From FT Alphaville:

For the first time since President Trump launched the first salvo of his trade war with China's President Xi Jinping, the two leaders are set to meet. This time, at the G20 summit in balmy Buenos Aires.

Following recent posturing by White House economic adviser Larry Kudlow and renewed threats from President Trump of more tariffs, the prospect of a grand resolution between the two countries appears chancy at best. What's more likely this weekend is that President Trump and Xi will emerge from their scheduled 90-minute one-on-one meeting, which is then followed by dinner, with some kind of blueprint in hand for future talks.

A ceasefire (or at least the indication that one could come) would no doubt buoy global markets and fortify Chinese equities and its currency, the renminbi. But whatever gains Chinese assets garner are likely to be shortlived. Undercutting a more sustained rally and the shoring up of the country's slowing economy is the persistent weakening of credit growth in recent months.

Despite a kitchen sink of stimulus this year, which has included four slashes to banks' reserve requirements, tax cuts and increased construction spending, lending remains tight and money supply now sits near record lows.

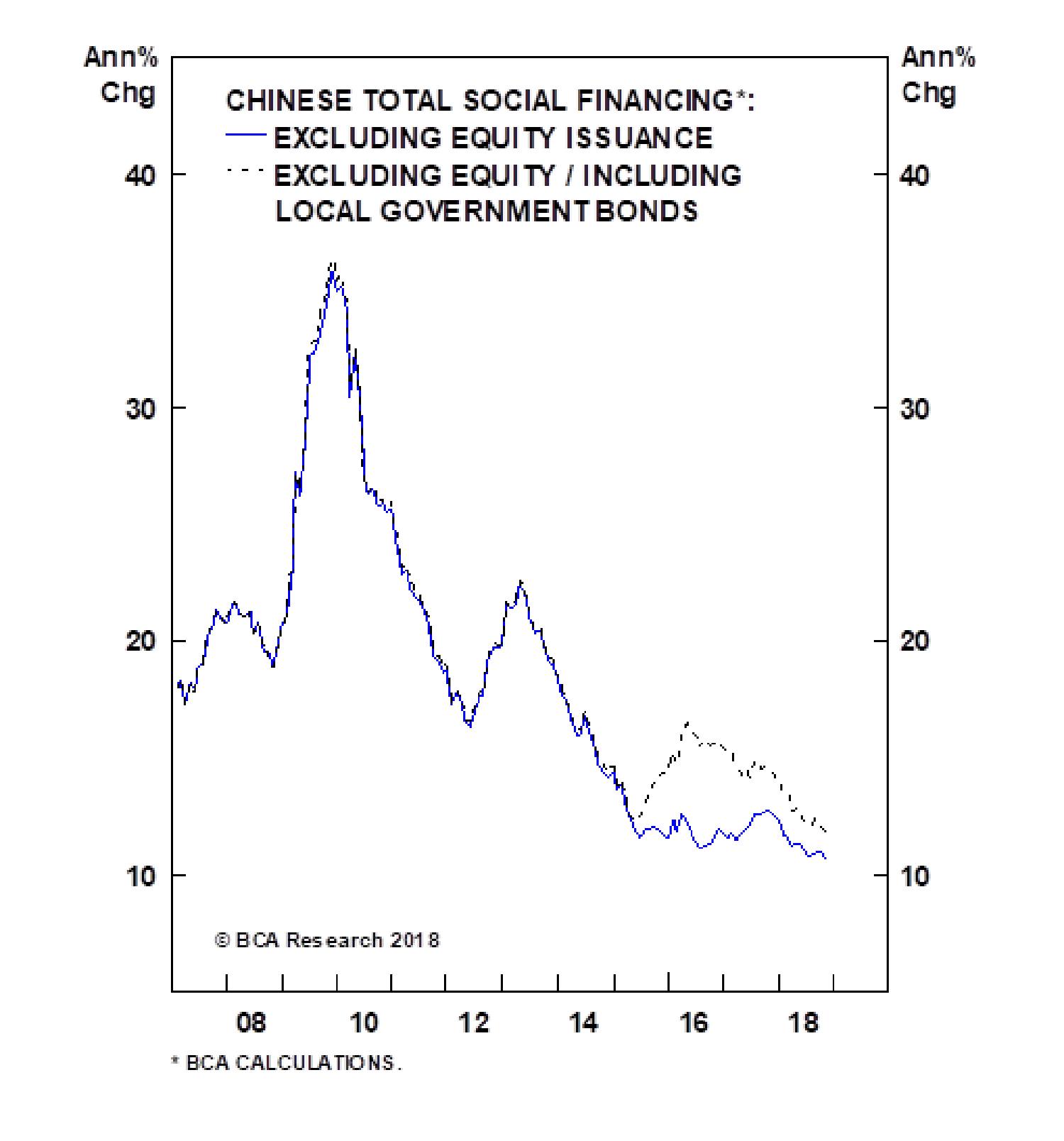

The most recent reading of total social financing (TSF), which is a broad measure of Chinese credit, fell again in October. Here's a chart from BCA Research showing that the year-over-year growth rate for adjusted TSF continues to slide:

With Chinese banks lending less and the country's money supply, as measured by M1, contracting, GDP growth has unsurprisingly taken a hit.......MORE