No matter what the Federal Reserve spokespeeps say their goal is, the result is always the same.

This is a very real problem and probably means a Fed overshoot is baked in the cake.

First up, Ed Yardeni at his Dr. Ed blog, April 15:

Outcome Rather Than Outlook; Reacting Rather Than Preempting

The Fed I: Backward Looking. Just in case we didn’t get the Fed’s memo on the change in its monetary framework, Fed Governor Lael Brainard explained it very clearly in a speech on March 23 titled “Remaining Patient as the Outlook Brightens.” Throughout her talk, she stressed very important distinctions in meaning between “outlook” and “outcome” and between “preempting” and “reacting.” She concluded her speech with her punchline: “By taking a patient approach based on outcomes [emphasis added] rather than a preemptive approach based on the outlook, policy will be more effective in achieving broad-based and inclusive maximum employment and inflation that averages 2 percent over time.”

Brainard acknowledged that the efforts of public health, fiscal, and monetary policymakers “have contributed to a considerably brighter economic outlook.” However, she stated that the Fed’s “reaction function” had changed in response to the pandemic. The Fed governor explained: “The FOMC has communicated its reaction function under the new framework and provided powerful forward guidance that is conditioned on employment and inflation outcomes. This approach implies resolute patience while the gap closes between current conditions and the maximum-employment and average inflation outcomes in the guidance.”

In effect, the Fed’s policy responses will be backward looking rather than forward looking. In an April 11 interview on CBS 60 Minutes, Fed Chair Jerome Powell reiterated this message as follows:

(1) Inflection point. He started with a very upbeat outlook: “What we’re seeing now is really an economy that seems to be at an inflection point. And that’s because of widespread vaccination and strong fiscal support, strong monetary policy support. We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation is coming in much more quickly.” He concluded the interview by saying “I’m in a position to guarantee that the Fed will do everything we can to support the economy for as long as it takes to complete the recovery.”(2) Recovery redefined. Got that? The Fed will keep policy ultra-easy until the recovery is complete. But wait a minute—real GDP is likely to be back in record-high territory by the second quarter. It is on the verge of a complete recovery. That’s true, but Powell and Brainard said that “broad-based and inclusive maximum employment” is one of the outcomes they want to see before the Fed starts tightening. Both also want to see inflation moderately above 2%. Powell explained: “And the reason for that is we want inflation to average 2% over time.”(3) Fed funds rate staying put. Once the Fed achieves this outcome, “that’s when we’ll raise interest rates,” Powell said. When asked whether interest rates might remain unchanged around zero through year-end, Powell said, “I think it’s highly unlikely we would raise rates anything like this year, no.”....

....MUCH MORE

Okay. Keep pumping until, one figure I've seen tossed about, one million people per month rejoin the ranks of the employed. However....

From ZeroHedge, April 9:

"There Are Absolutely No Job Seekers": How Trillions In Stimulus Sparked A Historic Job Market Crisis

Something odd is going on in the US economy.

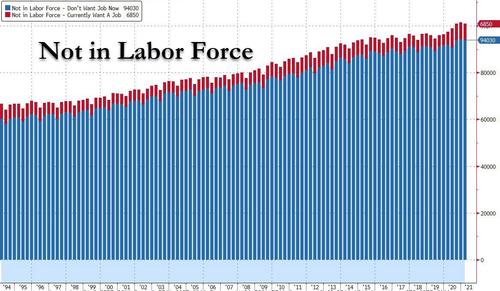

On one hand, in the aftermath of the covid pandemic there are millions and millions of former workers who have lost their jobs and are unable to return as their job may not even exist today (while their skills atrophy and they become increasingly unemployable with every day they are unemployed). Addressing this, on Thursday Fed Chair Powell spoke at an IMF panel saying that over nine million Americans remains out of work, while a quick look at the latest BLS data shows that there are over 100 million Americans who are out of the labor force (of whom just 6.85MM want a job currently, and a record 94 million don't want a job).

