see more pressure on price.”....

....MORE

In October 2022 we posted "Something Very Important Happened In The Oil & Gas Business This Week" Skipping past the intro:

....So, with that rather longer than usual introduction we see this brief little note at Reuters, October 17, 2022:

Founder Harold Hamm clinches deal to take shale producer Continental private

Continental Resources Inc (CLR.N) said on Monday it had agreed to a sweetened offer from founder Harold Hamm to take the U.S. shale oil producer private at a valuation of about $27 billion.

Hamm, a legendary oilman who once called the Organization of the Petroleum Exporting Countries a "toothless tiger," said in June that he wanted to take the company private because public markets have not supported the oil and gas industry.....

....MORE

We'll have more on this and what it might mean for oil & gas and for the wider markets but this post is already lengthier than I had intended.

Sorry 'bout that.