From Alhambra Investments, Nov. 19:

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

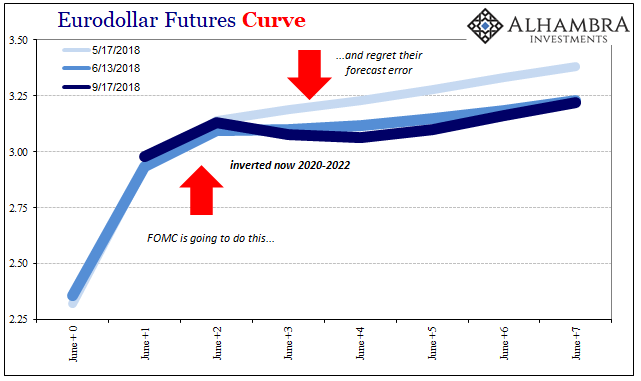

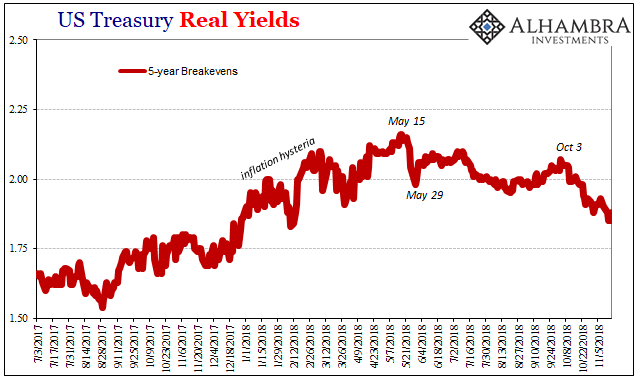

...The eurodollar futures curve, an extremely important juxtaposition of market expectations versus policy expectations, was at its steepest point way back in February. Nominally, rates were rising in UST’s and inflation expectations were moving in the right direction if still at a more deliberate pace. Global money market investors, those operating in eurodollar futures, were starting to wonder if Janet Yellen may indeed exit on the right economic note after all.

Jay Powell took over on February 5 in the middle of renewed market turbulence. As Bernanke, Powell’s first message was to reaffirm his commitment to transparency. In a video message, the new Chairman promised to explain “what we are doing and why we are doing it.” Monetary policy was back on track – so long as the economy continued to be.

It’s not that money markets don’t like Powell (well, it may be they don’t like his Bernanke-like surety that courts the same kind of arrogance), it’s just that he started out under the questionable circumstances left for him. If this sounds familiar for each time there is a switch in Fed Chairmen it is only because the economy never gets past these questionable circumstances.

By the middle of May, Powell turned clearly “hawkish” while global markets were rocked by a gigantic collateral call of a still-undetermined nature. Eurodollar markets would notice; even the FOMC would notice what with its later hesitant reference to “strong worldwide demand for safe assets.”

The eurodollar futures curve began to turn on Jay Powell afterward. It inverted in the middle and received scant attention for it. Quite simply, one of the largest, deepest perhaps most important markets in the world was saying Powell’s Fed was going to “raise rates” and then regret it.

This mid-curve inversion wasn’t an expectation for timing; the June 2021 contract inverted to the June 2020 didn’t mean the market was thinking the years 2020 into 2021 was when a teary-eyed Powell would hold that one press conference professing his error and begging for forgiveness.

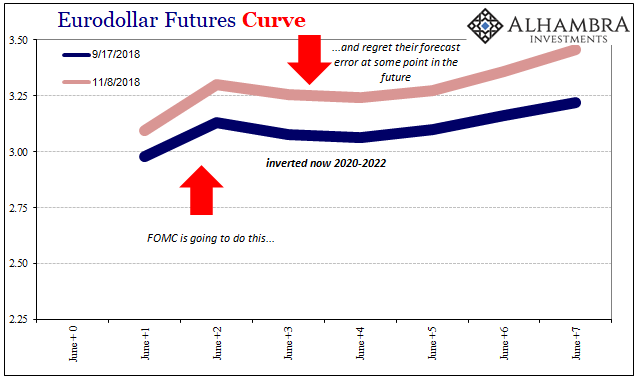

This inversion is non-specific as to time, even as it grew larger; it inverted further out to 2022. The market believes there is a non-trivial chance the Fed is making a forecast error, it just doesn’t know when officials will finally get around to realizing it. Central bankers are extremely stubborn ideologically and are the last to figure things out.

Since early September, Powell seemed to have found some real justification for his case. The August 2018 payroll report showed the highest wage gains in a decade, the very thing Yellen had been waiting for her whole time in office.

Yet, the curve twisted some more even as it pushed upward. Rates were going to get a little further now that Powell had the wage data, the market said, meaning a greater terminal point before the turnaround. May 29’s collateral debacle continued to weigh on market sentiment, meaning there was very likely going to be that turnaround regardless of BLS data.

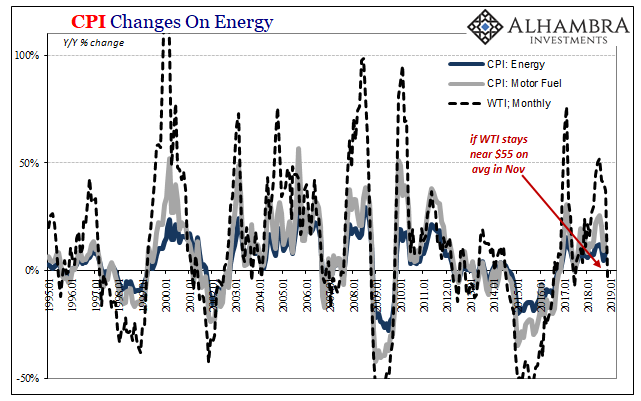

Over the last several weeks, however, alarms and concerns have multiplied. Another curve unable to make front page news for every reason that it should, WTI, has been signaling a very different scenario than economic acceleration. Worse, for Powell, a continued collapse in the crude price means regardless of wage data all the major inflation indices will begin to turn against him.

To say nothing about the real economic case oil contango presents. It isn’t a good one, to put it mildly.......MORE

See also Alhambra's November 14 "Live By The Oil Price…"