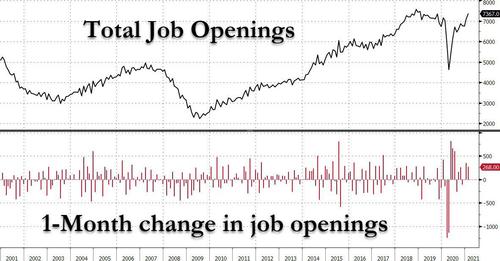

At the same time, as we pointed out last night, JPMorgan and many others have noted that when one looks at the recent JOLTS data, which showed a near record number of job openings, a clear trend is emerging: there is a big labor shortage in the US, one which could (finally) lead to higher wages in the US.

While JPMorgan did not dwell on what may be causing this unprecedented schism within the economy - after all, for normalcy to return, people must not only be employed but must want to be employed - it did suggest that the "robust" government stimulus may be keeping workers on the sidelines, a more detailed analysis from Bloomberg confirms the nightmare scenario: the trillions in Biden stimulus are now incentivizing potential workers not to seek gainful employment, but to sit back and collect the next stimmy check for doing absolutely nothing in what is becoming the world's greatest "under the radar" experiment in Universal Basic Income.

Consider the following striking anecdotes:

- Early in the Covid-19 pandemic, Melissa Anderson laid off all three full-time employees of her jewelry-making company, Silver Chest Creations in Burkesville, Ky. She tried to rehire one of them in September and another in January as business recovered, but they refused to come back, she says. “They’re not looking for work.”

- Sierra Pacific Industries, which manufactures doors, windows, and millwork, is so desperate to fill openings that it’s offering hiring bonuses of up to $1,500 at its factories in California, Washington, and Wisconsin. In rural Northern California, the Red Bluff Job Training Center is trying to lure young people with extra-large pizzas in the hope that some who stop by can be persuaded to fill out a job application. “We’re trying to get inside their head and help them find employment. Businesses would be so eager to train them,” says Kathy Garcia, the business services and marketing manager. “There are absolutely no job seekers."

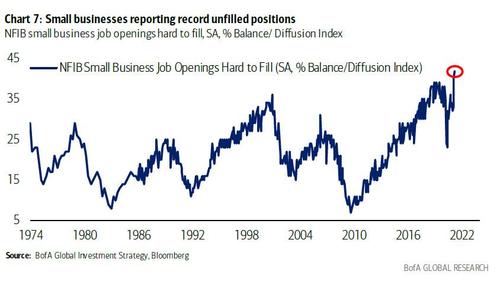

These are not one-off cases: these anecdotes, revealed by Bloomberg, expose the striking statistical reality in the US: on April 1 the NFIB (National Federation of Independent Business) reported that in March a record-high percentage of small businesses surveyed said they had jobs they couldn’t fill: 42%, vs. an average since 1974 of 22%.

Even more amazing: a stunning 91% of respondents said they had few or no qualified applicants for job openings in the past three months, tied for the third highest since that question was added to the NFIB survey in 1993.....

*****

....As Bloomberg writes, it is becoming increasingly the case that "generous unemployment benefits discourage people from seeking work." Anderson, the jewelry maker, says her ex-employees told her they preferred to stay unemployed—even though you’re not supposed to collect jobless benefits if you’re turning down work. But it's not like anyone will check.

The American Rescue Plan that Congress approved last month provides an extra $300 a week in jobless benefits through Sept. 6. "There still will be some people who say, ‘I’m glad to take my $300 to $400 a week and stay home, rather than go out and work and earn $500 a week,’” BTIG LLC analyst Peter Saleh, who covers the restaurant industry, told Bloomberg in March.....

....MUCH MORE

The Federal Reserve is fully aware that they have chosen to disseminate as a goal something that due to political action is not possibly going to be achieved before September 6th.

And due to political pressure from Congresspeeps and 1/3 of the Senate running in 2022 the "enhanced" unemployment benefits are very likely to be extended again.

Meaning the same dynamic of folks who are not currently working making the rational, in the short term, decision to not seek work is going to continue, meaning the Fed is not going to see its metric achieved meaning it's pedal to the metal for money going into savings, investments, and dare I dream, CryptoKitties.