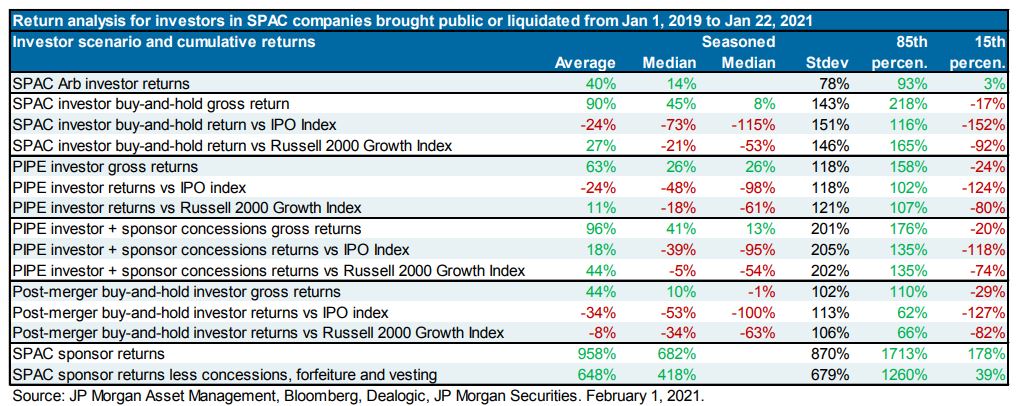

Here's the dirty little secret about SPACs and PIPEs, compiled by Irrelevant Investor:

Bulls get some, bears get some but the sponsors end up with the loot.

And the headline story from Bloomberg, April 16:

The Pritzkers built an empire spanning hotels to manufacturing before agreeing two decades ago to split up their fortune among 11 descendants.

Karen Pritzker, one of the heirs, has parlayed that wealth into venture capital, backing firms such as Snap Inc. and Spotify Technology. Now she’s joined the wave of investors turning to blank-check firms.

The Pritzker Vlock Family Office is the anchor investor for Thimble Point Acquisition Corp., a special purpose acquisition company that raised almost $300 million in an initial public offering in February. Executives from the family office, named after Pritzker and her late husband Michael Vlock, are leading the venture, which will focus on software and technology.

“It allows us to be able to take companies public and kind of complete the full life cycle,” said Elon Boms, 40, Thimble Point’s chief executive officer and managing director of the family office, which committed $50 million to the SPAC ahead of its IPO.

Growing Force

The SPAC boom has attracted financiers, former politicians, athletes and celebrities willing to use their fame to attract retail and institutional investment. About 600 blank-check companies have raised more than $182 billion since the beginning of 2020, according to data compiled by Bloomberg.

But family offices — the discrete, sometimes secretive firms that manage the affairs of the ultra-rich — have been one of the biggest driving forces.

While large family offices have long been investors in private equity and real estate, the recent flurry of SPAC bets show how they’re becoming a growing force in public markets. This comes at a time when some critics are pushing for more regulation of the investment firms following the implosion of Bill Hwang’s Archegos Capital Management, which has inflicted billions of dollars of losses from banks.Family offices are largely exempt from registering with the U.S. Securities and Exchange Commission, but SPACs have to file with the regulator, providing insight into how billionaires are managing their money.

Family offices and firms linked to them have launched — or sponsored — at least a dozen SPACs that have raised about $4.5 billion in the past year with a further $1 billion in pending offerings, according to data compiled by Bloomberg.

Och, Sternlicht

Former hedge-fund manager Dan Och has been particularly active through his Willoughby Capital. The New York-based firm has invested in a blank-check company targeting China’s consumer industry and also holds a stake in Thimble Point, according to a person familiar with the deal. A SPAC he’s sponsored, Ajax I, is merging with U.K.-based used-car platform Cazoo in a deal valued at about $7 billion.

Barry Sternlicht’s family office is affiliated with the creation of six SPACs. Meanwhile, a blank-check firm set up by a co-founder of Michael Dell’s family office raised almost $600 million in its IPO last month, while Tom Barrack’s Falcon Peak is sponsoring Falcon Acquisition, a blank-check company that’s filed for a $250 million public offering.

Most SPACs have been created in the U.S., but the trend has gone global. Black Spade Capital, the Hong Kong-based family office of casino mogul Lawrence Ho, has got in on the action. London-based billionaire Mohamed Mansour’s Man Capital invested in Grab Holdings Inc., Southeast Asia’s most valuable startup, before it announced a $40 billion tie-up on Tuesday.Rich families are even joining forces. NNS Group the family office of Egypt’s Nassef Sawiris, teamed with an investment firm for the Frere and Desmarais clans to launch Avanti Acquisition Corp., which is targeting European businesses after raising $600 million through its U.S. offering.

‘Very Active’

“Sophisticated family offices have been very active,” said Luigi Pigorini, head of Europe, Middle East and Africa at Citi Global Wealth. “They have incredible connections, knowledge and investment capabilities — all of these are important characteristics.”

The SPAC mania is showing signs of wear and tear with clogged deal pipelines, heightened regulatory scrutiny and concerns over the quality of the deals that have been done.

Real estate titan Sternlicht joked that a member of his domestic staff — his “very talented house manager” — probably could pull off a SPAC. He told CNBC last month that “if you can walk, you can do a SPAC,” and pointed out that many of the people behind blank-check firms are failed money managers or executives.

“Three days due diligence means you check the letterhead and find out if the company exists,” Sternlicht told CNBC. “It’s a little out of control. No, it’s a lot out of control.”

But Sternlicht is convinced he’s got the secret sauce. His Jaws Spitfire Acquisition Corp. is merging with Velo3D, a maker of 3-D metal printers, valuing the company at $1.6 billion. Jaws Acquisition Corp., another SPAC he’s backed, is merging with health-care provider Cano in a deal valued at $4.4 billion.

Bolster Returns

Even if SPACs flounder, it won’t necessarily hurt the family offices that have already launched blank-check companies.SPAC sponsors typically buy shares in firms they create at a fraction of the standard $10 price offered to IPO investors. They usually own about 20% of the blank-check firm’s equity after it goes public and can bolster their returns further through debt or equity financing and stock options....

....MUCH MORE