U.S. futures are trading up about 1% at 4.3190 and around a nickel below the late February spike high, 4.3755. If (when) that level is hit you have to go back to 2011 to find higher prices. And they aren't that much higher. It's a dangerous little game to trade in anticipation of a breakout but since 3.99 on the futures it looked as if the stars had aligned.

From ChartWatchers:

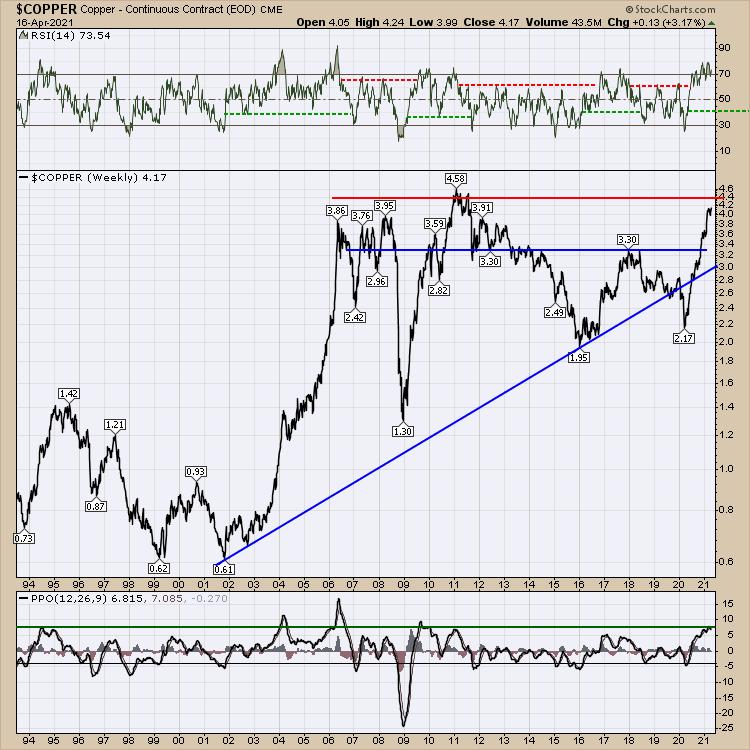

Can Copper Go Crazy?

I think we all know Copper is the fundamental metal for all of the green plans globally. Lately, Copper has been wandering sideways close to all-time highs. This chart below shows the last 25 years.

The price has consolidated for 8 weeks. But the underlying theme is that there are not enough copper mines to build out the infrastructure. This week, price started to break above a down trend in the consolidation. If you are following technicians that trade commodities, you'll understand the bullish implications of this....

....MUCH MORE

And should the move fail, well, it wouldn't be the first time someone was unhappy with the copper folk:

Recently:

Copper: "Record copper scrap flows this year won't plug deficit"

"METALS-Bullish investors push copper towards 10-year highs"

"Copper heads for biggest weekly gain since February"

The move is only beginning....

And via the FT's Natural resources editor:

"Chinese Firms Position for an Energy Transition Copper Supercycle"

Wood Mackenzie: "Build Or Buy: Are The Copper Majors Rising To The Growth Challenge?""