From ZeroHedge, September 20:

In our FOMC preview, we said that the only thing that will matter today was the Fed's 2024 median dot...

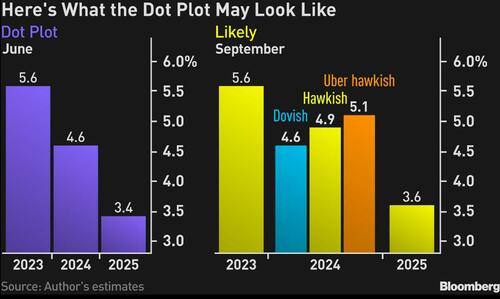

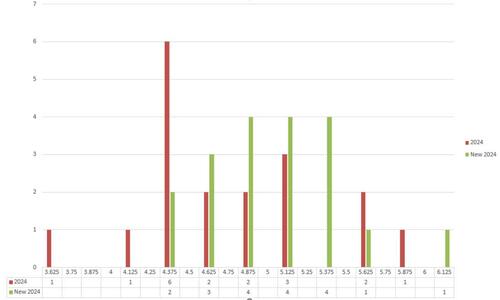

... and that's precisely what happened: with a statement that was a carbon copy of July, the real shocker today was the much more hawkish outlook for 2024. Indeed, as Bloomberg notes, when comparing the 2024 dots with the previous projection, one can clearly see a hawkish shift. The most frequent, (aka mode) projection from June was 4.375% (6 dots). Now, it’s between 4.875% and 5.375%. It’s a shift of as much as 100 bps.

And while the market swings around wildly, repricing trillions worth of assets based on a forecast which will be dead wrong months from today, let alone a year, here is what some Wall Street analysts, strategists and traders had to say in kneejerk response to the Fed statement and Powell presser.

Mohammed El-Erian

"I worry that the economic and policy signals coming out of this Federal Reserve press conference may come across to many as both confused and confusing. Some will deem this an inevitable consequence of this phase of the inflation and policy cycle; others will view it as further evidence of challenged Fed communication."

Ira Jersey, chief rates strategist at Bloomberg Intel

“A Fed that maintains short term rates well above 5% for most, if not all, of 2024 will keep the Treasury yield curve inverted for longer than many casual observers will be comfortable with. But in our view, even if the Fed doesn’t cut, the curve will continue to price for lower rates at some point in the future.”

Bloomberg Economics Team

“Even though the dot plot shows another hike this year, we see a number of potential adverse shocks to growth between now and end-year that could derail that plan. Economic uncertainty and disruptions from the UAW strikes and looming government shutdown may push the Fed to postpone a hike to 2024 — or even nix it completely. Still -- we do think the question of another hike this year is an increasingly close call.”

Zachary Hill, head of portfolio strategy at Horizon Investments.

"The Fed’s projections are compatible with a more resilient economy under higher interest rates, which implies a higher neutral rate. On its face, that is not a great reason to give up on equities, so I think that explains why we have had a muted selloff so far. Plenty of time left in the day though.”

....MUCH MORE