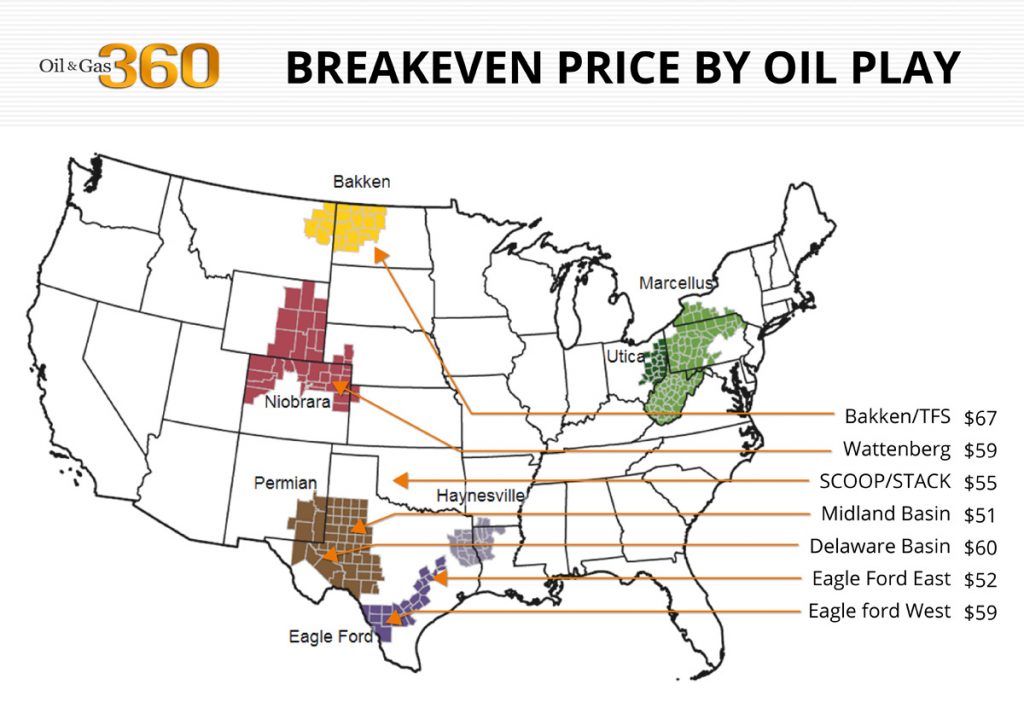

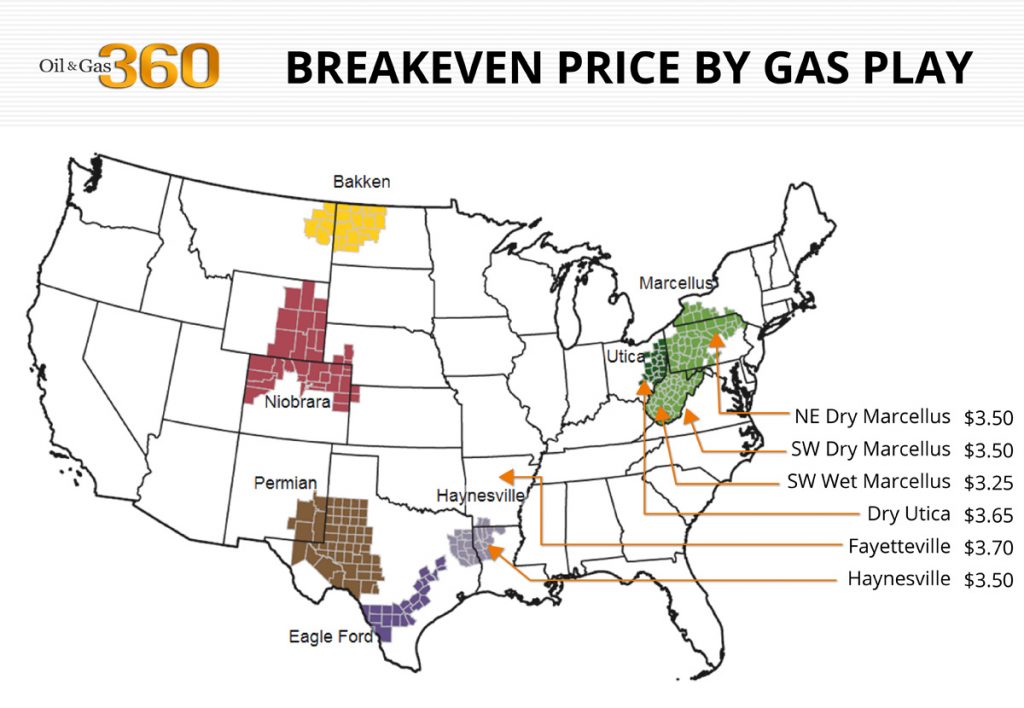

Median Breakeven Price for Oil is $55 per Barrel; Gas is $3.50 per Mcfe – KLR

Highest oil breakeven is in Williston Basin; for gas it’s the Fayetteville

Lowest oil breakeven is the Midland Basin; lowest for gas is the southwest Marcellus

A report from KLR Group today has pegged the breakeven costs for various oil and gas plays around the United States. The report looked at capital performance of E&P companies, and found that the highest breakeven for oil among the basins in the U.S. is NYMEX $67 per barrel for oil, while the highest breakeven for gas is NYMEX $3.70 per Mcfe.

The report found low end for U.S. supply is in the Midland Basin (about $51 per barrel) while the most expensive production is in the Williston Basin Bakken/TFS (about $67 per barrel). On the gas side, supply is bracketed by the southwest Marcellus (about $3.25 per Mcfe) and the Fayetteville (about $3.70 per Mcfe).

KLR’s research found that oil-dominated E&Ps (those whose production was at least 60% oil) had a median capital intensity of about $30 per BOE and operating overhead of about $14 per BOE, equating to a cash cost structure of about $44 per BOE. Given an approximately $11 per BOE median liquids (oil/natural gas liquids) price discount to NYMEX, said KLR, the current NYMEX-normalized oil-dominated E&P cost structure is about $55 per BOE.

The capital intensity for the median gas-dominated (less than 20% of the company’s production coming from oil) E&P is about $1.85 per Mcfe, while operating and overhead expenses is about $1.25 per Mcfe, equating to a cash cost structure of around $3.10 per Mcfe. Given a $0.40 median gas price discount to NYMEX, the current NYMEX-normalized gas-dominated E&P cost structure is about $3.50 per Mcfe, KLR said.

In order to generate 10% unleveraged rates of return, U.S. basins need $104 oil and $5.50 gas

Oil’s steady climb back from the low-30s has given some hope that prices may again reach the breakeven prices mentioned in the KLR report, but there will be much further to go before producers realize 10% rates of return on their production, the energy analyst group said.

In the Midland Basin/Eagle Ford East, where the breakeven is the lowest in the U.S., it would still require a NYMEX oil price of $80-$85 to generate a 10% unleveraged return, said KLR. The low capital intensity, and higher oil composition and oil price realization drive the region’s strong metrics.

The SCOOP/STACK has the second-highest price requirement for a 10% return despite its relatively low breakeven due to its low oil composition, the report said. Despite capital intensity of about $22 per BOE, NYMEX oil prices would still need to reach about $101 per BOE before operators in the region saw a 10% return....MORE