A lot of hope has been invested on the back of very little evidence that the Fed is turning dovish. Also, Bitcoin bubbles and Ray Dalio’s lessons learned.

The Bond Market Stops Making Sense

I don’t think last week’s dose of Fedspeak moved the needle much on the likely course of Federal Reserve interest-rate hikes next year. Barring a sharper slowdown in the U.S. economy than most forecasters expect, we should brace for the federal funds target rate to be about a percentage point higher by the end of next year than it is now. On that basis, it looks as though the bond market has stopped making sense. The benchmark 10-year Treasury note yield is at its lowest since the first week of October, just before shooting higher:

What a long, strange trip it’s been. But there was a change in sentiment. If the federal funds futures market is to be believed, then the odds are now a little more than 40 percent that the Fed hikes no more than once from now until the end of 2019:

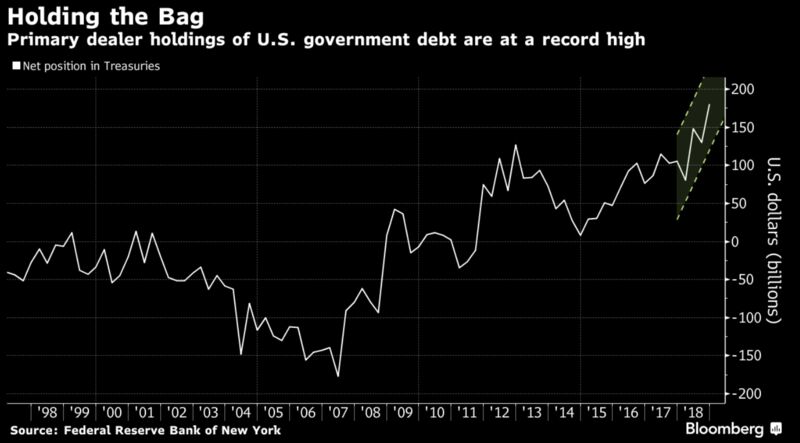

***And yet primary dealers, the big banks that trade with the Fed and are obligated to bid at the U.S. Treasury auctions, are holding more long-term Treasuries than ever before. This chart is from Bloomberg News’s Emily Barrett:

They’re unlikely to be holding this much inventory because they like Treasuries. A more probable explanation is that they can’t find willing buyers, and will treat any decline in yields (or increase in bond prices) as an opportunity to decrease their inventory. As Barrett put it, “With a limit to how much the government’s guaranteed buyers can absorb, it’s a trend worth watching.”...MUCH MORE