For miners, refiners and end-users anyway. Speculators have to play in the equities. Which is probably for the best as spot has collapsed from $26.18 per kilogram in December 2017 to $11.23 in October this year.

The headline story from the Financial Times:

It has long been known that Latin America’s “lithium triangle” of northern Chile, northern Argentina and southern Bolivia contains some of the biggest deposits of the key electric vehicle battery ingredient on the planet, in the salt flats of the Andes and the Atacama Desert.A quick look at the map says Ecuador may be the next hotspot for more expensive hard-rock lithium.

But a recent discovery further north has fuelled speculation that Peru too might join the lithium party and turn the triangle into a square.

In July, Canada’s Plateau Energy said it had found an estimated 2.43m tonnes of lithium carbonate equivalent on the Macusani plateau near Puno, southern Peru.

It is the first discovery of its kind in the Andean nation and if confirmed would be one of the 10 largest hard rock lithium resources in the world. Furthermore, the mineral is in a volcanic tuff, close to the surface, and could be extracted using open-pit mining techniques, making it relatively cheap.

The potential find comes as analysts forecast that demand for the metal, which is also used in smartphone batteries, will double by 2022. However, Peru faces a crowded market, with investors worried about a lithium oversupply and a drop in prices for the material in China this year....MUCH MORE

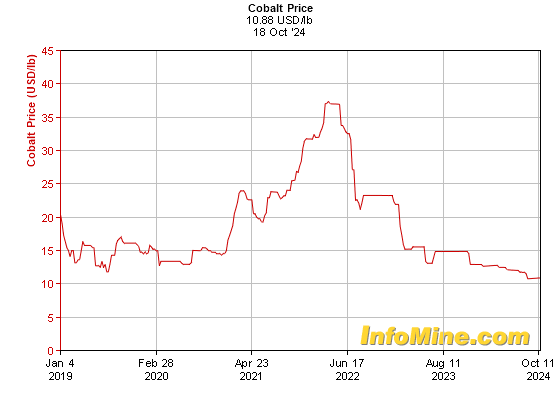

Meanwhile, our old friend cobalt which does have futures has fallen on hard times as battery makers work to cut the amounts used in their offerings.

Tesla/Panasonic have a goal of zero cobalt but because there hasn't been any breakthrough battery chemistry to replace LiCo the progress has only been incremental, though substantial.

Here is the last couple years of price action for U.S. cobalt:

And on the LME:

source: tradingeconomics.com