From The Market Herald:October 2, 2020:

In this feature:

- A credit explosion down under is setting the country up for a heavy correction in the years to come

- To combat economic shock, the Federal Government wants to bring in Chapter 11-style bankruptcy laws and roll back responsible lending legislation

- It comes as the country's debt continues to grow, overshadowed by rising global arrears

- Meanwhile, mounting deferrals and a jump in lending are setting the country up for another credit crisis

- It's something we experienced when we saw thousands of loans go sour

- While they dodged the bullet then, banks and fintechs will come under fire when the bubble bursts this time around

- But there are companies within the debt collection and technology space which are poised to grow amid the crunch

A credit explosion down under is setting the country up for a heavy correction in the years to come.

On our home turf, new policy reform is being ushered through to stimulate the economy and get Australians spending again.

While only time will tell if this has the intended effect, one thing is clear: the move will see mum and dad investors saddled with extra debt amid one of the worst recessions on record.

And while much of the focus is on the now, those looking ahead will see there's clear winners and losers when the great Australian credit crisis hits.

And while much of the focus is on the now, those looking ahead will see there's clear winners and losers when the great Australian credit crisis hits.

Policy reform

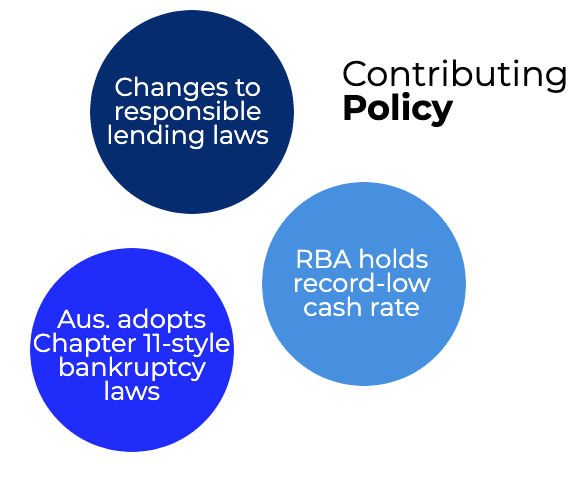

The credit explosion will be fuelled by a wave of policy changes, tabled by the Federal Government in recent weeks.

First, changes to Australia's bankruptcy laws to mirror the U.S.'s Chapter 11 filings will throw a life raft to small businesses. Under the alterations, business owners have 20 days to come up with a plan to restructure debt and trade out of insolvency.

Then, news that responsible lending laws were being stripped back was welcomed by the banks. The switch is a win for them — it places extra onus on the customer to make sure they can pay back their debts.

"We can’t have a world in which, if a borrower can’t repay the loan, it’s always the bank’s fault,” RBA Chief Philip Lowe said in August.

“On a portfolio basis, we want the banks to make some loans that actually go bad because if a bank never makes a loan that goes bad, it means it’s not extending enough credit.”

RBA Chief Philip Lowe, August 2017Coupled with the RBA's record-low cash rate, which, in turn, fuelled modest interest rates, there's a growing pool of cheap money readily available for consumers.

It's a theme amplified by the booming buy now, pay later space, which encouraged a new generation of consumers to enter interest-free debt and pay it off in bite-sized instalments....

....MUCH MORE

Completely Unrelated:

"Australia’s Lesser Known Commodities Booms"

From Winton's The Longer View:

The typical Australian analogy for the China-fuelled expansion in commodities trading would probably be the mid-19th century gold rush.