We might see some inventory coming on the market when potential sellers get more comfortable with strangers walking through their homes as in the days of yore. And if the kinks in the lumber biz get straightened out we would see more newbuilds.That said there is a large gap between supply and demand.

From Upfina, April 26:

A Catalyst For Higher Stocks?

As we have been discussing for about 3 quarters, the US housing market is on fire. COVID-19 spurred on the demand originally created by demographics. This trend was already going to occur anyway. Lower rates and the need to move out of cities accelerated the trend; home builders weren’t ready. This is too good of a market for homebuilders although commodities such as lumber have increased substantially making housing raw materials cost more.

New home sales exploded in March. The yearly data is skewed because of the pandemic and the monthly data is skewed because of the bad weather in February. Specifically, new home sales were up from 846,000 to 1.021 million. The best comp might be to January in which new home sales were 1.010 million. It’s going to be interesting to see how strong the spring selling season gets in April and May. Some are saying the housing market actually needs higher rates because demand is so strong. It would be healthier if prices didn’t increase this quickly.

*****

Even though home prices have increased, the median price to income ratio in America makes housing look cheap compared to much of the developed world. As you can see, America’s 4x ratio is below all the other countries listed. It’s notable that America is a wide-open country with plenty of land. It’s nothing like Israel, Japan, and much of western Europe. America is closer to Australia and Canada which still have higher ratios. Both are known for their housing bubbles though.

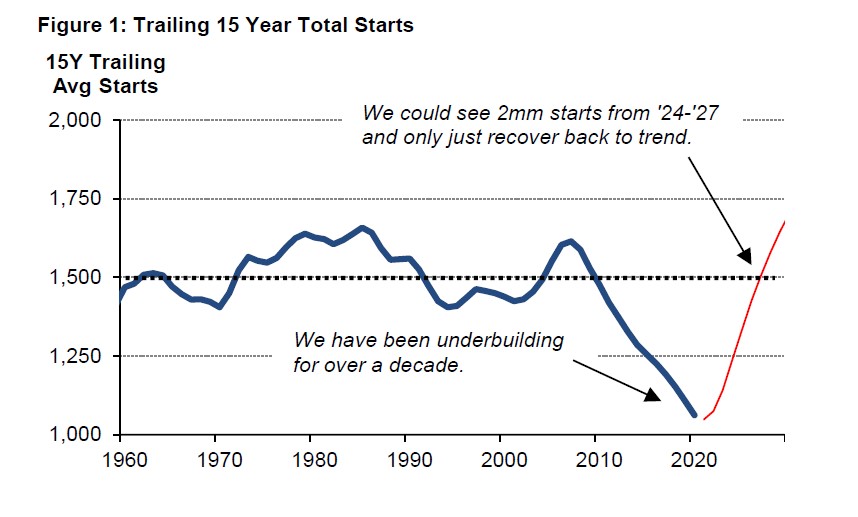

America has underbuilt housing for the past decade because of the overhang from the housing bubble. It’s the best time to invest after a bubble bursts. Think of how great it was to invest in technology stocks in 2003. Now isn’t as great of a time to invest in homebuilders of course because everyone sees this playing out. The homebuilder index is already up 39% in the past 6 months and 118% in the past year. Regardless of whether those stocks are a buy, there will be much more housing built in the next 5 years.

The chart below shows the 15 year trailing measurement of housing starts.

2 million starts would get America back to its long term trend. There is a housing shortage that won’t go away for a few years. It wouldn’t be a surprise for America to overbuild because that’s how cycles work. It’s interesting how there wasn’t that much overbuilding in the housing bubble. That was more about reckless speculation and loans given out to buyers that couldn’t afford homes. The fact that we didn’t start highly overbuilt explains how the reading has gotten this low....

....MUCH MORE